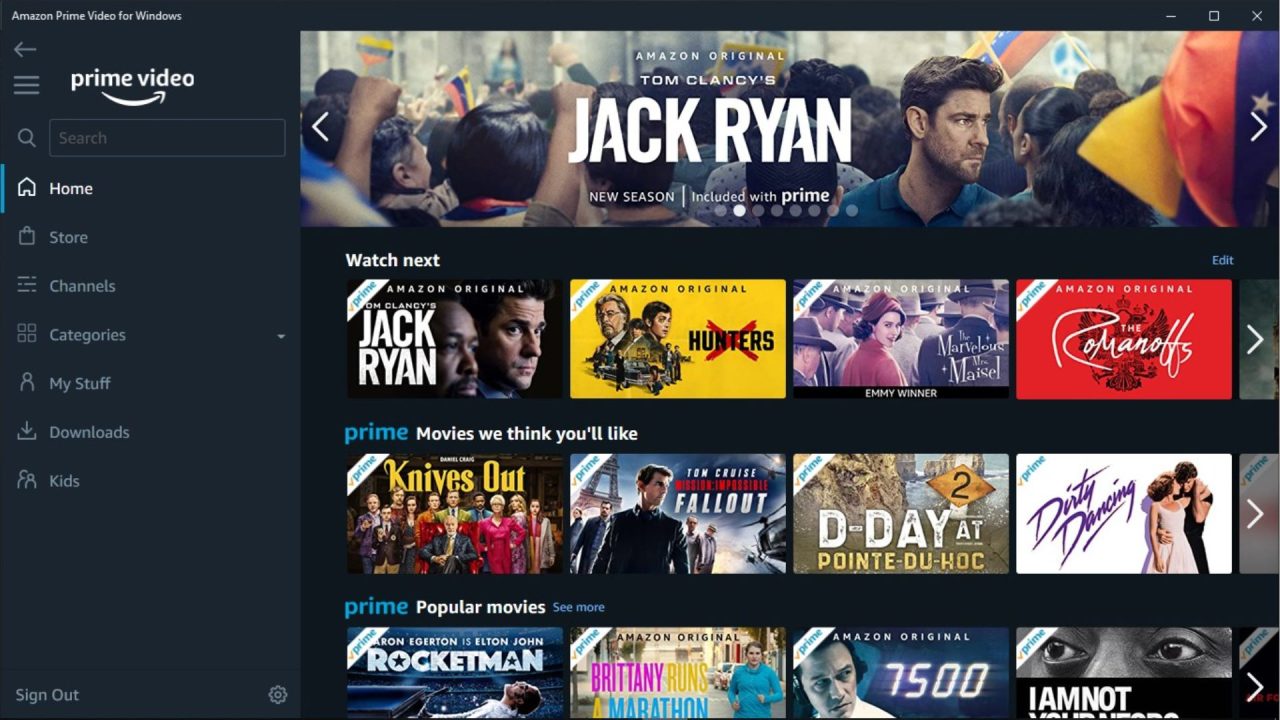

The forthcoming frontier in Amazon’s rapidly expanding advertising domain lies within Prime Video. The recent rollout of a Prime Video ad tier at the end of last month, a feature also embraced by its streaming counterparts, marks a pivotal step in the company’s pursuit of enhanced profitability.

Just a few weeks following Amazon’s restructuring efforts involving job reductions across its Prime Video and MGM Studios divisions, advertisements were formally integrated into Prime Video on January 29th. Differing from Netflix and Disney+, which present ad tiers as economical alternatives, Amazon has made its ad tier a standard offering for all Prime Video users, while charging an additional $2.99 per month for access to an ad-free version.

Social media channels have been abuzz with discontent, with users expressing dissatisfaction over the notion of having to pay for something that was previously complimentary. However, on the flip side of this debate, the influx of additional revenue from advertisements is poised to furnish Amazon with added resources to invest in compelling shows, films, and live sports.

This, in turn, is expected to elevate the streaming service’s appeal to customers, consequently enhancing the value proposition of the entire Prime subscription, which encompasses perks such as expedited shipping. Prime membership is priced at $14.99 per month or $139 annually.

