Key Insights:

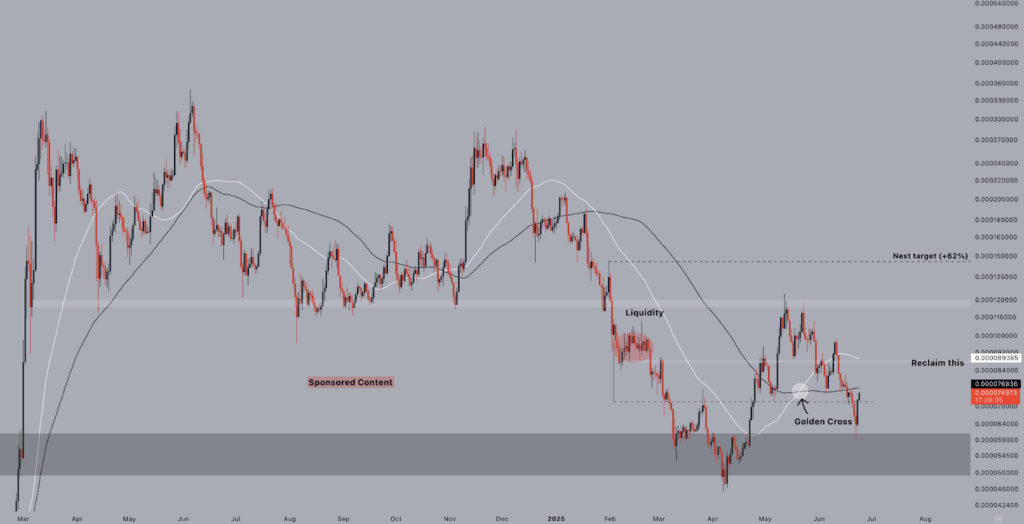

- FLOKI crypto remained below the 0.000084 resistance zone despite a recent Golden Cross signal.

- FLOKI crypto price is trading under all key weekly moving averages, including the 99-period MA at 0.00011174.

- The 0.000054–0.000070 range continued to act as a strong accumulation and reversal zone.

FLOKI crypto showed signs of recovery across multiple timeframes, while analysts observed critical resistance and momentum levels. More so, recent upward movement has attracted short-term interest; FLOKI price continues to face technical barriers that could determine its next trend direction.

Rejection at Key Resistance Caps FLOKI Crypto Recovery Attempts

According to analyst Jelle, FLOKI crypto recently registered a Golden Cross formation on the daily chart. This occurred as the short-term moving average crossed above the long-term average, which typically signaled medium-term bullish intent.

Despite being a bullish crossover, FLOKI crypto continued trading below an important reclaim level pegged at $0.0000893885. This level corresponded with the breakdown structure of 2025, which was previously misplaced in the year. FLOKI crypto price attempted to re-enter this liquidity zone again, but was unable to remain above it, which was an indication of sustained resistance.

Furthermore, liquidity zone of $0.0000840000 has repelled retests severally, stamping its position as a strong barrier. FLOKI crypto will trade below this level until it recoups and consolidates above this level, with upside continuation uncertain. The analyst further noted of historical accumulation base as a demand zone between $0.0000540000 and $0.0000700000.

Besides, if the reclaim zone is breached and held, the next upside FLOKI crypto price target sits at $0.0001500000. This would represent a +62% move from current levels and revisit the 2024 range lows, providing a potential pivot for broader bullish momentum.

FLOKI Crypto Faces Rejection Despite Short-Term Bounce

Analyst CryptoGenzo noted that FLOKI crypto has recorded a 5.25% gain from a multi-week low of $0.00004545. However, the FLOKI price remained below all three key moving averages—MA(7), MA(25), and MA(99)—indicating the broader trend is bearish.

The MA(7) at $0.00008319 and MA(25) at $0.00008603 are acting as dynamic resistance. Until these are reclaimed, FLOKI crypto price will encounter near-term rejection on upward moves. Also, the analyst pointed out that stronger momentum will be required to overcome this MA cluster.

Additionally, long-term MA(99) with a value of $0.00011174 brought in the upper limit of full reversal. FLOKI crypto had to finish strong above this level on a large weekly volume to signal a trend switch. In its absence, the short-term reward could be restricted to reactive purchasing.

Further to that, the analyst referenced a November 2023 candle that triggered a parabolic breakout, noting that a similar structure has not yet appeared. A comparable weekly bullish engulfing formation could support a more sustainable FLOKI crypto price prediction toward the MA(99) level.

Volatility Builds Amid Struggles to Break Above Mid-Range Barrier

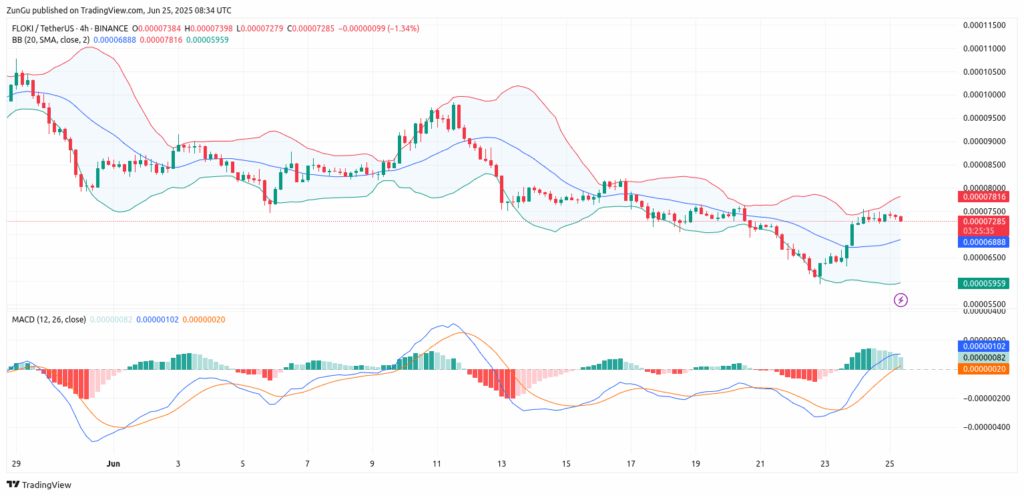

Moreover, a separate short-term analysis showed FLOKI crypto in a consolidation phase. Floki price continued to trade at $0.00007285, just below the 20-period simple moving average (SMA) mid-band at $0.00007384.

In addition, Bollinger Bands were moderately expanding, with the higher band at $0.00007816 and the lower band at $0.00005959. This expansion followed a prior squeeze, indicating that the asset’s volatility is on the rise. FLOKI crypto price failed to close convincingly above the mid-band on several recent attempts.

A confirmed close above the upper Bollinger Band could indicate short-term breakout continuation toward the psychological $0.00008000 zone. If FLOKI price fails to hold above the mid-band, a pullback toward the lower band or even $0.00006500 is possible.

On the other hand, the MACD indicator showed a bullish crossover. The MACD line is above the signal line, and the histogram printed green bars, indicating early-stage bullish momentum.

However, the histogram slope has started to flatten slightly, suggesting a potential slowdown in momentum. For the bullish scenario to persist, increased trading volume will be essential to confirm strength behind the move.

As a result, when the momentum slows, and the coin fails to establish higher lows, FLOKI crypto price might eventually move towards support tests around $$ $0.00006500. Otherwise, MACD remained in the positive territory, yet further confirmation is necessary.