Key Insights:

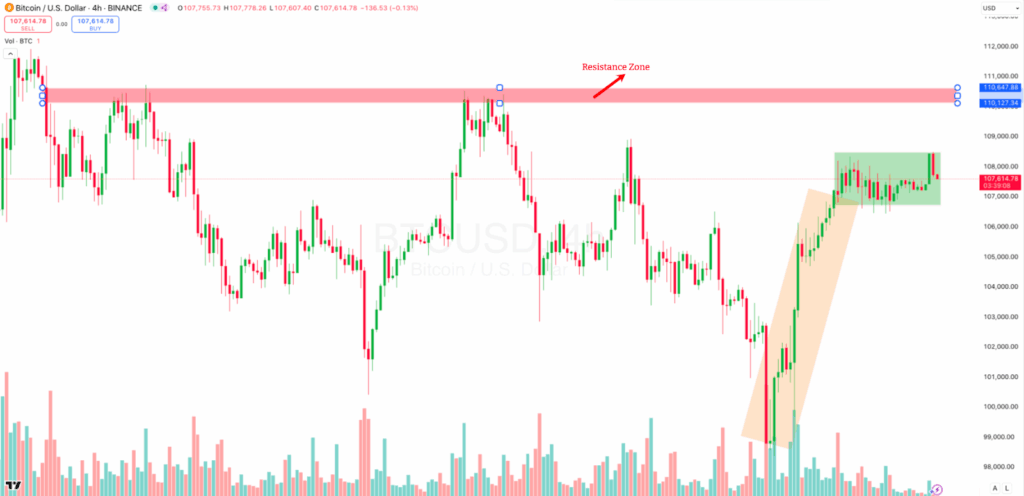

- After hitting a new all-time high, Bitcoin recently saw a 5% price dip.

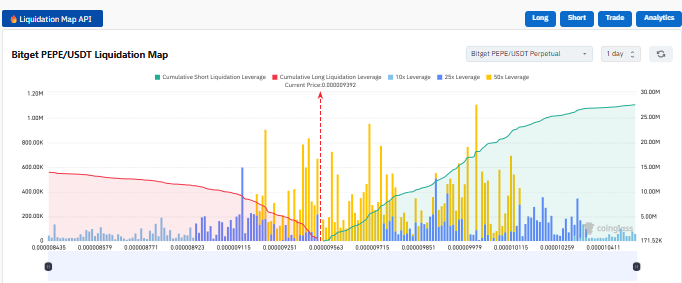

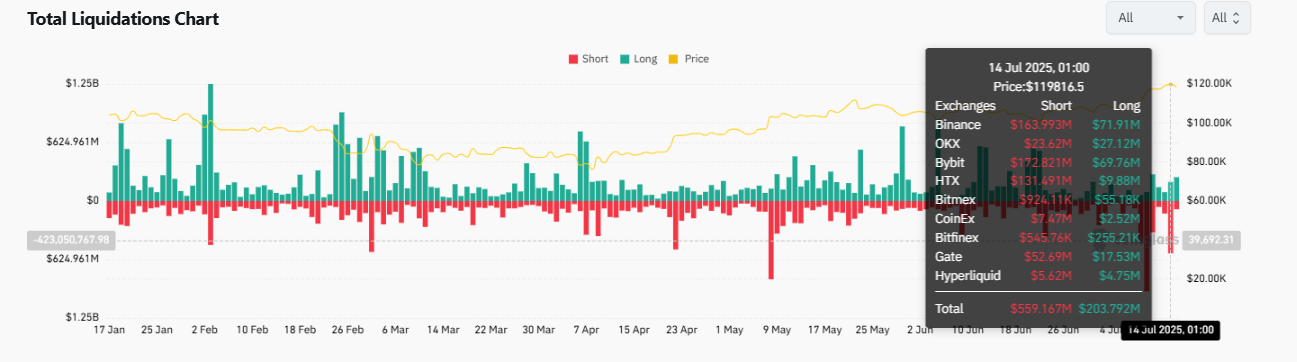

- This drop triggered over $450 million in crypto liquidation, heavily affecting long positions.

- A large, inactive Bitcoin wallet moving 40,000 BTC may have spooked the market.

Bitcoin recently suffered a massive 5% slump on Tuesday, 15 July. This happened just a day after it reached a new all-time high price above $123,000.

This sharp pullback triggered BTC liquidation events. Millions in leveraged long positions were wiped out across exchanges. Here’s how this volatility has led to devastation across the market, and what could be next.