In the short term, both the ad-generated income and the streamlining of operations through layoffs are anticipated to bolster the profitability of a video business that has traditionally operated at a loss. Collectively, these maneuvers stand to brighten the outlook for the company overall, complementing the upsurge in growth witnessed in its lucrative cloud segment, Amazon Web Services (AWS), and the enhancement of margins within its expansive e-commerce realm.

“We have increasing conviction that Prime Video can be a large and profitable business on its own and will continue to invest in compelling exclusive content for Prime members,” remarked Amazon CEO Andy Jassy during the fourth-quarter conference call earlier this month.

The introduction of the ad tier is poised to play a significant role in reinforcing this conviction. For users opting to pay the monthly fee to bypass advertisements, this revenue will augment subscription earnings. Critically, it is also anticipated to stimulate the expansion of Amazon’s increasingly pivotal advertising-services business, which surged by 26% year over year in the fourth quarter, accumulating $14.65 billion in revenue.

This constituted nearly 14% of the company’s total sales, compared to about 12.4% in the corresponding period of the previous year. Advertising has emerged as a progressively vital revenue stream for Amazon, alongside other major retailers such as Walmart and grocery chain Kroger.

While showcasing ads on a retailer’s website, such as a sponsored product on Amazon.com, serves as a prime example, these companies are also taking supplementary measures to fortify their digital advertising enterprises, known as “retail media networks.” Walmart recently announced its intention to acquire television manufacturer Vizio for $2.3 billion to bolster its ad business.

The advent of Prime Video’s new ad tier is poised to be a significant distinguishing factor for Amazon’s retail media network compared to its competitors, according to Sky Canaves, a retail and e-commerce analyst at Insider Intelligence. Amazon is distinguished as the sole retailer possessing a substantial content arm, thereby affording it firsthand access to customer data from Prime members, which it can leverage for advertisers seeking to promote products during Prime Video programming.

Conversely, Walmart’s competing subscription service, Walmart+, relies on a collaboration with Paramount Global’s Paramount+ to furnish its members with a streaming service. Nevertheless, Walmart’s ownership of Vizio, along with its SmartCast operating system, which facilitates advertising, will provide the retailer with a fresh avenue within the connected TV market to leverage its shopper data.

