Key Insights:

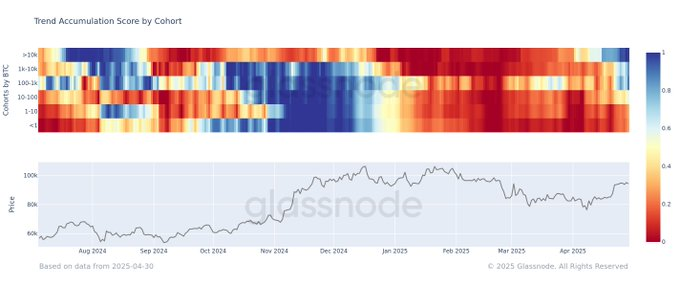

- Bitcoin whales are accumulating aggressively, with wallets holding over 10,000 BTC showing a strong increase in their positions.

- The accumulation score for large holders has surged to 0.95, reflecting peak confidence despite market uncertainty.

- Mid-sized holders with 1,000 to 10,000 BTC steadily increase their holdings, but at a slower pace than whales.

Bitcoin (BTC) price shows mixed signals as large holders accumulate while smaller wallet activity declines.

On-chain data highlights diverging behavior between major and minor market participants. This contrast points to a possible shift in market sentiment, raising questions about an upcoming price reversal.

Bitcoin Whales Boost Holdings Amid Uncertainty

The high-profile Bitcoin whales who own above 10,000 BTC continue to accumulate based on their strong belief in the investment potential.

This score indicates that major Bitcoin holders continuously intend to buy at current levels, reaching 0.95.

Their accumulation of data means they foresee at least ten more years of continuous growth, combined with their lack of concern about market fluctuations.

These major players demonstrate different actions than spot market participants, showing decreasing demand.

These wallets have demonstrated continued activity while building up their holdings throughout the past week.

The observed pattern demonstrates long-term price performance optimism among investors, thus indicating a possible redistribution strategy.

These wallets maintain steady operations during retail withdrawal periods, acquiring greater dominance over the price direction.

A market direction change typically follows when ownership concentrations shift in the market. People are starting to consider their actions a primary signal of changing market attitudes.

Mid-Level BTC Holders Lack Bullish Power

The buying patterns of wallets between 1,000 and 10,000 BTC demonstrate moderate accumulation scores within the range of 0.8 and 0.9.

The market activity levels measured by these entities do not match the intensity shown by larger holding entities, although they have not exited.

The entities build their positions at a steady pace while monitoring market trends.

This group supports the current price area while showing restrained accumulation habits.

Their continuous monitoring is crucial for market stability during periods of low volume activity.

Whales maintain greater involvement than this group, which indicates they are currently exhibiting cautious behavior.

The interactions of such users make little impact compared to dominant whale behaviors. As a price guard mechanism, these entities keep the market steady but lack sufficient strength to reach fresh price peaks without help.

The position taken by the sharks contributes to the overall indication that collective market sentiments distribute unequally between different groups.

Small Bitcoin Wallets Cut Buying Activity

The accumulation activity among wallets with 10 BTC or less remains stagnant, with a fixed score of 0.3.

The Phase shows diminished new investor participation and lower position investments because of declining interest.

Market participants in this category tend to choose profit-taking and adapt their behavior to anticipated market risks.

Spot market Bitcoin trade volumes decreased at the same time, smaller wallets showed decreased activity.

Spot market activity detected a substantial change because the weekly spot volume delta decreased from—$30.9 Million to—$193.4 Million from April 27 through April 29. Demand decreased drastically while sales pressure increased dramatically.

The Profit Taker RSI indicator from Glassnode reached 82, indicating that profit harvesting has reached an overheated state with excessive execution.

The indicator revealed that numerous users chose to take profits from their investments, which adds to the diminishing buy-side activities.

Collectively, these trends reveal retail participants have decreasing confidence while reducing their involvement.

BTC Price Goes Past $96K Mark

Bitcoin was trading at $97,013 above its pivotal support level of $94,000, having surged past the stick $94K to $95K zone.

The ongoing market interest can be observed through price action, yet the trading faced a daily downtrend, which reached its lowest point at $92,982.

The market shows a positive tendency while starting to demonstrate conflicting indications.

Relative Strength Index (RSI) measured at 70.13 while writing, while its moving average was 64.98. The ongoing upward potential, coupled with potential price overbought conditions, appears in the market now.

When the Relative Strength Index surpasses the current level, the price may experience increased selling activity due to traders looking for market corrections.

The value of the MACD histogram reaches 588, while the MACD line at 3,176 plots apart from the signal line at 2,588.

Market data shows an ongoing strong buying trend, which implies minimal bearish forces operate at this moment. The negative spot volumes could lead to decreased divergence between these indicators.