Key Insights:

- Strategy, formerly known as MicroStrategy, halted its Bitcoin purchases between March 31 and April 6.

- The purchase pause is unusual, as the firm has regularly acquired Bitcoin bi-weekly since 2020.

- Bitcoin’s drop below $80,000 coincided with Strategy’s halt, raising concerns about its investment outlook.

MicroStrategy, now rebranded as Strategy, led by Michael Saylor, didn’t buy any Bitcoin between March 31 and April 6. The company paused its routine stock purchases to raise capital through share sales.

This strategy has established a consistent weekly cycle. When the company paused its Bitcoin acquisition, Bitcoin’s price significantly declined to $80,000.

The organization extensively acquired its assets immediately before this brief duration. In late March, Strategy made two substantial purchases totaling 22,048 Bitcoin. It spent $1.92 Billion after obtaining 6,911 Bitcoins worth $584 Million earlier.

The sudden suspension demonstrates concern over Strategy’s belief in existing crypto market trends. The suspension reveals a careful investigative period instead of a short-term postponement.

Strategic Analysis showed that the Bitcoin purchase prices averaged $94,922 during the first quarter. Current Bitcoin prices being lower than their buying level exposes the company to the possibility that its value will become negative.

Michael Saylor’s Strategy Faces Pressure Amid Bitcoin Losses

Strategy currently possesses 528,185 BTC worth $35.63 Billion, which it obtained by spending $67.458 per Bitcoin. The current market slump has driven the company to report a $5.91 Billion unrealized loss in the first quarter of this year.

The sharp price drop suggests growing threats to maintaining its future accumulation plan. The unrealized loss reveals the narrow financial space between gains and losses when operating with a substantial Bitcoin holdings position.

A substantial Bitcoin price decline might require Strategy to evaluate its investment assumptions. The firm could encounter difficulties from the increasing loss, which may cause it to consider selling its assets.

The reaction could become harmful when Bitcoin moves to the market, regardless of the payment method.

The organization of Michael Saylor currently possesses more than 2% of the total Bitcoin supply in the market. Major sales procedures lead to market fears that additional price declines could occur.

MSTR Stock Falls Amid Market Turmoil

Strategy’s stock trades under the ticker MSTR and has decreased by 13%. This led to current market prices of $256 per share. The investment value has decreased with Bitcoin’s value reduction and responded to broader market movement.

New tariffs unveiled by former President Donald Trump caused widespread disturbances in the stock market. This week’s opening trades revealed a 3.5% reduction in the S&P 500 index. It is approaching bear market criteria.

Stock fluctuations on the Nasdaq have also caused the MSTR value to decrease. Strategy’s stock performance has eliminated every gain achieved throughout this year. It currently presents an 8% decrease for 2025.

The business performance closely correlates with Bitcoin’s market value. However, strong macroeconomic pressures increased its financial losses.

The ongoing crypto price drop and trade war are adding stress for MSTR shareholders. These negative factors increase the risks of a further market value decline.

Higher trade tariffs could reduce investor confidence in MSTR, which Michael Saylor had established in years. This shift might lead to decreased investments in such sectors.

Whales Keep Buying as Strategy Stands Still

Strategy, the Bitcoin holding company of Michael Saylor, has paused its operations amidst ongoing acquisitions by major Bitcoin holders. This development reflects a shift in market dynamics.

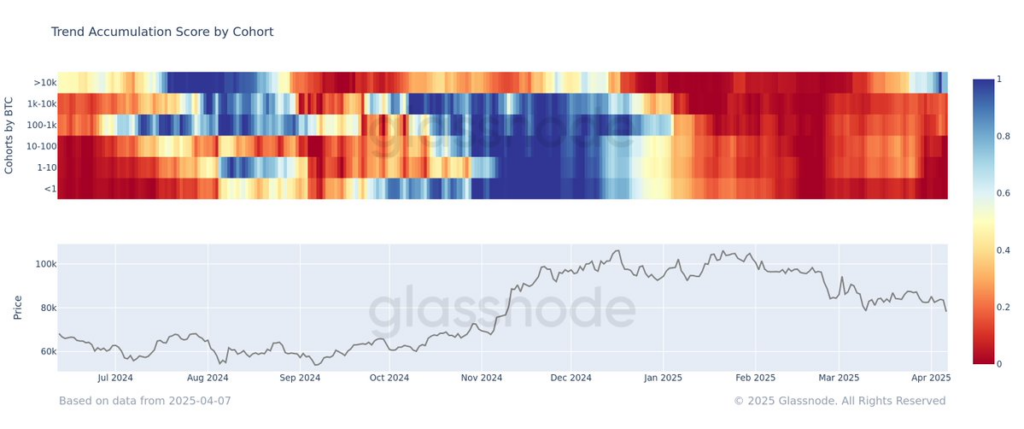

Glassnode observed top accumulation activity from wallets owning over 10,000 BTC during the early parts of this month. The accumulation score displayed maximum value points that indicated massive purchasing behavior lasted for 15 days.

The score descended to 0.65, but evidence indicates that whips remain interested in buying Bitcoin. Institutional holders maintain their optimism for Bitcoin investments even as market conditions decline.

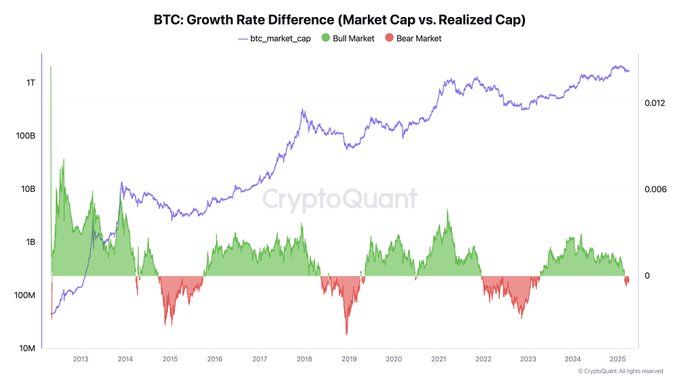

The environment remains uncertain, and there is a high level of reactivity. According to CryptoQuant leader Ki Young Ju, the bull market seems to have reached its end.

Appearing cautious indicates whales may experience danger when the price shows signs of dropping further. The continued accumulation of Bitcoin does not guarantee that recent acquisitions will yield profits.