Key Insights:

- Over 26% of the total Bitcoin supply is currently held at a loss, according to CryptoQuant data.

- The percentage of Bitcoin in loss has risen sharply from just 1.46 percent in January to current levels.

- Many investors bought Bitcoin during the late 2024 rally and are now facing unrealized losses.

Bitcoin recently experienced renewed pressure as market volatility pushed many investors into lost territory. Recent data from CryptoQuant confirmed that over 26% of the circulating Bitcoin supply is now held at a loss.

This trend reflected a sharp shift in sentiment. Just a few months ago, nearly all holders were in profit.

Bitcoin Slips as Over 26% of Supply Sinks Below Purchase Price

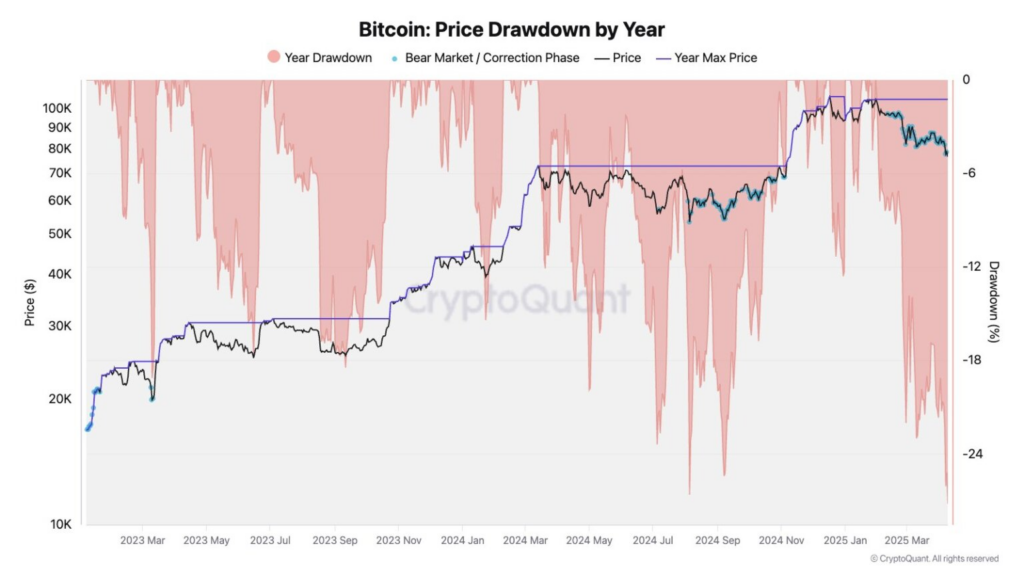

The number of Bitcoin holders in the red has climbed to 26%, indicating growing pessimism across the market. As recently as January 18, only 1.46% of Bitcoin was held at a loss, showing how quickly conditions have changed.

Market direction underwent a sudden transformation. This caused Bitcoin to hold at a loss and plummet to 0.015% in mid-December.

According to CryptoQuant data, underwater supply expansions are linked to current macroeconomic trends and investors’ market purchase points. Many investors bought Bitcoin during the late 2024 rally when prices surged to near-record levels.

Investors acquired at high market points now watch their assets devalue since the prices have dropped below their original buy-in amounts.

At press time, Bitcoin price hovered around $76,880, down 3.7% in the last 24 hours. The number of holders in loss positions has now reached September 2024 levels. However, the value of their holdings remains elevated from that period.

Recent investments demonstrate the effects of purchasing from the last price upswing at high values.

Bearish Technicals Reinforce Market Uncertainty

Bitcoin has faced strong resistance from key exponential moving averages. They are now capping any attempts at recovery. The price stayed beneath the 20, 50, 100, and 200-day EMAs as these indicators maintain a range between $82,591 and $88,049.

Every time Bitcoin fails to surpass these resistance levels, the market downturn continues with increased strength. Market momentum indicators currently indicate additional downward pressure for Bitcoin prices throughout the brief term.

Traders consider the market conditions balanced with an RSI reading of 46.60. On average, the RSI indicator at 43.33 supports this perspective. Similar to previous indicators, selling power dominates over buying power in the market movement.

The MACD indicators showed negative signals. This happened as the MACD line maintained a position of -1,588 below the signal line at -1,454.

The current reading in the histogram stood at -135. This confirmed that downward price mobility remained active in the market. The probability of testing lower support remains high unless Bitcoin can close decisively above the EMA resistance cluster.

Institutional Outflows Deepen Bitcoin’s Decline

Institutional investors have shown reduced interest, further adding to Bitcoin’s weakness. Farside Investors said $326.3 million flowed out of Bitcoin ETFs yesterday alone.

The Crypto market experienced a continued drain for seven straight trading days after the last eight sessions. The regular transfer activity showed that massive investors have decided to decrease their holdings or cash out. On the other hand, uncertainty prevailed in the market.

Institutional investors’ selling contributes to retail investors’ market declines, thus influencing broader market opinion. The thinning of liquidity creates stronger resistance to recovery attempts in the market.

Market participants have adopted a holding position while they watch for steady market indicators that indicate entry points. ETF investment activity remains stagnant because market participants believe the near-term market recovery will not happen any time soon.

With global macroeconomic conditions weighing heavily, Bitcoin faces additional barriers to a sustainable recovery.

Bitcoin’s Position Remains Stronger Than Past Lows

While 26% of Bitcoin’s supply is lost, the overall investor base is in better shape than during previous downturns. In November 2022, when the FTX collapse rattled markets, over 56% of Bitcoin holders were underwater.

The present investor base retains better stability than previous market lows, even during this persistent correction period. Investors who bought Bitcoin before the 2024 bull rally phase continue to experience market advantages in the existing conditions.

Most investors who entered before recent buyers continue to have profitable positions, although new investors face losses. The supply of underwater crypto assets remains near recently established entry points. The timing of their entries heavily influences investors’ market positions.