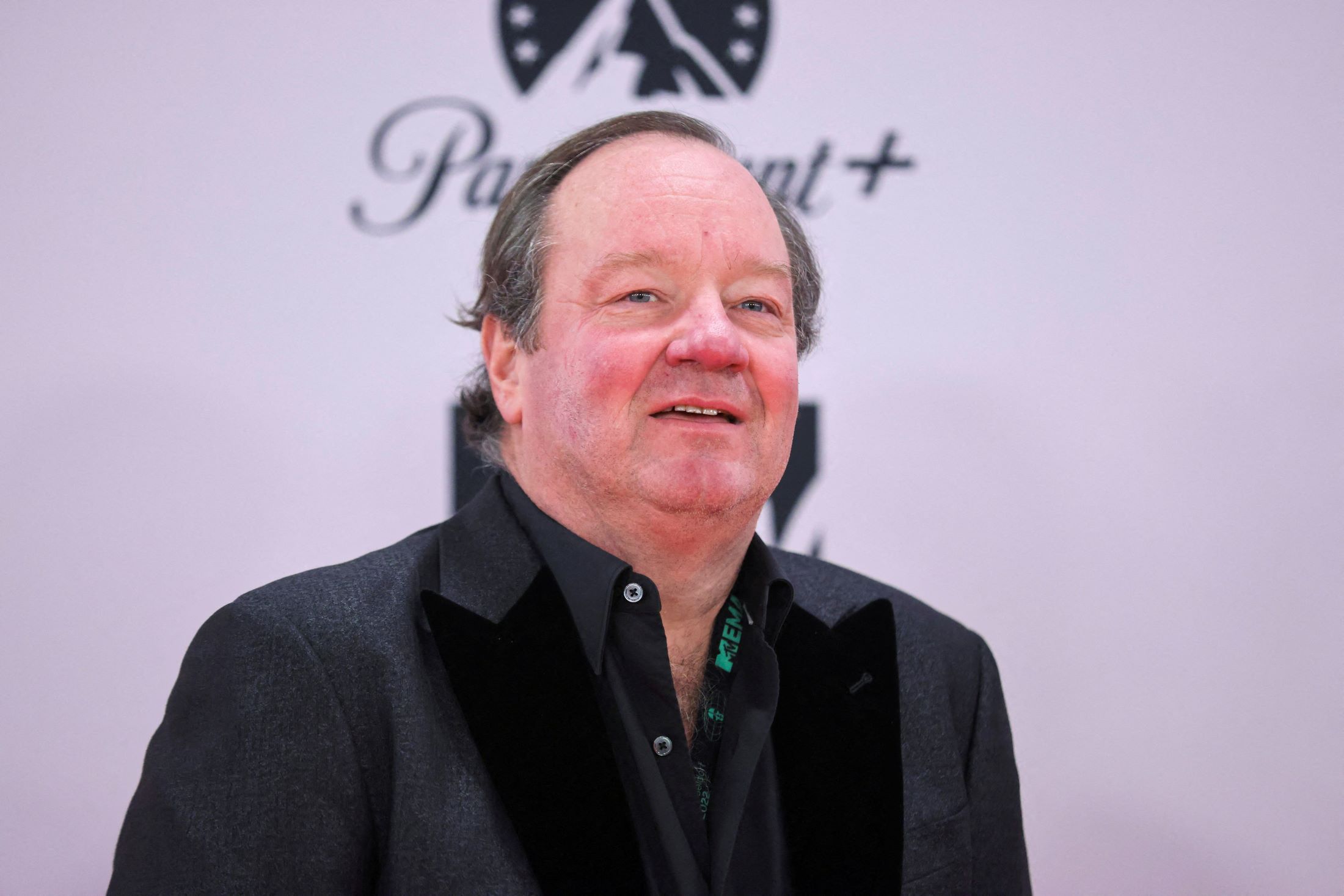

According to reports from various media outlets, Paramount Global (PARA) is anticipated to announce the departure of CEO Bob Bakish. This development arises amid heightened investor interest in the company’s strategic moves.

The Wall Street Journal initially broke the news about Bakish’s potential exit, suggesting an imminent announcement, possibly by Monday, amidst escalating tensions between Bakish and Shari Redstone, who wields control over Paramount through her family’s holding entity, National Amusements.

As per the report, Paramount is considering installing an “Office of the CEO” composed of division heads to replace Bakish. In response to this news, shares have surged approximately 5%.

National Amusements is reportedly engaged in exclusive negotiations with David Ellison’s Skydance Media for the sale of its controlling stake in Paramount, as per a knowledgeable source.

However, concerns have been voiced publicly by Paramount’s nonvoting shareholders regarding the terms of this deal, criticized for favoring Redstone. The exclusivity period with Skydance is set to expire on May 3.

Concurrently, media reports suggest discussions between Sony Pictures Entertainment and private equity firm Apollo Global Management regarding a potential joint bid for Paramount. (Disclosure: Apollo owns Yahoo Finance.)

MoffettNathanson analyst Robert Fishman highlighted the impending deadline for Redstone to make a decision, particularly emphasizing the expiry of Paramount’s distribution deal with Charter by the end of the month.

Fishman underscored the potential impact of Disney’s groundbreaking deal with Charter on Paramount, should Charter opt to discontinue Paramount’s cable networks or demand heavily discounted bundling of Paramount+ for its subscribers.

However, Fishman emphasized that Paramount’s future hinges largely on Redstone’s decisions. Despite shareholder appeals for reconsideration of the Apollo/Sony deal, Redstone appears inclined to proceed with Ellison and his supporters at present.

In terms of financial performance, Bloomberg consensus estimates project a direct-to-consumer (DTC) loss of $347 million for Paramount in the first quarter, marking a narrower loss compared to the fourth quarter’s $490 million and the year-ago period’s $511 million.

The company previously stated its anticipation of achieving domestic profitability for Paramount+ by 2025. The streaming platform currently boasts 67.5 million total subscribers.