The Catalyst for The BTC Liquidation

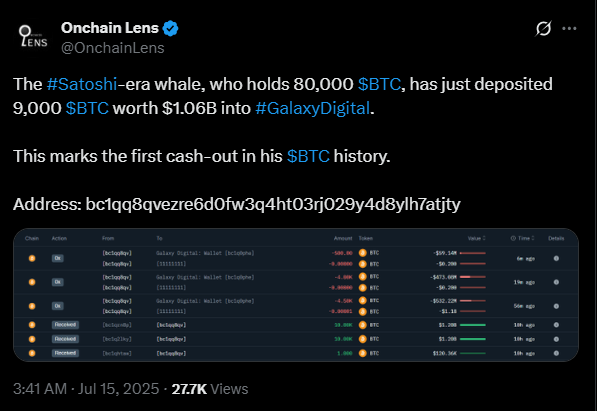

The movement of a single, long-time Bitcoin holder may have triggered the sharp drop in Bitcoin price. On Monday, this wallet transferred approximately 40,000 Bitcoin to Galaxy Digital, worth around $4.8 Billion.

While there is no clear clue that this amount of Bitcoin was immediately sold, it has been enough to spook the market. On-chain data further linked this sender to the owner of an old Bitcoin wallet, which had remained dormant for 14 years.

This “ancient whale” shuffled 80,000 Bitcoin worth $9.6 Billion just last week. This marks the first BTC liquidation in this Bitcoin holder’s history.

Sudden movement of dormant BTC liquidation may have spurred market volatility and triggered chain reactions. Leverage risks, stop-loss orders, and margin calls likely affected widespread liquidations.

Market Reaction and BTC Liquidation Wave

Historically speaking, whale movements have often caused large price movements in either direction. For example, the German government sold off 50,000 Bitcoins a year ago. This, at the time, was valued at $2.3 Billion.

As a result of this sale, the cryptocurrency crashed by around 20%. This is despite Bitcoin recovering above the $100,000 price level shortly after.

This unknown whale, which has started moving their assets, holds almost double the amount Germany once did. This means they could sell at double prices and increase the ongoing market jitters.

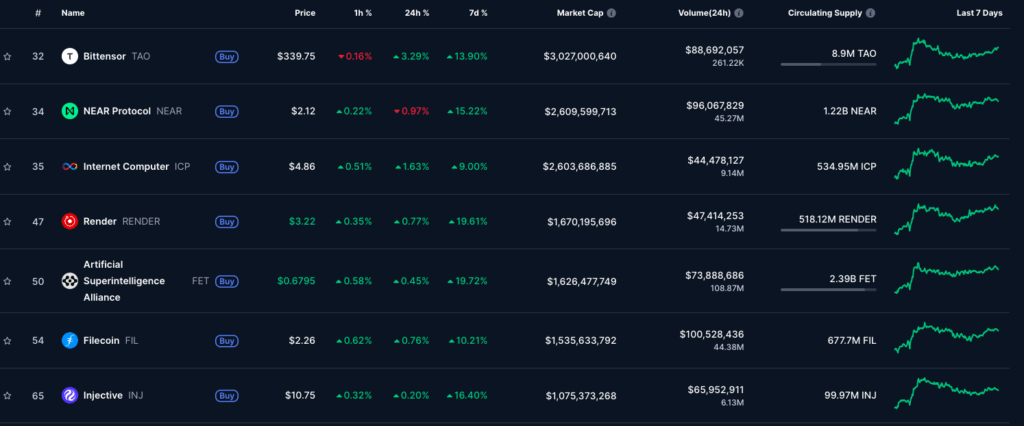

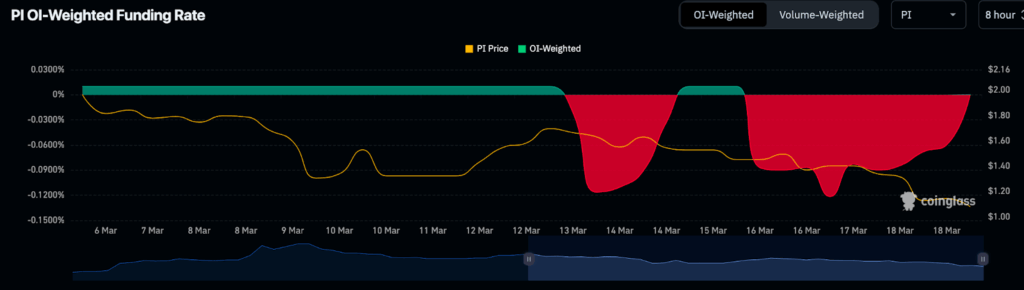

Another wave in this bearish storm was the predictable wave of short-term profit-taking that followed Bitcoin’s new price record. According to Coinglass data, around $3.5 Billion in gains were swept off the board after Bitcoin topped $123,000.

