Key Insights:

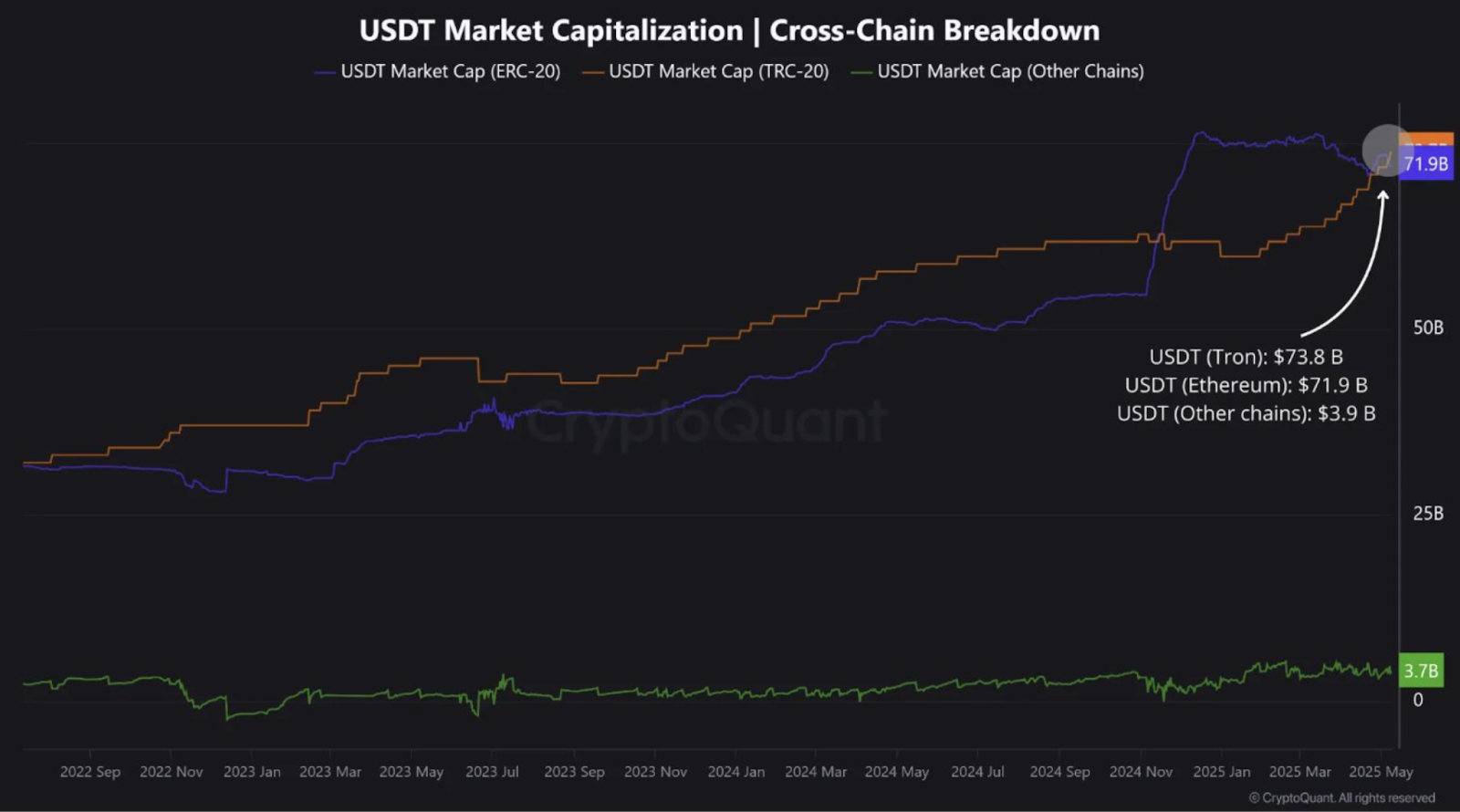

- TRON overtakes Ethereum in USDT supply with $73.8B, ahead of Ethereum’s $71.9B.

