Key Insights:

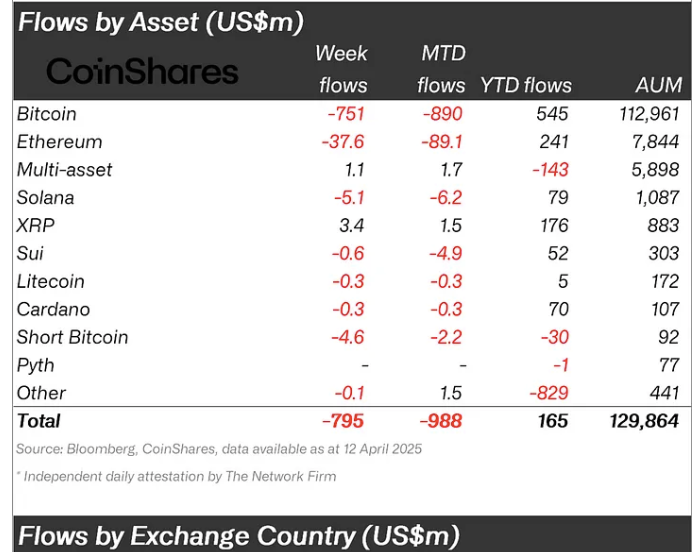

- The digital asset market recorded $795 Million in outflows last week, wiping out nearly all gains made in 2024.

- XRP attracted $3.5 Million in inflows, while major cryptocurrencies experienced significant capital exits.

- XRP maintained price support above $2.00 and posted a daily gain of 1.61 percent despite weak trading volume.

The digital asset market faced sharp outflows, totaling $795 million last week, erasing nearly all 2024 gains. Amid this downturn, XRP Price showed resilience with consistent inflows.

It also maintained stable price action throughout the period. Despite broader losses, Ripple displayed relative strength, stirring attention across the crypto space.

XRP Price Gains Ground Amid Crypto Outflows

While Bitcoin, Ethereum, and Solana registered steep outflows, XRP attracted $3.5 million in new inflows over the week. XRP staged a standout performance by attracting $3.5 Million in new inflows.

This sharply contrasted with market trends, where uncertainty led most assets to lose their capital base. Ripple’s performance raises interest in whether it could lead to a rebound. XRP price traded at $2.15 during the latest session, recovering from a minor decline earlier in the day.

Ripple price remained above the $2.00 support level to keep a short-term bullish outlook while facing weak trading volume indicators. Accumulation signaled on the charts supported its daily price increase of 1.61%.

Technical indicators suggested neutral market sentiments because the daily RSI stood at 50.31, demonstrating balanced trading momentum. The MACD histogram moved to 0.0230, indicating initial bullish momentum signs.

According to on-chain metrics, the positive movement of the XRP price continued. However, it did not deter investors from withdrawing funds from spot market trading operations.

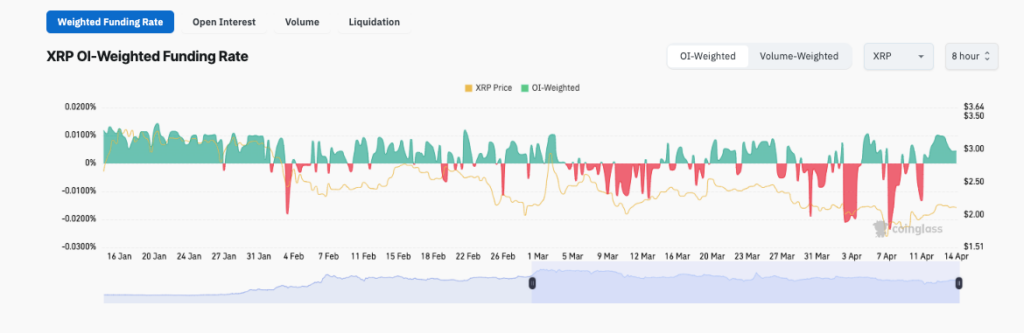

Coinglass reported that Ripple saw persistent outflows through early April. This reflected repositioning by major participants. Futures Open Interest (OI) dropped by 11% to reach $3.2 Billion because traders withdrew their interest in leveraged positions.

Market participation declined following a 4% drop in daily trading volume. The volume settled at $3.99 Billion during this period.

XRP’s unique position amid the market downturn is partly linked to developments in the Ripple-SEC case. Market optimism is rising regarding unresolved legal issues surrounding the digital asset.

A resolution could bring more precise and improved regulatory definitions. Despite the positive indications for XRP, the macroeconomic environment and weak customer interest are price-limiting factors.

Bitcoin Faces Steep Outflows Despite Positive YTD Figures

Bitcoin took the most significant hit, shedding $751 Million in net outflows last week as sentiment turned risk-averse. Bitcoin underwent its third straight capital flight run during this period.

Since February, this trend has resulted in an outflow of over $7.2 Billion. Despite the pullback, Bitcoin’s YTD inflows remain at $545 million.

Market watchers also observed a decline in short-Bitcoin products, with $4.6 Million exiting these vehicles. Investors opt to adjust their investment positions instead of executing aggressive bearish trades. This shift reflected a need to reassess market exposure amid current conditions.

The lack of aggressive buying indicated investors lost confidence in a forthcoming price rally. Bitcoin price recovered late in the week, contributing to a rise in assets under management to $130 Billion.

The mixed technical signals have yet to produce any confirmed upward movement. There has been no significant trading activity while institutions withdraw resources from their leading platforms.

The United States continues to create perpetual policy doubt that intensifies market-related uncertainties regarding tariffs and international trade operations. Crypto markets display quick reactions toward such announcements because they function through speculation.

For Bitcoin, staying above key support levels may prove difficult without renewed inflows. The asset maintains its position as a market leader.

However, current macroeconomic developments highlight potential weaknesses in its performance. Bitcoin’s resilience depends on whether broader sentiment improves in the coming weeks.

DeFi Slowdown Hits Solana and Ethereum

Ethereum saw $37.6 Million in weekly outflows as the second-largest crypto struggled to maintain investor confidence. The coin’s latest market price variations have established neither new investment nor meaningful trading volume changes.

Ethereum continues to mirror Bitcoin in terms of broader sentiment alignment. Solana lost $5.1 million from investors after a period of enthusiasm during Q1, which has subsided.

The market value has decreased while trading activity diminished, although the network launched significant new services. Today, market trends determine this asset’s short-term movement rather than inward forces related to its specific assets.

Ethereum and Solana lack immediate upside momentum, with no clear catalysts supporting renewed growth. Fresh buying activity becomes crucial to determine if prices will maintain their current boundaries or drop according to rising sales volumes.

Both assets remained unchanged during the late-week recovery period. Some technical indicators show moderate strength but are combined with weak accumulation trends across both blockchain networks.

Ethereum’s staking trends show signs of slowing, while Solana’s DeFi activity has plateaued recently. Proofs indicate that capital investors withdraw funds from major altcoins and redirect them towards various defensive investments and lower-cap opportunities.