Key Insights:

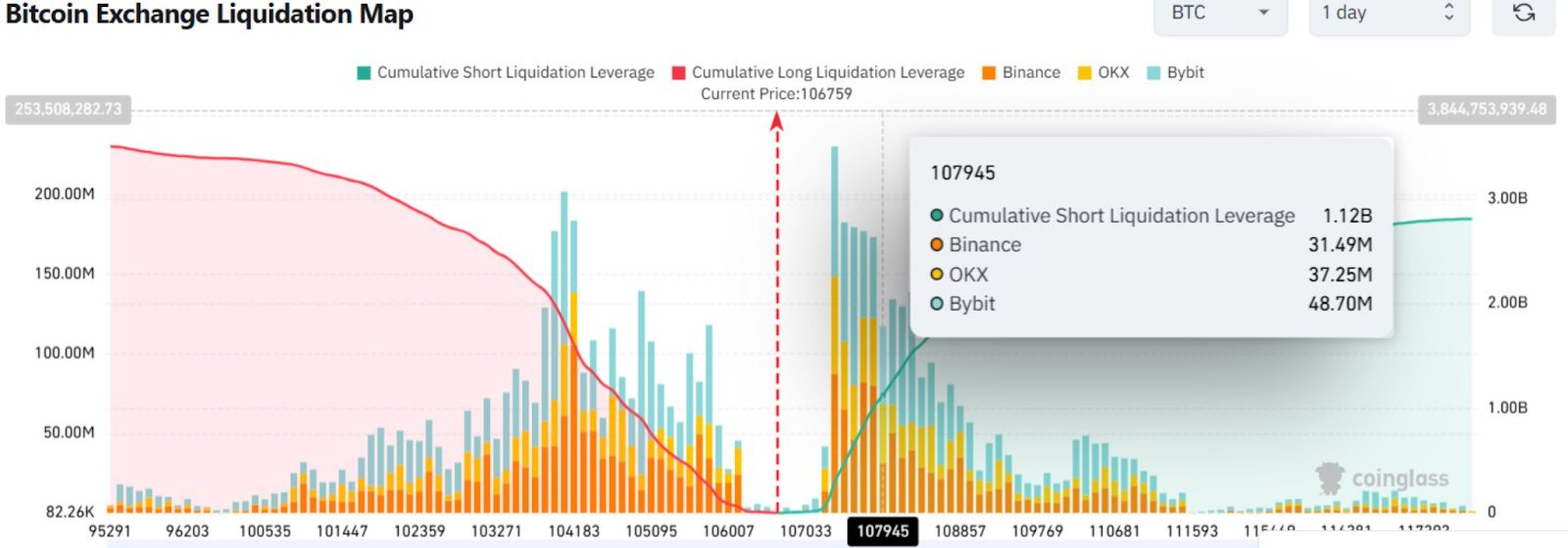

- $1.1B in BTC shorts face liquidation if price breaks $108K.