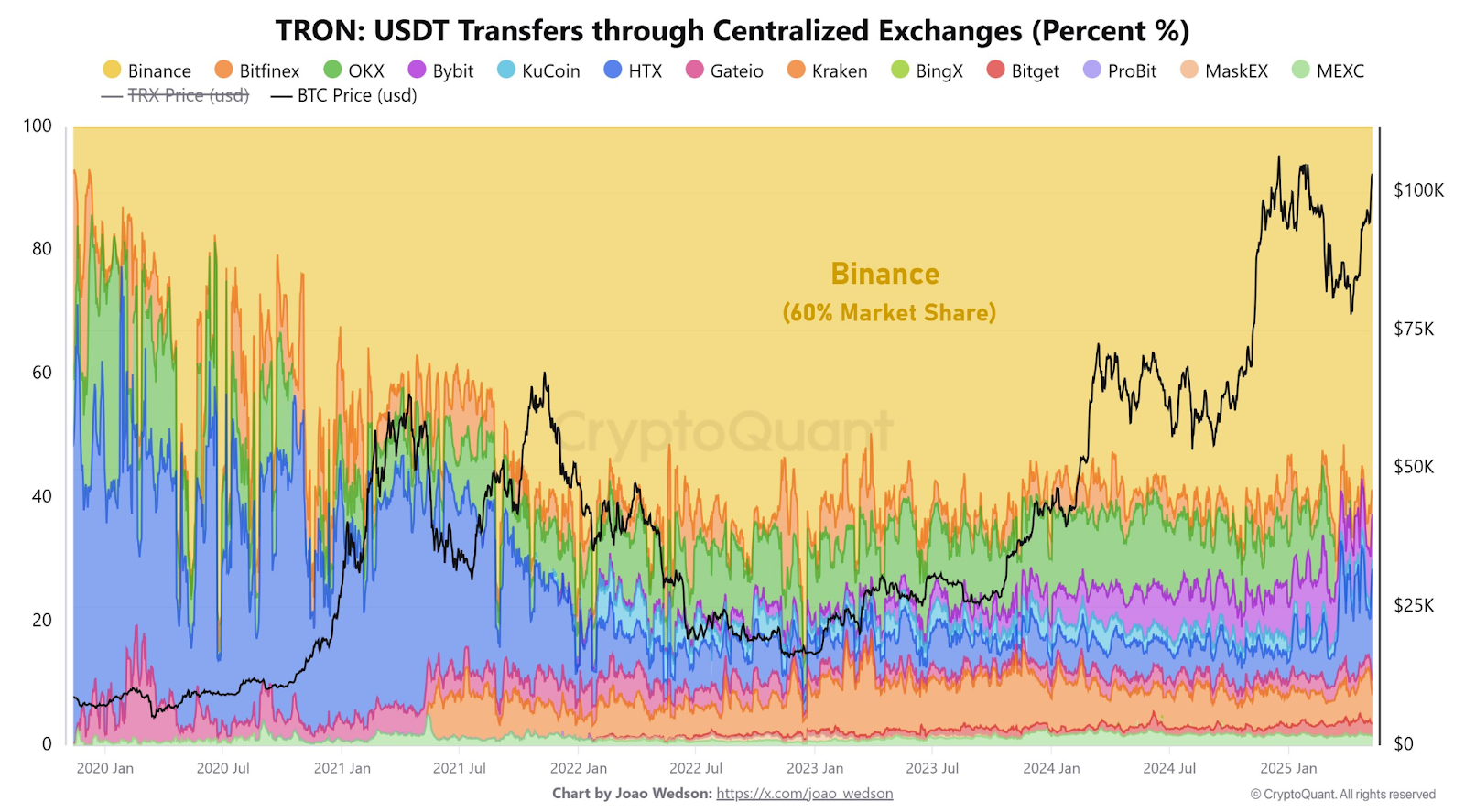

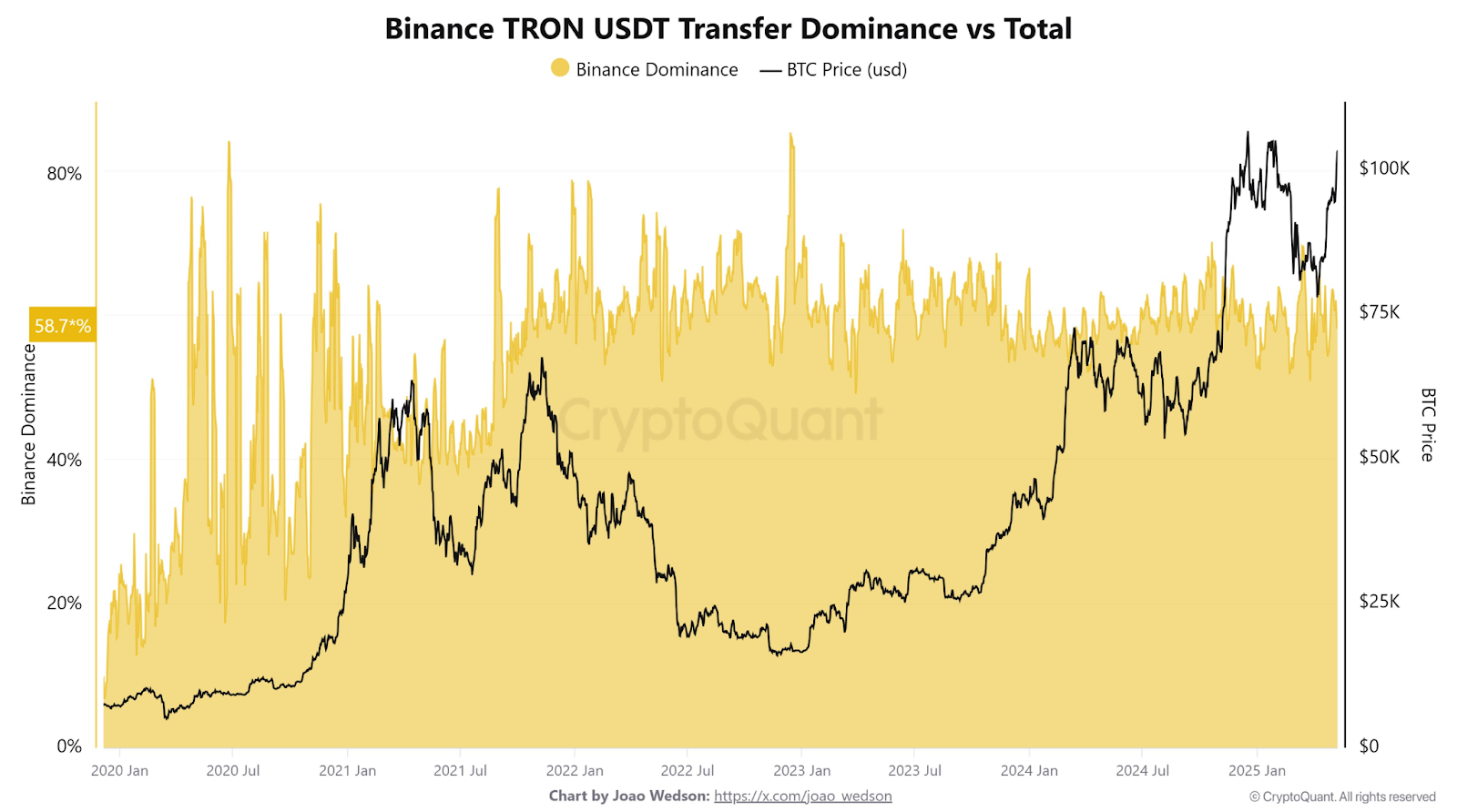

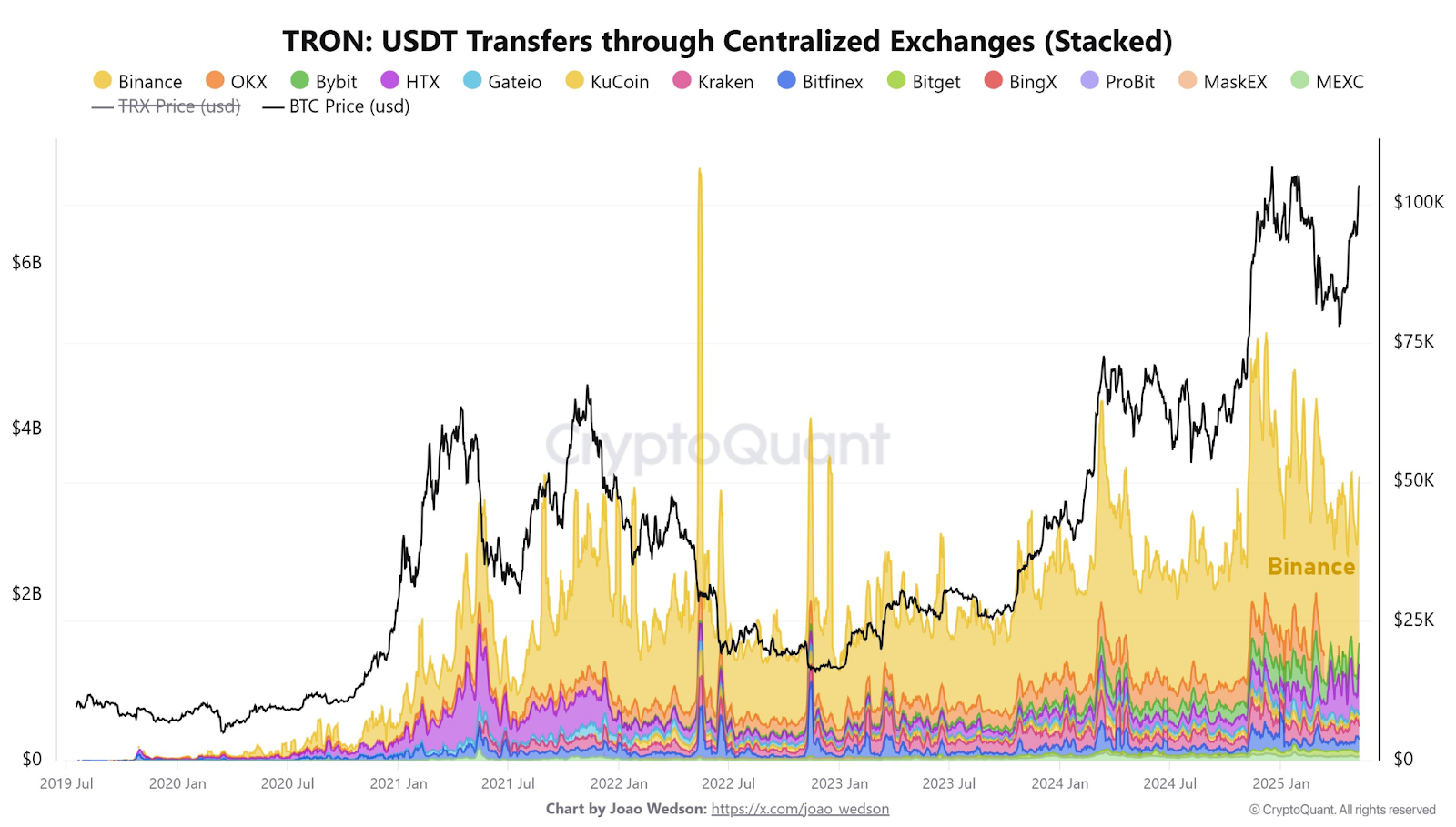

- Binance handles 60% of TRON USDT transfers, averaging over $600M daily.

- TRX chart signals trend strength, with key support at $0.209 and potential target near $2.

TRON now leads Ethereum in USDT supply, holding $73.8B on TRC-2.0. Binance manages 60% of those transfers. Stablecoin activity continues to rise, keeping TRX trading at substantial volumes. Analysts are watching for a possible move to $2.

TRON Overtakes Ethereum in USDT Supply

TRON has overtaken Ethereum regarding the total circulation of the USDT supply for the first time. TRX holds $73.8 Billion USDT as of May 2025, while Ethereum has $71.9 Billion. Other chains account for a much smaller portion of $3.9 Billion in total, according to CryptoQuant.

USDT growth on TRON has been stable and continuous. Ethereum’s supply stagnated throughout 2024, but TRON’s surged from mid-2023. This change shows an increased preference for reduced fees and increased transaction speed, which are provided by TRON’s TRC-20 standard.

The difference between TRON and Ethereum is not that big – $1.9 Billion – but the power shift is obvious. It shows how users and institutions are tilting toward cheaper blockchain networks, particularly for high-volume transactions.

Binance Dominates TRON-Based USDT Transfers