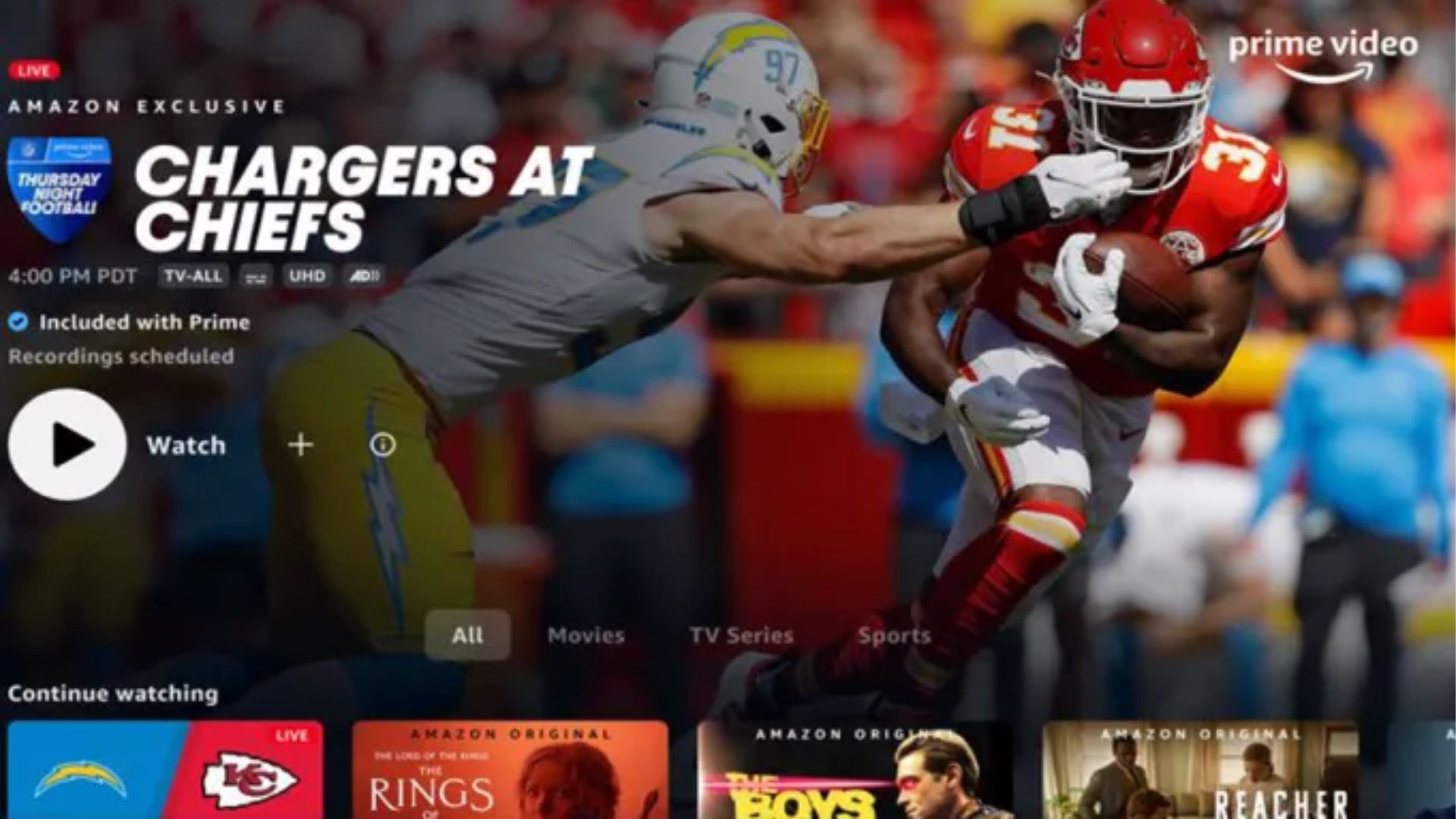

Sports holds a significant position within Amazon’s content strategy.

The pinnacle of Amazon’s sports endeavors lies in its exclusive 11-year agreement with the National Football League (NFL) to stream Thursday Night Football on Prime Video. According to Nielsen data, Amazon’s broadcasts averaged 11.86 million viewers per game in its recently concluded second season, marking a notable 24% increase compared to the inaugural season in 2022. Notably, the broadcasts witnessed “dramatic year-over-year gains in ad sales,” as highlighted by Jassy during the recent earnings call.

In a milestone move, Amazon also introduced its inaugural NFL Black Friday game exclusively streamed on Prime Video in November, attracting an average of 9.6 million viewers. The company aims to establish the Black Friday game as a recurring NFL tradition. Significantly, this game provided the e-commerce giant with an opportunity to experiment with shoppable TV ads for in-stream purchases, featuring QR codes displayed on-screen for viewers to scan using their smartphones, granting access to holiday-shopping deals.

“This would be direct attribution of seeing the ad and making a purchase, the holy grail for advertisers,” remarked Canaves. This advertising format assumes increasing importance as advertising budgets transition from traditional TV to streaming platforms, aligning with Amazon’s strengths.

“Amazon is positioning itself to be a disruptive force in sports advertising by offering innovations such as targeted ad formats for NFL football audiences, alongside AI-powered features to enhance the viewing experience and elevate fan engagement,” Canaves emphasized. Furthermore, Amazon recently secured a deal to exclusively broadcast an NFL playoff game next season, marking the second occasion a streaming service has clinched exclusive broadcast rights for an NFL postseason matchup.

Comcast-owned Peacock witnessed substantial streaming viewership for the Wild Card game between the Miami Dolphins and the Kansas City Chiefs. Insider Intelligence forecasts digital live sports viewership to soar to 126.8 million by 2027, representing a surge of approximately 36% compared to the 95.5 million viewership recorded in 2023. Prime Video, boasting a dominant presence in digital live sports, stands to benefit from this anticipated growth in viewership, with increased ad spending potentially flowing toward its streaming platform.