Key insights:

- Solana price rebounded sharply after a major correction, showing renewed strength and sparking investor optimism.

- The coin regained over 12% in a single day, lifting its price back above the $108 level.

- Technical indicators confirmed support zone strength and successful trendline validation, encouraging cautious buying activity.

Solana (SOL) price suddenly rebounded after a steep correction. This raised fresh hopes among investors anticipating an altcoin recovery.

The crypto market suffered notable losses recently. However, Solana showed strong momentum in the past 24 hours.

Rising volatility and shifts in sentiment add uncertainty to the short-term outlook. Concerns about global crypto regulation further complicate the market’s direction.

Solana Price Shows Bullish Signs After Drop

Solana price experienced a sharp 14% decline during the past week as bearish forces took over the broader crypto market. After a bearish market attack, SOL tokens regained more than 12% value that day.

This demonstrated strong market demand. This reversal brought SOL price back above $108, reviving discussions of a potential continued recovery.

Market observers noted that the price action aligned with a crucial support zone. Solana managed it to hold despite recent selling pressure. A classic trendline validation test was successfully finished on the charts to empower additional bulls in the market.

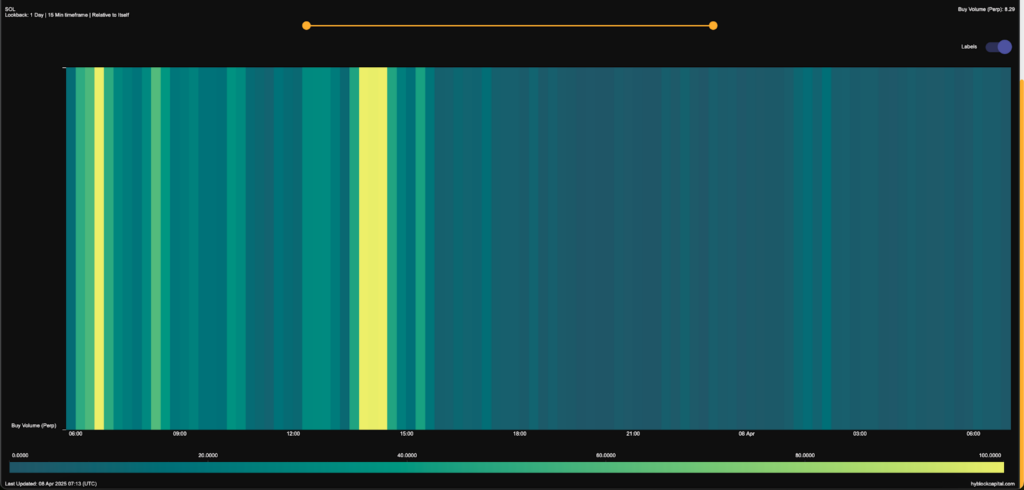

Enter buyers pushed the market toward recovery while they kept their moves conservative. Data from Hyblock Capital showed that Solana’s buy volume reached over 99. This suggested intense buying activity within a short timeframe.

Such a reading suggests that retail traders and institutions have started showing interest. Analysts urge caution despite the promising data. Global regulatory shifts and macroeconomic challenges demand careful consideration.

SOL Long Positions Drop as Sentiment Shifts

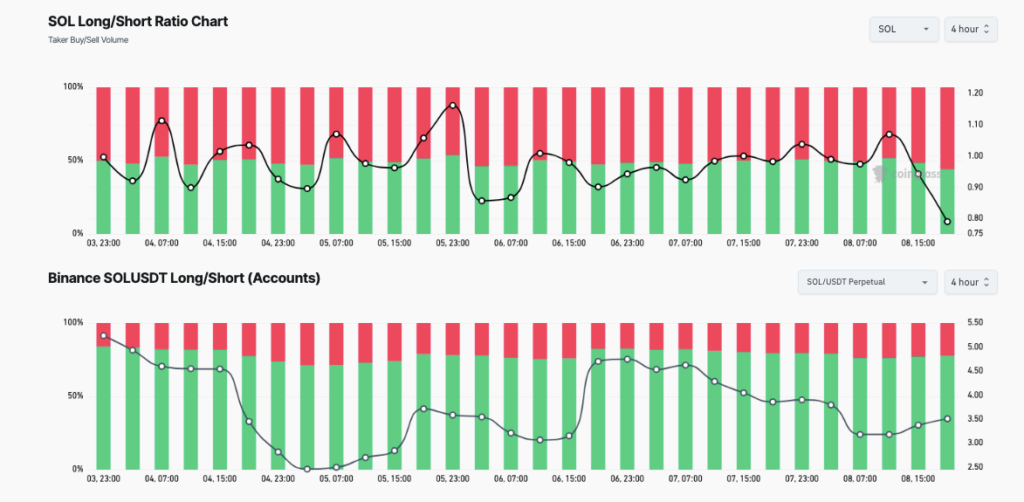

The long/short ratio of Solana displayed considerable movement over the last five days. This suggested fluctuating sentiment among futures traders.

The trend of long position contracts on April 5th reached a high peak. This became brief before positions faced a ratio decline to 0.80. Recent price increases failed to stop bearish market sentiment from improving.

Similarly, Binance’s SOL/USDT perpetual market highlighted a gradual decline in long account dominance since April 6th.

Long/Short trading accounts moved from high numbers exceeding 5.0 to lower ratios near 3.0 by April 8th. This might show traders taking profits out of their positions.

Growing uncertainties in the market prompted traders to adjust their positions. Anticipation of forthcoming regulatory changes also influenced their strategies.

Binance has displayed this conservative approach because several national governments are developing their crypto regulations. This may have made traders less inclined to take risks.

Multiple jurisdictions adopting regulatory oversight practices leads traders to consider/perceive higher financial and legal costs in their operations. Market speculations face reduced betting intensity despite positive price movements in the market.

Altcoin Season Still Unlikely Despite Solana’s Bounce

While Solana price recovery sparked optimism, broader indicators show that an altcoin season remains unlikely in the immediate term. Market dominance for Bitcoin remains strong because the Altcoin Season Index currently stands at 18.

Most of the capital is flowing into Bitcoin instead of altcoins. Despite Solana’s bounce, the weak index reading indicates a limited appetite for widespread altcoin accumulation under current market conditions.

Investors are reluctant to switch to different assets because they need additional monetary policy and regulatory transparency regarding cryptos. Investor risk tolerance remains low because this leads to limited mass investment that restrains substantial price gains.

Solana’s open interest, which dropped during last week’s price decline, hinted at a potential reversal but lacked strong follow-through. Both rising price levels and increasing open interest must be maintained for an extended period to validate strong, bullish market trends.

Presently, mild optimistic sentiments regarding altcoins might be insufficient to start sustained price rallies. Though Solana’s recovery is a welcome sign, the crypto market remains fragile due to regulatory uncertainty and shifting trader sentiment.

Crypto regulation is increasing its influence as authorities across regions prepare for stricter compliance frameworks. Investors and institutions alike are adapting strategies to navigate this evolving landscape.