The scale of this BTC liquidation is not surprising, especially considering how market data was before the climb. This showed that nearly every Bitcoin holder was sitting on profits. This mass profit-taking might have contributed to the market’s volatility, wiping traders out of their positions.

Tuesday in particular saw more than $450 Million in total crypto liquidations. The bulk of this wipeout affected traders who were holding long positions. This shows that many leveraged traders were caught off guard by the sudden downturn.

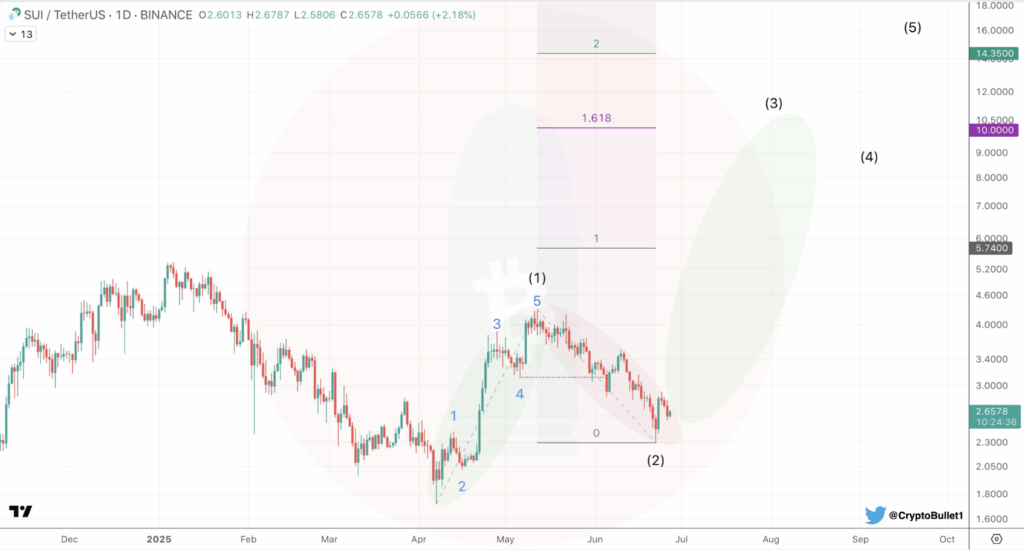

The Bullish Outlook Despite Roadblocks

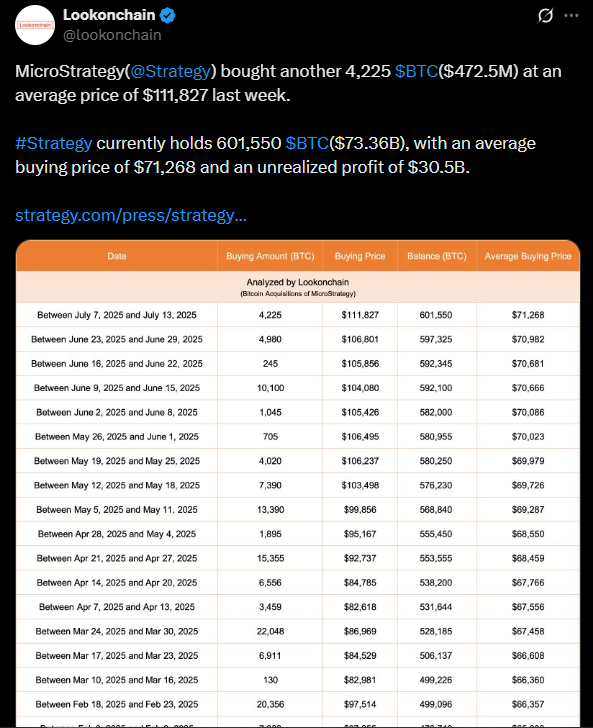

Despite the recent price correction and BTC liquidation events, market watchers remain optimistic. This bullish sentiment is driven mainly by continued institutional investment and sovereign states’ rising Bitcoin adoption rate.

Very recently, MicroStrategy, one of the largest corporate Bitcoin holders, added another worth of Bitcoin to its balance sheet. Analysts, including BitWise CEO Matt Hougan and Markus Thielen from 10x Research, echo this long-term bullish sentiment.

The crypto market continues to be largely euphoric, which is to be expected from a late-stage bull cycle. What is essential now is for traders to stay disciplined and manage trades properly.

Significant profit-taking events and liquidations are part of a healthy market cycle. However, they also remind us that the market contains its fair share of risk, especially for those using high leverage.

In the meantime, investors should closely monitor further whale movements, institutional inflows into Bitcoin ETFs, and support levels.