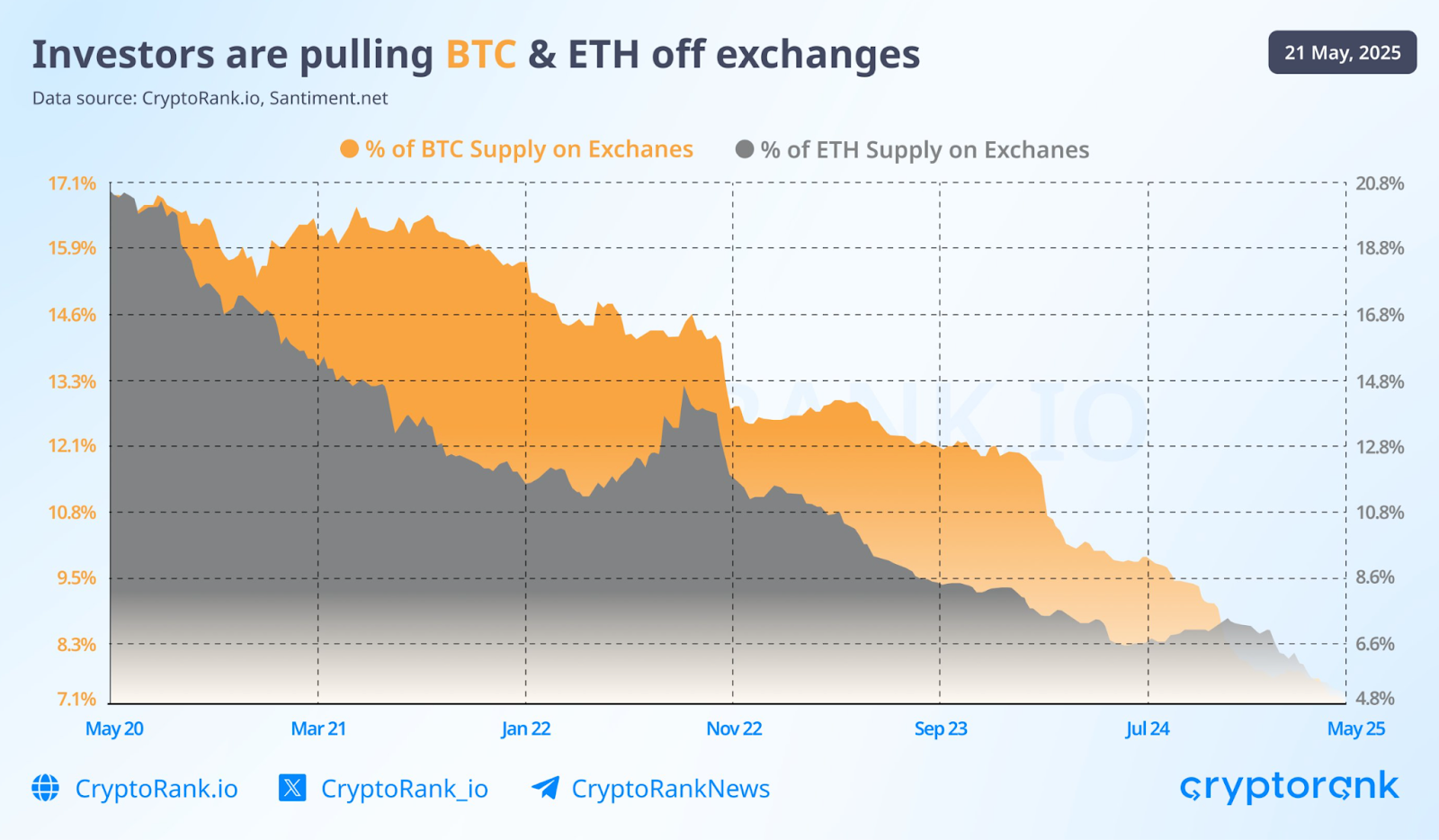

- BTC supply on exchanges drops to just 8.6%, lowest since 2017.

- Technicals show potential rally toward $120K after consolidation.

Bitcoin’s rise to $107,000 has caused thousands of short positions to be at risk of being liquidated. At that price, shorts could lose more than $1.1 billion.

At the same time, investors are taking BTC off exchanges, causing the supply to drop to its lowest point since 2017. As a result, prices might continue to rise.

BTC Shorts Near Liquidation as Price Climbs

Bitcoin is now at $106,000, which is close to the level that could cause $1.12 billion of short positions to be liquidated. According to Coinglass, above $108,000, those who sold Bitcoin short risk significant losses. Binance, OKX, and Bybit have seen combined short liquidations of more than $117 million.

At the same time, the liquidation map demonstrates how leveraged traders are facing pressure. The total short exposure on Binance is $31.49 million, on OKX it is $37.25 million, and Bybit shows $48.70 million.

When traders sell their losing positions, they often buy BTC again to cover the losses, which helps push prices up.

Moreover, we can see from the weekly chart that Bitcoin tends to repeat patterns after MACD bullish crossovers.

The latest MACD crossover is green, and previous times this happened, strong rallies usually followed. Bitcoin rose by 207% in just 22 weeks after the 2020 Venus retrograde.

A 139% increase took place after the 2022 reversal. Since the 2024 halving, Bitcoin has seen a rise of 72% in just 9 weeks.

Bitcoin Supply on Exchanges Falls to Multi-Year Lows

Adding to the bullish sentiment, more investors are taking their Bitcoin and Ethereum off centralized exchanges these days.

According to CryptoRank, BTC held on exchanges is now at 8.6%, the lowest number in eight years. Ethereum is now being held off exchanges at its lowest level in a decade.

In addition, when exchange-held supply decreases, it is often linked to more stable prices and a tendency for people to hold on to their assets for a long time.

Often, investors take their assets out of exchanges and put them into cold wallets or DeFi platforms when they want to keep them for a longer period or use them differently.

