Key Insights:

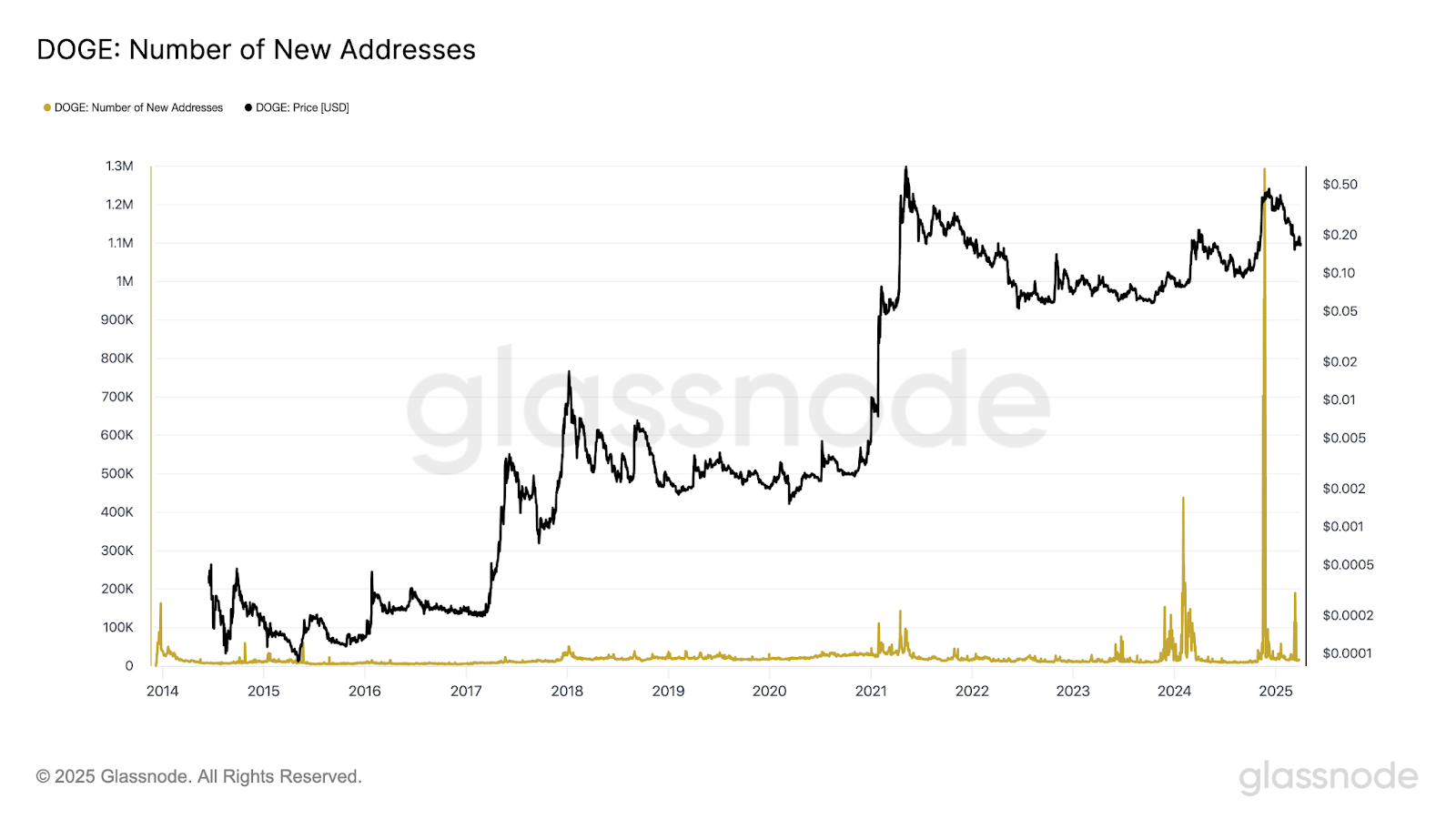

- Dogecoin network activity surges, with new addresses nearing past cycle highs.

- Falling wedge breakout and Stochastic RSI bullish cross suggest trend reversal.

- OBV breakout and liquidation map show strong buying pressure building for Dogecoin.

Dogecoin has broken out of a falling wedge pattern and recorded a bullish cross on the Stochastic RSI.

On-chain data shows a sharp increase in new addresses, while the OBV pattern and liquidation levels suggest rising trading activity around current price levels.

Spike in New Dogecoin Addresses Hints at Fresh Momentum

Glassnode on-chain data indicates that Dogecoin is seeing a steep rise in new addresses being created on its network.

In the past, sharp increases in the number of new addresses have occasionally occurred during periods of strong price appreciation.

According to recent figures, new addresses are approaching peak cycle highs. This sharp rise shows that more users are coming into the Dogecoin network for trading, holding, or any other activities within the ecosystem.

Price movements are often supported by growing network activity because it brings more liquidity and market interest.

Dogecoin’s bullish technical setup could be strengthened by sustained growth in user adoption, as the market looks for larger moves across crypto assets.

Bullish Wedge Breakout in Play — More Upside?

Two important technical signals have recently appeared on Dogecoin’s biweekly chart. Trader Tardigrade analysis shows that DOGE has broken out of a falling wedge pattern that had been forming since late 2024.

