Apple has announced that sideloading will be introduced to European iPad users with the release of iPadOS 18 on September 16.

This update will bring the tablets in line with the iPhone, which saw similar changes six months earlier due to the European Union’s Digital Markets Act.

According to a post on the developer’s blog, several updates will take effect on September 16:

- EU users will be able to download iPadOS apps not only from the App Store but also through alternative distribution methods.

As previously noted in May, if developers have agreed to the Alternative Terms Addendum for Apps in the EU, the first annual installs of iPadOS apps will start to accrue, and the reduced App Store commission rate will apply.

- Alternative browser engines will be supported in iPadOS apps.

- Historical App Install Reports in App Store Connect, which can be used with the fee calculator, will now include iPadOS data.

For European iPad users, sideloading will introduce the following changes:

- Third-party payments: Developers will be allowed to offer third-party payment systems, and users can utilize alternative payment wallets.

- Browser choice: During iPad setup, users will have the option to select other browsers as their default.

- Third-party marketplaces: Users can download third-party marketplaces and apps through them, including platforms like the Epic Games store and Fortnite.

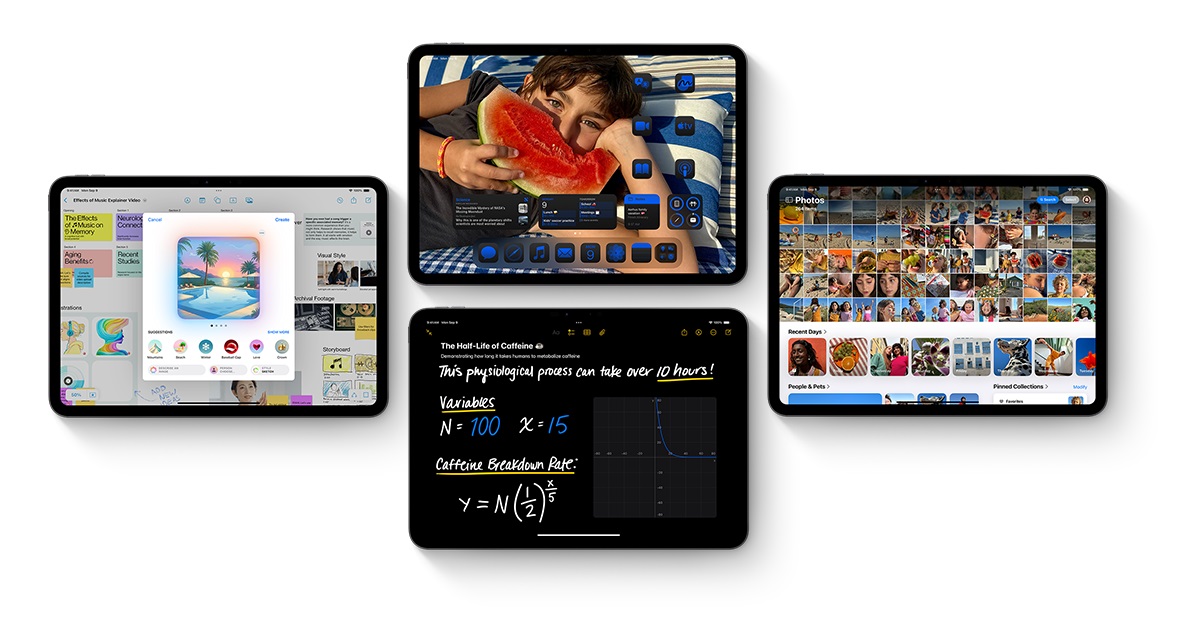

iOS 18 and iPadOS 18 will feature a new Default Apps section in Settings, where users can see all available default apps.

Apple has indicated that future updates will allow users to set default preferences for tasks such as dialing phone numbers, sending messages, translating text, navigating, managing passwords, selecting keyboards, and filtering call spam.

Apple also disclosed that EU users will have the option to delete default apps such as the App Store, Messages, Photos, Camera, and Safari.

While users have been able to remove some default apps previously, the removal of apps like Messages and the App Store was not allowed due to concerns about system integration.

Apple now appears to have found a way to decouple these apps from core system functions.

Additionally, Apple has recently updated its App Store and third-party marketplace policies for European users, and further changes may be forthcoming.

The company might be required to eliminate the Core Technology Fee that developers incur when offering their apps outside the App Store.