Key Insights:

- An Ethereum whale accumulated over 20,000 ETH in a coordinated series of transactions following a recent price dip.

- The whale used Aave to deposit ETH as collateral and borrowed $15.4 million in USDT to potentially reinvest.

- Additional ETH purchases were made shortly after, increasing borrowing capacity and signaling a high-conviction strategy.

Ethereum (ETH) has shown early signs of recovery as it moved away from recent lows. Within 24 hours, an ETH whale made significant purchases, signaling growing confidence. Simultaneously, leverage activity and DeFi borrowing increased, indicating a possible breakout.

Ethereum Whale Accumulates Over 20,000 ETH and Moves to Aave

An Ethereum whale initiated large transactions after the recent price pullback. The whale withdrew 15,953 ETH from OKX and sent them to multiple addresses. The whale deposited ETH into Aave through its platform via Aave as a borrowing operation.

Shortly after, the whale borrowed $15.4 million USDT using the deposited ETH. Further trading or accumulation appeared to be why the funds returned to OKX. Historically, this financial maneuvering strategy has been employed by the same group of wallet operators.

A few hours later, the whale added another 4,208 ETH to the same accumulation pattern. The extra collateral deposit expanded the available borrowing capacity. The multiple fast transactions indicate the whale holder’s strong commitment to their accumulation strategy.

The whale used six different addresses to move and manage the Ethereum. When withdrawn from OKX, the separate addresses received partial ETH amounts. Because of their strategic placement, these actions indicate systematic planning over spontaneous trading decisions.

On-chain data confirmed the whale’s consistent behavior with prior ETH moves into DeFi. The whale chose Aave as its main option for converting ETH into other DeFi products. The current protocol maintains more than $17.5 Billion value within its locked status.

This series of actions coincides with Ethereum’s bounce from recent lows near $1,400. The price reached $1,675.17 during the whale’s buying spree. As Ethereum rose, the market began to reflect a shift in sentiment.

Leverage and DeFi Activity Rebuild After Liquidations

The DeFi user base boosted their borrowing operations following mass liquidations, which minimized leverage exposure. Ethereum whales now borrow more stablecoins while protecting their positions with low liquidation levels. This action creates a positive outlook regarding price recovery.

The total open interest in ETH surged to $8.98 Million within 24 hours. Higher leverage positions returned to the market after traders adopted a more restrained approach in the past months.

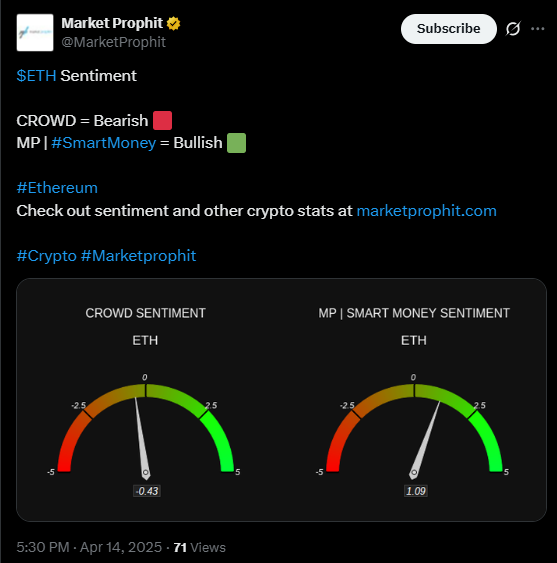

The number of investors with open positions leaning towards being bearish makes up more than 38% of the total market stake. Optimistic and pessimistic outlooks on price movements are engaged in a continuous struggle inside the market.

The share of liquidations between short sellers and long owners remained even during the previous few hours. Sky Protocol and Aave performed major liquidations by exceeding essential risk thresholds.

Liquidation risks decreased by $164 million when the total went from $1.1 Billion to $936 Million. The majority of positions that became over-leveraged have already been managed effectively.

With risk levels reduced, whales are now positioned for longer-term gains. Whales currently hold assets with a liquidation protection value of $905.