Falling wedge break out often show potential for a trend reversal. A bullish cross on the Stochastic RSI is also supporting this breakout, which is when the blue and orange lines crossed upward, indicating momentum strength.

These developments indicate that Dogecoin’s technical outlook is improving after months of downward pressure.

On-Balance Volume Mirrors Past Outperformance Pattern

Additionally, the On-Balance Volume (OBV) for DOGE/BTC is mirroring a pattern that was last observed before Dogecoin’s major rally from October to December 2024.

OBV is a cumulative trading volume that tracks buying and selling pressure.

The current OBV breakout from a consolidation phase is very similar to the pattern before Dogecoin’s previous outperformance against Bitcoin.

DOGE had been building volume for weeks without a major price movement, and it surged during that period.

Price action and OBV trending together can indicate a stronger move later on. Even if prices move slowly at the beginning, a continued rise in OBV would indicate that buyer demand is increasing.

Dogecoin may soon outperform Bitcoin again, if it repeats this behaviour, but external market conditions will also be a factor.

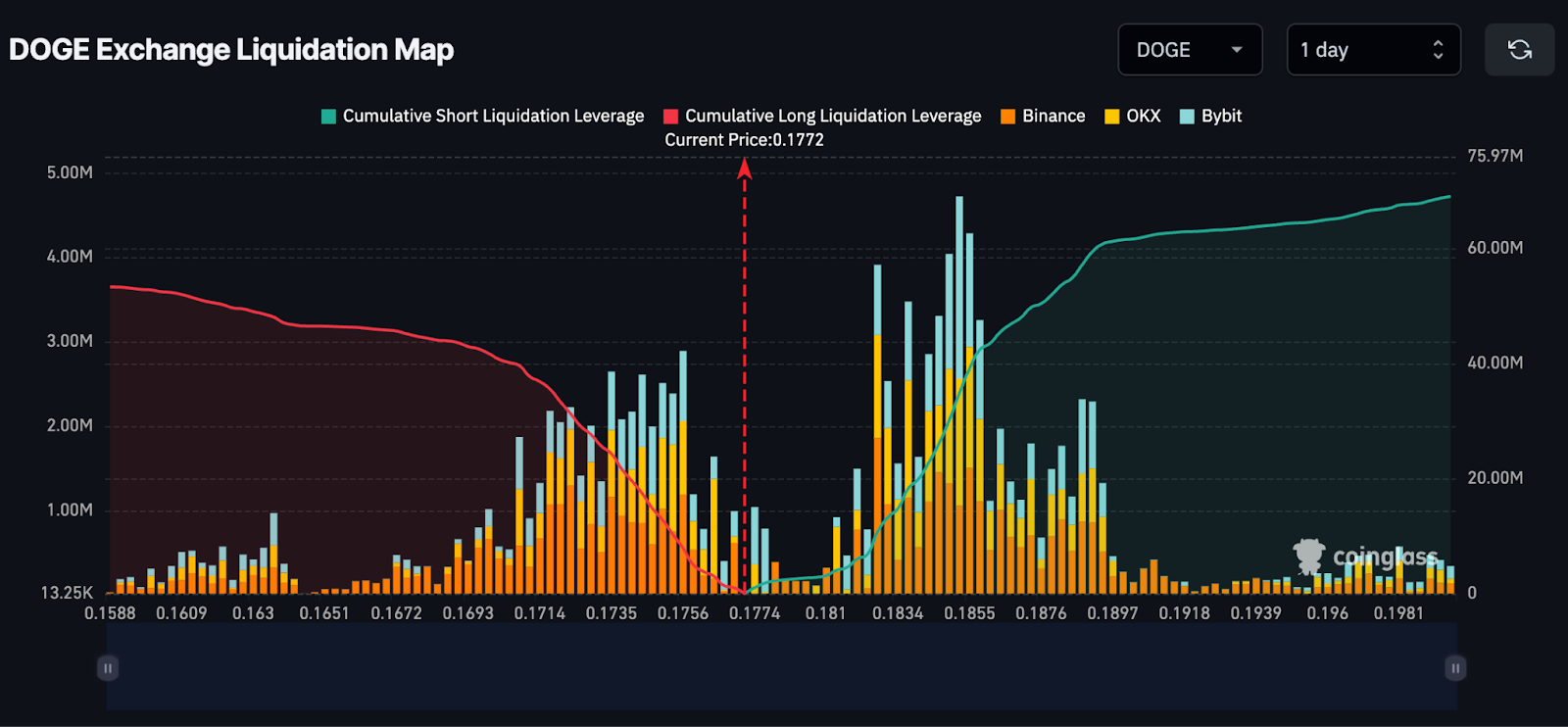

Liquidation Map Shows Potential Pressure Points

One key metric traders are watching closely is the liquidation map, which highlights where potential pressure points could trigger the next major move.

It’s clear from the map that short liquidations are concentrated heavily between $0.18 and $0.19.

If Dogecoin’s price breaks above that zone, it could induce a short squeeze, with short sellers having to buy back their positions, further driving the price higher. This can cause fast, sharp price movements.

Conversely, on the downside there’s a cluster of long liquidations around the $0.17 level. This point could be a point of selling pressure as long positions are liquidated if the price drops below this point.