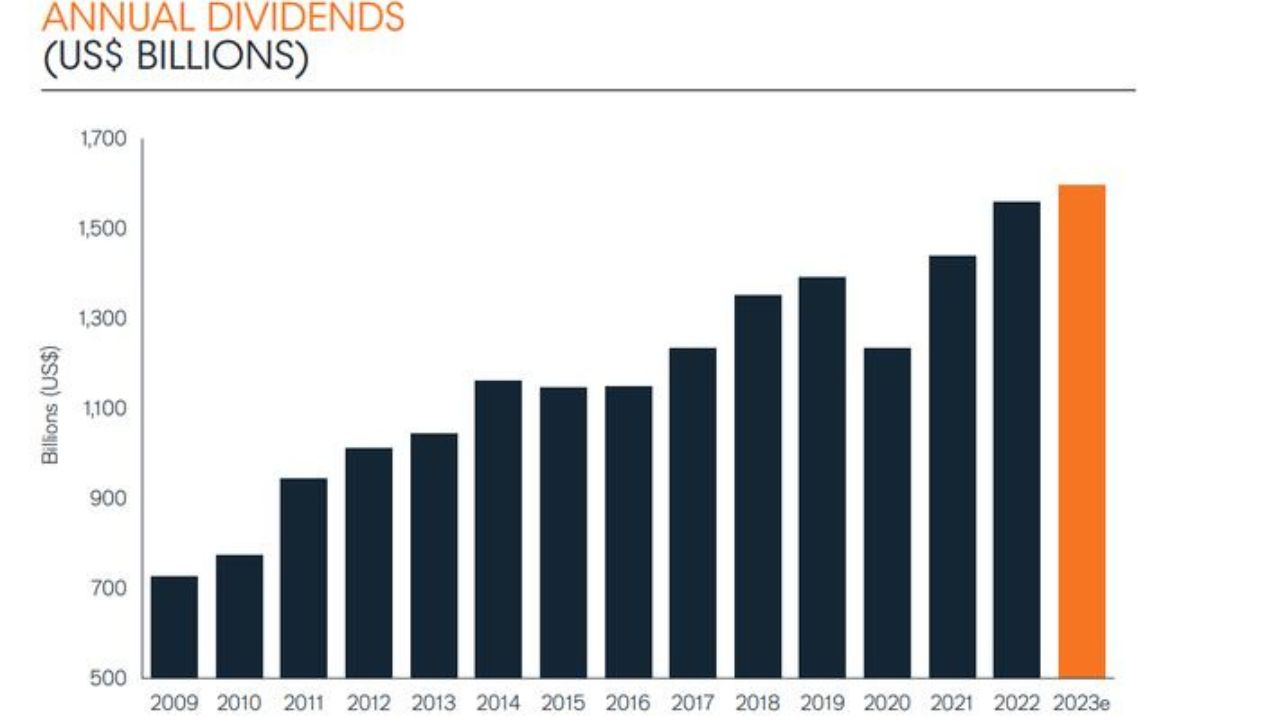

In a recent report by British asset manager Janus Henderson, global dividend payouts to shareholders reached an unprecedented $1.66 trillion in 2023.

The Global Dividend Index report, published on Wednesday, March 13th 2024, revealed a 5% year-on-year increase in payouts on an underlying basis. Also, the fourth quarter exhibited a 7.2% surge compared to the previous three months.

Banking Sector Drives Growth

The banking sector emerged as a significant contributor, accounting for nearly half of the world’s total dividend growth.

The report highlighted that record payouts in this sector were propelled by high interest rates, which bolstered lenders’ margins.

Major banks, including JPMorgan Chase, Wells Fargo, and Morgan Stanley, had announced plans to increase their quarterly dividends after successfully clearing the Federal Reserve’s stress test.

Moreover, the lingering post-pandemic catch-up effects played a crucial role in fully restoring payouts, with HSBC being particularly visible in this regard.

Although emerging market banks significantly contributed to the increase, Chinese banks did not partake in the dividend boom experienced by the global banking sector.

Offset by Mining Sector Cuts

Despite the positive impact of banking dividends, the report noted that cuts from the mining sector nearly entirely offset this growth.

Major companies such as BHP, Petrobras, Rio Tinto, Intel, and AT&T announced substantial dividend cuts, diluting the global underlying growth rate for the year by two percentage points. This masked significant broad-based growth observed in various parts of the world.

‘Key Engine of Growth’ in Europe

Janus Henderson’s report highlighted that approximately 86% of listed companies worldwide either increased dividends or maintained them at current levels in 2023.

22 countries, including the U.S., France, Germany, Italy, Canada, Mexico, and Indonesia, witnessed record payouts. Europe, in particular, played a pivotal role as a “key engine of growth,” with payouts increasing by 10.4% year-on-year on an underlying basis.

Looking ahead to 2024, Janus Henderson anticipates total dividends to reach $1.72 trillion, reflecting an underlying growth of 5%.