Ethereum Recovers from BTC Lows as Accumulation Rises

Ethereum showed signs of stabilizing against Bitcoin, moving from a low of 0.019 BTC back to 0.02 BTC. The rising values indicated that ETH was in a recovery phase. Strength emerges from investing when local Bitcoin prices reach their lows.

ETH also gained from gaps forming in the CME futures market. Both temporary price movements and long-term targets converge toward gaps created in the market. A price target may develop at $1,812 because of a visible market gap.

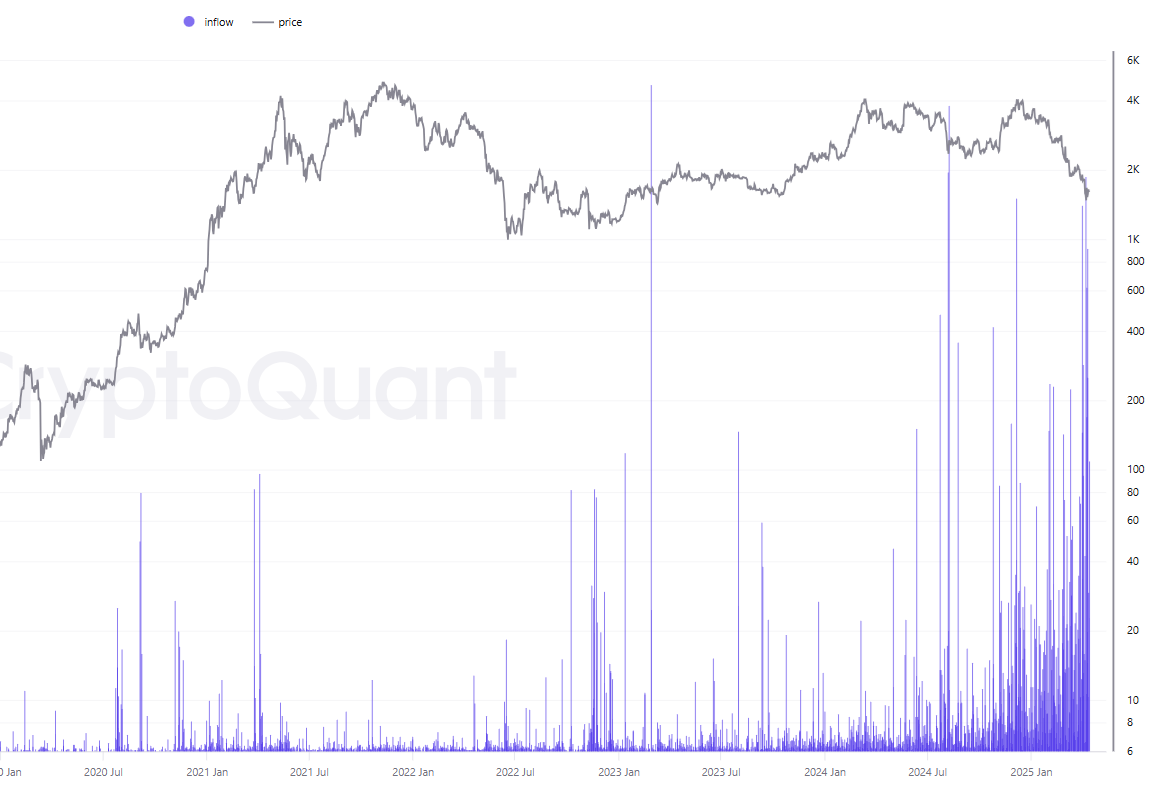

The price drop of ETH under $2,000 caused more wallets to purchase the token. Ethereum received increased inflows from wallets that contained any amount of ETH balance. The purchasing behavior continued during periods of market downturn alongside negative crowd opinions.

When ETH reached the previous low of $1,400, strategic accumulation occurred instead of widespread selling. Large entities participated in this accumulation process.

However, individual wallet owners showed similar behavior by increasing their ownership. Ethereum’s resilience during dips adds to the breakout narrative.