The outlook for U.S. small-cap stocks in 2024 appeared promising, following a generally lackluster performance in 2023. However, recent volatility has unsettled investors as uncertainty regarding the Federal Reserve’s stance on interest rate cuts resurfaced amidst mixed January inflation data on Wall Street.

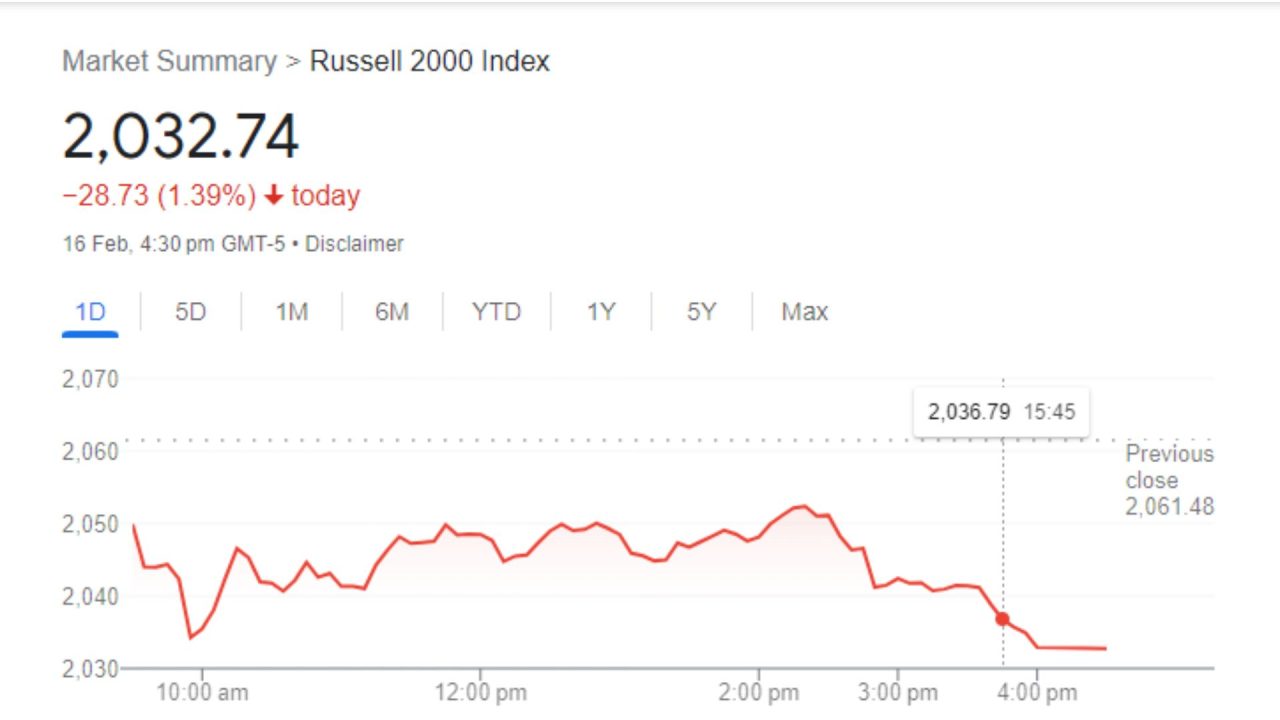

The Russell 2000 index, which measures the performance of 2,000 small and mid-sized companies, witnessed its lengthiest streak of seven consecutive sessions with at least a 1% move in either direction since March 2023, according to Dow Jones Market Data.

During this period, the Russell 2000 outpaced the Nasdaq Composite, which dropped 1.3%, by the widest margin since December 15 of the previous year.

The S&P 500 also experienced a 0.4% decline, and the Dow Jones Industrial Average dipped 0.1%, marking the end of a five-week winning streak for all three major large-cap indexes.

Anna J. Rathbun, Chief Investment Officer at CBIZ Investment Advisory Services, underscored the dependency of small-cap stocks on interest rates and their susceptibility to volatility. Rathbun emphasized that small caps often face increased volatility when there’s a sentiment that interest rates will remain higher for an extended period.

The week commenced with a nearly 4% drop in the Russell 2000 on Tuesday, triggered by a hotter-than-expected January inflation report. Investors feared that interest rates might stay elevated for a longer duration than anticipated.

However, sentiment shifted in the subsequent days due to dovish comments from Chicago Fed President Austan Goolsbee and a weak retail sales report, reigniting hopes for a potential rate cut in the coming months.

Consequently, the Russell 2000 ended the week around 2.5% higher, marking its best daily percentage gain since December.

At the start of the year, there were expectations of a significant resurgence for small-cap stocks, driven by the belief that their brief outperformance in December could extend into the new year as interest rates decrease and the U.S. economy navigates toward a soft landing.

However, contrary to these expectations, the Russell 2000 has only risen by 0.3% compared to the 4.9% advance for the S&P 500 and the 5.1% gain for the Nasdaq over the same period.

David Lefkowitz, Head of Equities for the Americas at UBS Global Wealth Management, suggested that small-cap stocks are poised to catch up with their large-cap counterparts after trailing behind in 2023.

Lefkowitz highlighted that periods of negative correlation between interest rates and small caps tend to be short-lived. Even if this correlation persists, UBS’s outlook for the 10-year Treasury yield to fall to 3.5% by year-end could support small-cap outperformance in the coming months.

Despite the recent rise in interest rates, small-cap stocks haven’t outperformed, as an increase in earnings growth has not convincingly materialized.

The chart analysis indicates that small caps typically outperform when rates are rising, and economic growth remains robust. However, the current lack of conviction regarding a soft landing for the U.S. economy contributes to the volatility in the Russell 2000.

Steve Sosnick, Chief Strategist at Interactive Brokers, characterized the recent volatility in small-cap stocks as an “opportunistic rotation” rather than a “fundamental move.”

He explained that the rotation is driven by money flowing into this sector as the mega-cap-tech-led rally broadens, suggesting a tactical move rather than a shift based on fundamental factors such as looser credit conditions or a robust U.S. economy.

Sosnick cautioned that the profitability of this rotation depends on successfully catching the waves. Small-cap stocks, being more prone to unprofitability, require a strong economy or favorable rates for borrowing to stay afloat until they become profitable.

Without signs of either a strengthening economy or easing credit conditions, the Russell 2000 may continue to face headwinds compared to its larger peers.