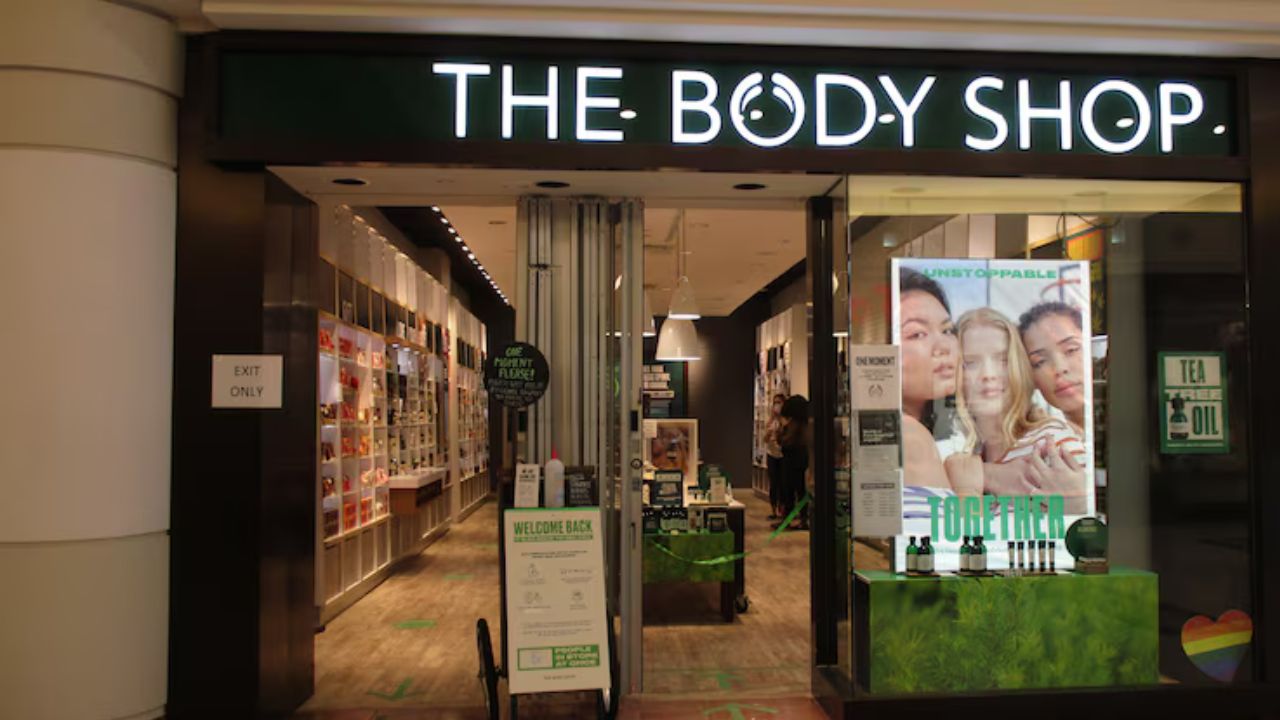

The renowned UK-based cosmetics company, The Body Shop, has made a significant announcement regarding its North American presence, revealing the closure of all US-based operations and the initiation of store closures in Canada as part of a bankruptcy filing.

The decision comes amid challenging economic conditions, with a particular impact on traditional retailers operating in malls, catering primarily to the beleaguered middle class.

Why the Shutdown?

The company officially communicated the cessation of its US subsidiary’s operations, effective from March 1, as part of its broader strategy to navigate financial challenges.

The move is attributed to the adverse effects of high inflation experienced in recent years, which have disproportionately affected businesses like The Body Shop.

The company’s reliance on mall-based retail, coupled with economic hardships faced by the middle class, has contributed to the decision to shutter its operations in the United States.

When Does It Take Effect?

The cessation of operations in the United States became effective on March 1, marking a crucial milestone in The Body Shop’s strategic response to economic challenges.

Simultaneously, the company announced the immediate commencement of liquidation sales in 33 out of its 105 Canadian stores.

Despite these closures, all Canadian locations are expected to remain operational for the time being, indicating a phased approach to restructuring in the region.

The Canadian market is not exempt from the repercussions of The Body Shop’s financial woes.

With 33 stores in Canada entering into liquidation sales, customers will have the opportunity to avail themselves of discounted products as the company seeks to manage its inventory.

The decision to halt online sales via Canada’s e-commerce store adds another layer to the restructuring process, indicating a comprehensive reevaluation of the company’s retail strategy in the region.

Challenges Faced by Traditional Retailers

The broader economic context, characterized by high inflation rates in recent years, has proven particularly challenging for traditional retailers like The Body Shop.

Operating predominantly in malls, the company faced the brunt of shifting consumer behaviour and the economic struggles of the middle class, further compounded by the rise of e-commerce.

The bankruptcy filing underscores the need for adaptability in the retail sector, with a focus on addressing changing consumer preferences and economic challenges.