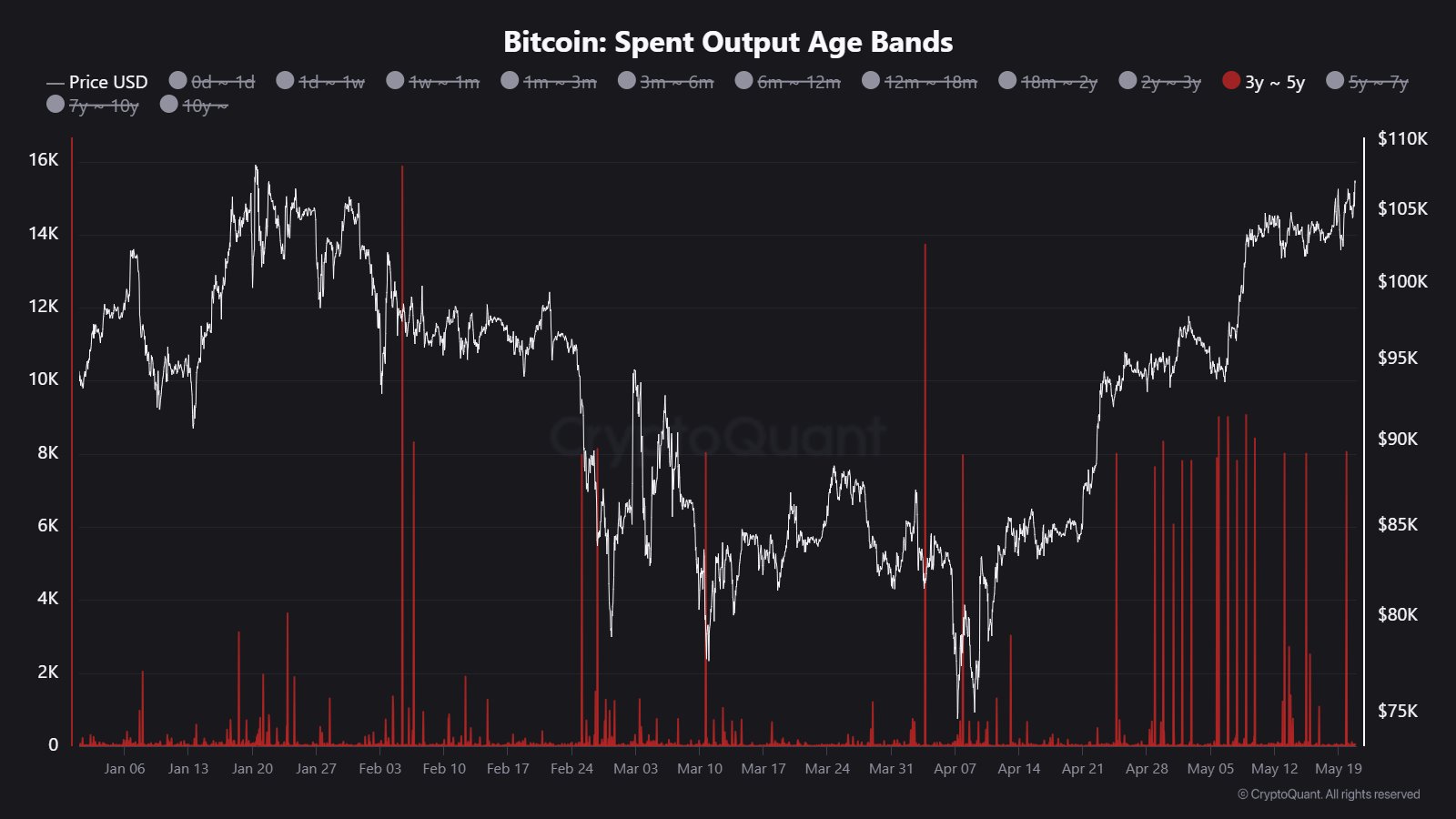

This is evidenced by 8,511 BTC, each 3 to 5 years old, moved on-chain. We have seen large movements of old coins like this 22 times in 2025.

Even so, it’s sometimes unclear if these movements are a sign of selling or simply a way to reorganize wallets. At times, those who hold cryptocurrency for a long period move their coins to different wallets for security. Still, when there are many older coins being moved, it often points to big investors returning to the market.

In addition, the spent output chart on CryptoQuant confirms that this trend is occurring. After Bitcoin’s price passed $105,000, we have seen more red bars which indicate coins aged 3 to 5 years being moved. As a result, those who have held cryptocurrencies for a long time may be paying more attention to recent price movements.

