Key Insights:

- Bitcoin whales have been selling their holdings since 2017, and have reduced their total holdings by 40%.

- These early adopters are taking in profits after holding BTC for 8-16 years.

- The whale sell-off coincides with an increase in institutional and governmental Bitcoin acquisitions.

Bitcoin may still be holding strong above the $100,000 mark. However, underneath the surface, there is an ongoing a wave of profit-taking. According to available data, large holders, often referred to as “whales” have continued offloading their positions.

This trend has persisted for nearly a decade, and while retail investors and institutions remain bullish, data suggests the biggest and oldest Bitcoin holders are reducing their holdings. So, who’s selling and why now?

Whale-Sized Sell-Offs

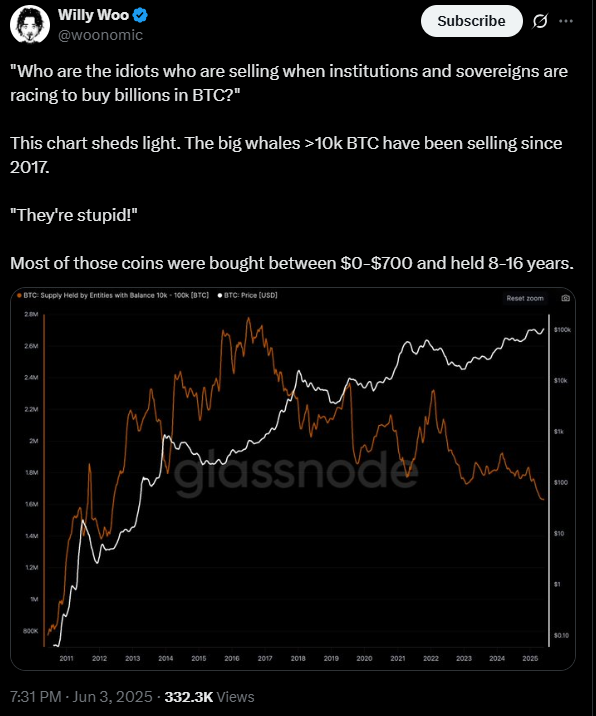

According to on-chain analyst Willy Woo, whale wallets holding between 10,000 and 100,000 BTC have been steadily selling since 2017.

These whales were early adopters and bought their BTC at prices between $0 and $700. After holding for eight to sixteen years, many of them are now securing profits as Bitcoin continues to reach new highs.

The numbers confirm this behaviour. Over the last eight years, the total BTC held by these whale entities has dropped roughly 40%, from 2.7 million coins to around 1.6 million.

This is not a sudden exodus by any means. Instead, it is a calculated and long-running strategy by these long-term holders who are cashing out their wins at reasonably high price levels.

While it’s easy to assume big investors would be buying more as Bitcoin reaches new highs, the opposite appears to be true. Those who got in early are choosing this moment to lock in gains.

“Big Whales” Exit as Institutions Enter

One of the interesting things about this trend is that it is happening while institutions and even governments are rushing to buy Bitcoin. This indicates a baton-pass of sorts, where the cryptocurrency is transitioning from a niche, high-risk asset to a more widely accepted one.

Woo addressed this on social media, and pointed out the curious timing. “Institutions and sovereigns are racing to buy billions in BTC,” he noted, “while the original whales are selling.”

This shows an important moment in Bitcoin’s life cycle, one where legacy holders are replaced by new entrants, all of whom have different motivations.

Bitcoin Hits All-Time Highs, Profit-Taking Intensifies

Bitcoin’s recent surge to an all-time high of nearly $112,000 in late May only added fuel to the profit-taking fire.

According to data from Glassnode, the average coin sold during this period brought in a 16% profit. That’s a strong incentive for holders, especially those sitting on older BTC to sell.

Glassnode also reported that on June 3 alone, realized profit soared to more than $500 million per hour during three separate spikes.

This shows an intense selling pressure, even as prices remain historically high. For comparison, fewer than 8% of Bitcoin’s trading days have been more profitable for sellers.

Overall, despite this sell-off from whales, Bitcoin has shown a great deal of resilience. After peaking at nearly $112,000, the price retraced by about 5.5%, before dipping to $105,000 and then rebounding slightly. As of early June 4, the asset is now hovering somewhere around $105,750.

What This Means for Investors

Bitcoin has remained above the $100,000 level for a record-breaking 27 days. This is a lot more than its previous streak of 18 days above six figures back in January.

The psychological strength at this level shows that the market still has strong buying support, even as older players are flying the coop.

The ongoing profit-taking from whales doesn’t necessarily mean that a crash is inbound. However, it does show that the market is in a transition, where long-time whales are exiting and large institutions are entering.