Bitcoin’s ascent to a record high on Tuesday mirrors a broader surge in 2024, with other cryptocurrencies and investment vehicles linked to bitcoin experiencing a notable uptick.

The launch of bitcoin exchange-traded funds (ETFs) is often cited as a catalyst for the crypto market’s resurgence. Since their introduction on January 11, the price of bitcoin has surged by over 30%, as reported by Coin Metrics. These ETFs have witnessed similar upward movements.

Two standout performers among the ETFs are the iShares Bitcoin Trust (IBIT) and the Fidelity Wise Origin Bitcoin Fund (FBTC). IBIT has attracted close to $8 billion in investor funds, while FBTC is nearing $5 billion, according to FactSet data. Conversely, the Grayscale Bitcoin Trust (GBTC) has seen a reduction of over $8 billion in assets.

JPMorgan analyst Kenneth Worthington suggests that GBTC redemptions might be fueling inflows into other ETFs with lower fee rates like IBIT and FBTC.

For investors seeking higher risk, leveraged bitcoin futures ETFs like the 2x Bitcoin Strategy ETF (BITX) have surged by nearly 90% year-to-date.

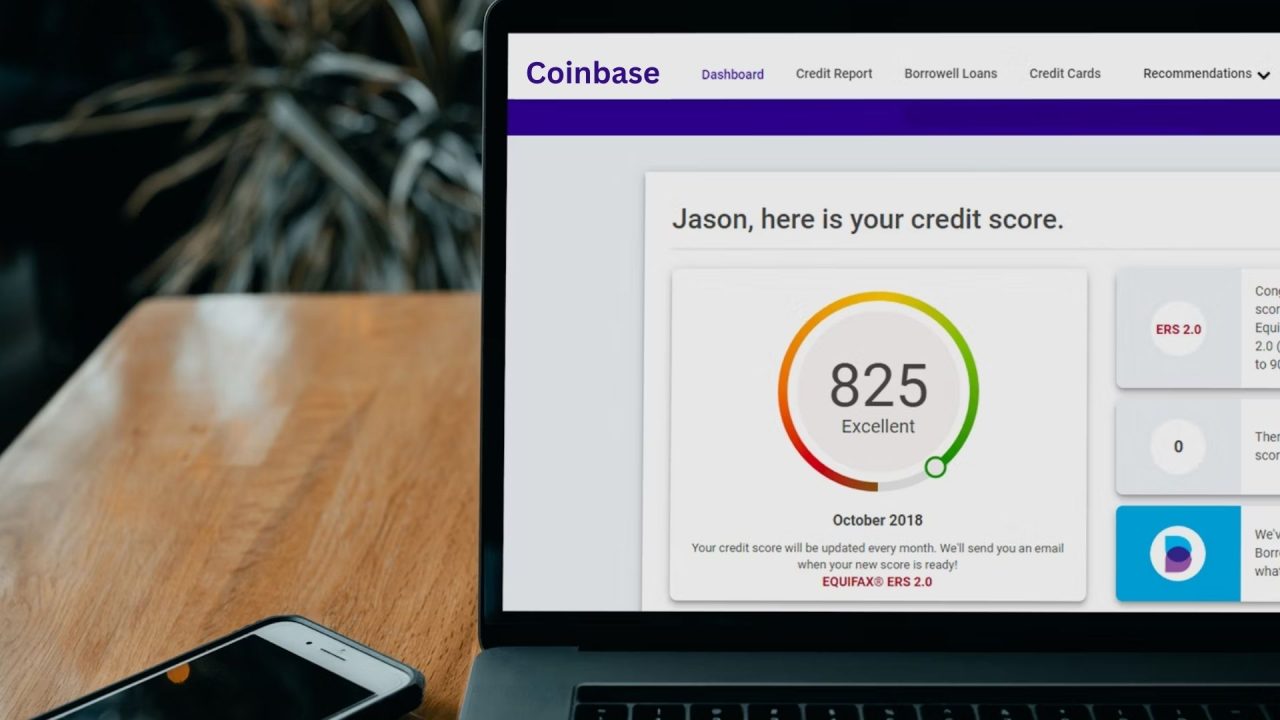

The bullish sentiment isn’t confined to ETFs; traditional methods of investing in bitcoin via the equity market are also seeing a surge. Microstrategy, a software company holding a significant amount of Bitcoin, has witnessed its stock price more than double in the past month. Similarly, shares of crypto exchange Coinbase and brokerage firm Robinhood have surged by over 80% and 50%, respectively.

Other cryptocurrencies are also rallying, with ether’s price increasing by more than 50%.

However, crypto mining stocks present a different narrative. Marathon Digital and Bitfarms have experienced declines in their share prices, with Marathon’s losses for the year only partially offset by a recent rally.

Interestingly, these mining stocks were among the best performers in 2023, potentially signaling a precursor to the bitcoin rally. Marathon surged by over 500% last year, while the Valkyrie Bitcoin Miners ETF (WGMI) jumped by approximately 300%.