Binance still leads TRON’s USDT transfer activity; it handles 60% of all such transfers on centralized exchanges. This puts the exchange far ahead of other platforms such as OKX, HTX, Kraken, and KuCoin.

The stacked and percentage charts indicate that Binance handles more than $600 Million in TRON-based USDT daily. That’s higher than all the other exchanges combined. The dominance is at 58.7%, consistent with increasing USDT volume and market activity.

The sustained increase in Binance’s share since early 2021 indicates that it has developed infrastructure well-suited to TRC-20 users. This could also explain why institutional traders would rather use the exchange for huge-volume stablecoin transfers.

With the increase in BTC prices, the rise in TRC-20 volume on Binance is a sign of high activity in the crypto market. Such trends represent overall sentiment and liquidity within the ecosystem.

TRON’s Chart Pattern Points to Uptrend Continuation

Looking at the price, the native token of TRON, TRX, is trading around $0.26. It is trending up strongly on the weekly chart.

Price action has held above a long-term support line since 2020. The structure constantly increases from 2023 onwards, with distinct higher lows and consolidation zones.

The pattern escaped from a multi-year triangle formation in late 2023 and retested the support successfully. TRON has gained momentum and formed a stronger price foundation. It could push toward $1 and $2 if the trend holds.

Such a change from $0.26 to $2 would be a 669%. In 2019-2021, TRX previously rallied 6,469% from its bottom near $0.007 to $0.44. Such historical performance does not guarantee future performance but puts current targets in context.

Growing Liquidity Could Drive Demand Further

The rise in USDT on TRON is closely linked to liquidity movements. High USDT transfer volume on Binance further influences this trend.

More stablecoins on-chain are usually an indication of increased market participation. As stablecoins such as USDT are commonly utilised for trading, their flows indicate sentiment.

The growth of TRON-based USDT supply also indicates the demand from users for cheaper and faster stablecoin transactions. Ethereum gas fees remain problematic for many, so TRON is a more popular option for fast transfers and on-exchange operations.

If TRX keeps increasing while the USDT supply and substantial exchange dominance increase, it might attract more attention. The chain has gained a considerable share of stablecoin activity without significant network stress.

Liquidity and exchange flows may continue to define price moves as the market moves upward. Binance’s central role fuels this growth narrative, the cost-efficiency of TRON, and stablecoin demand.