European markets closed higher on Friday to start the new trading month after a winning February, as investors assessed fresh inflation data out of the eurozone. The pan-European Stoxx 600 ended the session up 0.6%. Tech stocks led gains, adding 1.6%, while insurance fell 0.7%.

February’s flash euro zone inflation reading showed the headline consumer price index fell to 2.6% from January’s 2.8%. Economists polled by Reuters had forecast a headline reading of 2.5%.

“The European Central Bank will be monitoring Friday’s reading closely as it charts its course of future interest rate cuts, with economic growth remaining stagnant across much of the bloc. The market expects the ECB to begin cutting in June, alongside the Fed.”

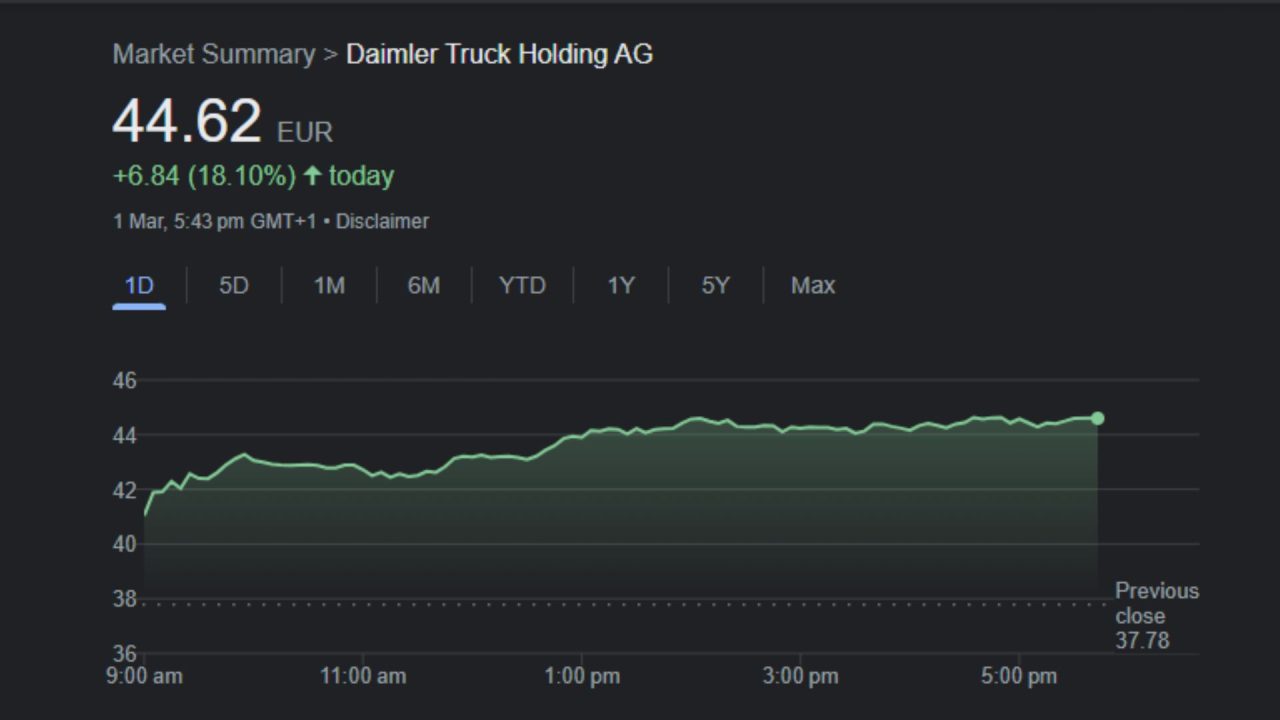

Earnings were the key driver of individual share price action in Europe, with Grifols, Daimler Truck, and ITV all posting double-digit gains on the back of strong results.

In Asia-Pacific, Japan’s Nikkei 225 closed at a fresh record high on Friday, just short of the 40,000 level, while Chinese markets rose on the back of fresh manufacturing data from the mainland.

Stateside, U.S. stocks were higher after Wall Street wrapped a fourth consecutive winning month, with the tech-heavy Nasdaq Composite reaching its first closing record since November 2021.