Key Insights:

- A Dogecoin whale transferred 300 million DOGE worth around $41.77M to Binance on April 7.

- This transaction triggered a 15% price drop, bringing DOGE to a low of $0.13 within 24 hours.

- The large-scale deposit increased DOGE’s exchange supply and contributed to growing selling pressure.

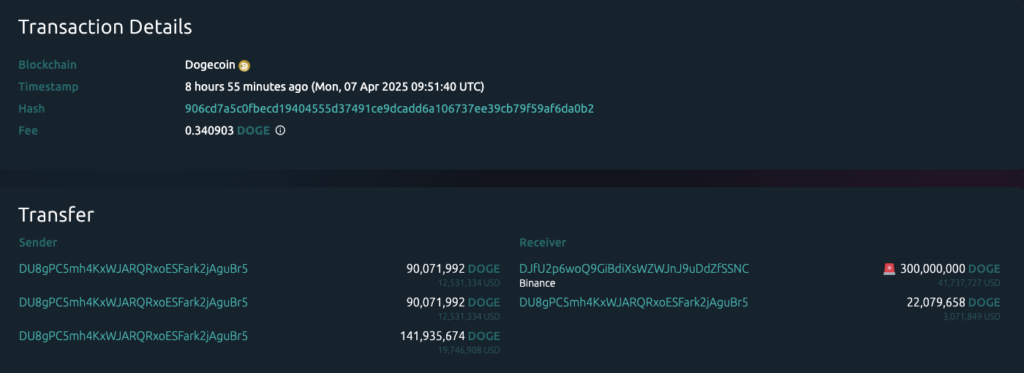

A massive Dogecoin (DOGE) transaction sparked intense volatility in the market at the beginning of the week. On April 7, a whale wallet moved 300 million DOGE, worth approximately $41.77 Million, to Binance.

This large transaction added significant selling pressure and pushed DOGE into a rapid price decline. Following the transfer, Dogecoin dropped nearly 15% within 24 hours and reached a low of $0.13.

The transaction was performed by the whale located within the DU8gPC5mh4KxWJARQRxoESFark2jAguBr5 wallet. This activity raised concerns as it increased DOGE’s circulating supply on the exchange.

When the price descended, it occurred while the cryptocurrency market experienced a broader sell-off period. It intensified due to worldwide market instability.

During periods of macroeconomic shifts, Bitcoin, Ether, and other major cryptocurrencies faced significant market value declines.

These reductions were observed across the broader cryptocurrency market. Dogecoin’s sharp drop signals potential instability as more investors react to whale movements.

Dogecoin Breaks Support Amid Market Chaos

Cryptocurrencies experienced more intense selling behavior after new geopolitical events caused worldwide economic disturbances. The market dropped after Donald Trump implemented new reciprocal trade measures that damaged global financial markets and risk-oriented assets.

Cryptocurrencies reacted sharply, and Dogecoin’s fall paralleled the market-wide stress. As economic fears mounted, investors responded by reducing their exposure to volatile assets such as Dogecoin.

The marketplace remains affected by political events because these developments steer market attitudes toward pessimism. DOGE’s drop below $0.17 signaled a technical breakdown, reflecting weak support from its trading range.

Dogecoin lost key support levels during this period and has remained under pressure ever since. The current market performance demonstrates compounded effects between economic instability and substantial token market fluctuations.

Current conditions suggest that DOGE may continue facing downside pressure without a reversal signal.

DOGE RSI Signals Possible Trend Reversal

Market analysts presented opposing outlooks following the whale dump and DOGE’s sharp decline. Analyst Berke Oktay indicated that the $0.17 price support loss creates space for further price dipping.

The signs from trading technology indicators weakened, and he predicted heightened risks at these essential price points. However, analyst Trader Tardigrade highlighted a second bullish divergence in the Dogecoin Relative Strength Index (RSI).

Despite falling prices, he argued that rising momentum showed signs of a possible flipping of market trends. The market experiences this pattern before it enters recovery phases throughout its cycles.

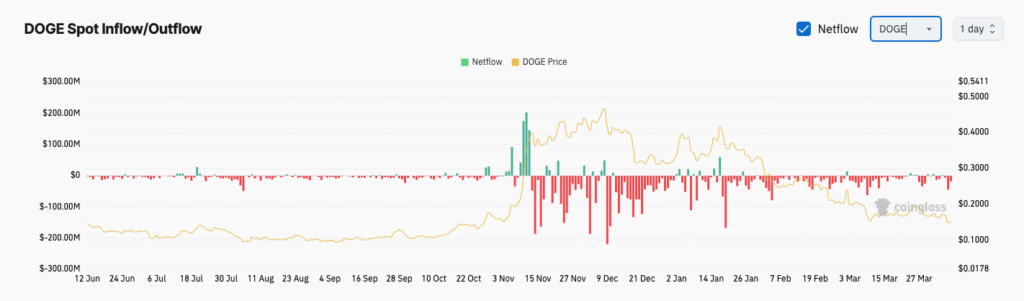

Though DOGE declined sharply, data from CoinGlass showed persistent outflows from spot markets beginning mid-November 2023. These outflows suggest holders continue withdrawing DOGE from exchanges, possibly reducing immediate selling pressure.

Prolonged negative netflow activity suggests market participants are committed to holding their DOGE positions. This trend reflects a medium- to long-term investment strategy.

Dogecoin Outflows Rise Despite Price Decline

In November 2023, Dogecoin experienced a sharp price rally, rising to nearly $0.40 as exchange netflows peaked. The exchange deposits reached significant high points when short-term profit-takers engaged in the market.

Throughout December, bigger withdrawal amounts started to appear, and growth occurred. Since early 2024, DOGE has seen multiple sharp exchange outflows exceeding -$100 Million, including in March.

The market data shows that decreasing platform withdrawals from sellers precede buying patterns. This could mean investors are storing their tokens in reserve warehouses.

The exchange supply of DOGE is lower than during the previous market peak despite the decreasing token prices.

Dogecoin traded at around $0.1484, down significantly from its November highs. The trend displays mixed market sentiments because of outflows and a weakening price direction.

In the context of long-term market confidence, whales’ short-term selling aligns with the decreasing supply on trading platforms. This trend reflects broader market dynamics influencing cryptocurrency activity.