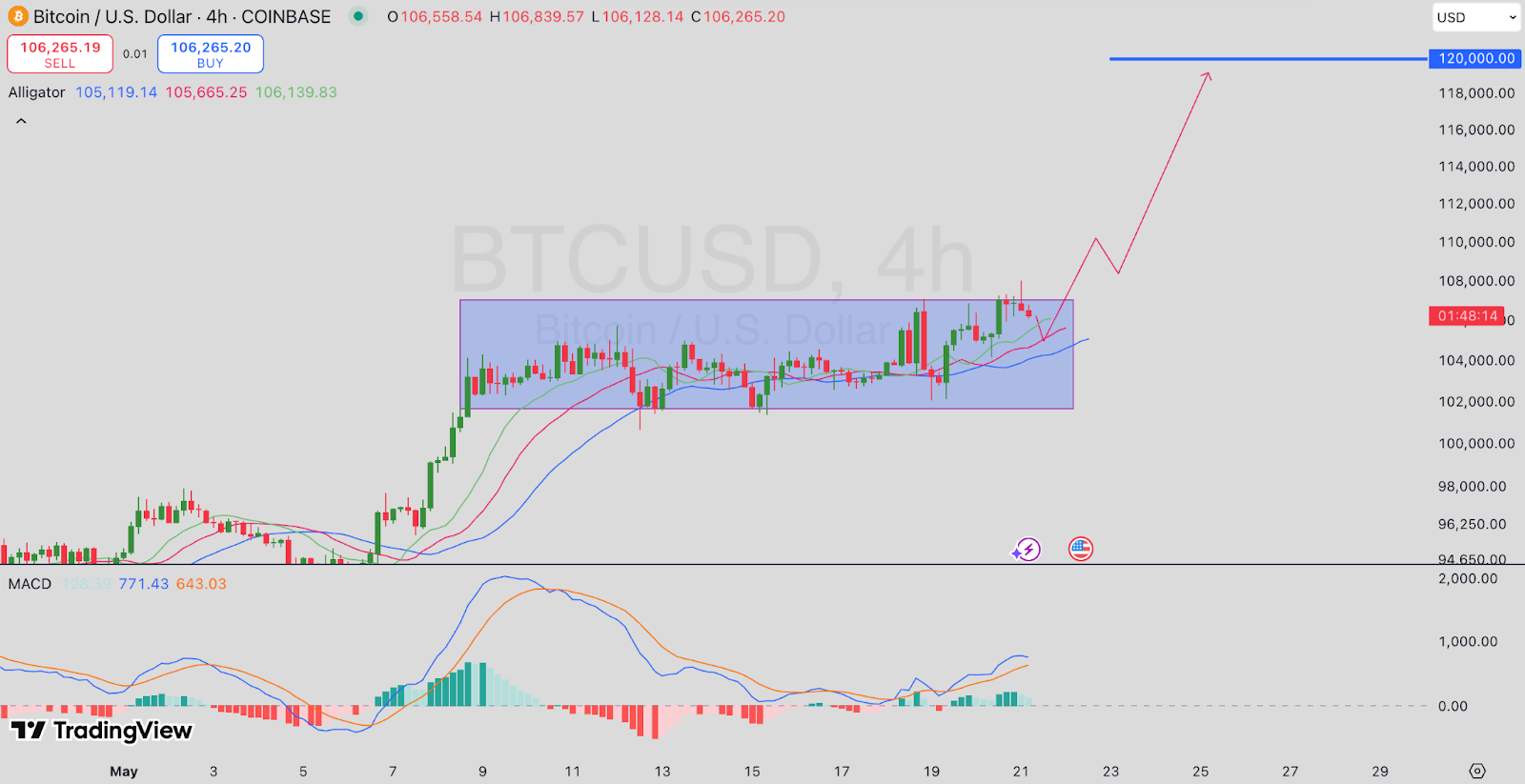

BTC Consolidation Hints at Move to $120K in the Short-term

On the 4-hour chart, Bitcoin is moving between $104,000 and $108,000. A clear consolidation period is visible in the chart, and the Alligator shows that the trend is building. As soon as bitcoin breaks $108,000, the next resistance could appear near $120,000.

Besides, the MACD is also bullish, as the histogram has turned green and the signal line is on the rise.

This means traders believe that prices will go up in the near future. According to the forecast, the price can retrace a little to $106,000, followed by a rise to $120,000.

As a result, if Bitcoin surpasses $108,000 and short positions are closed, the route to $120,000 could become clear very quickly.