Key Insights:

- Despite recording weekly gains, Cardano’s price dropped to $0.6205 after a 2.3% decline.

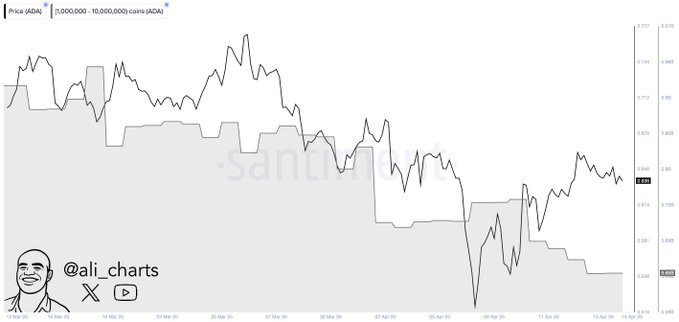

- Over 100 million ADA were dumped by large holders in one week, causing a sharp shift in market sentiment.

- The whale selloff followed a brief rally from $0.51, prompting concerns about long-term confidence in ADA.

Cardano’s (ADA) market performance has drawn attention after a sharp whale dump of 100 million ADA shook recent gains. The token recently traded at $0.6205, showing a 2.3% daily decline despite a weekly rise.

While short-term data reflect minor recoveries, indicators suggest a growing pressure that could impact Cardano’s near-term direction.

ADA Whale Dump Sparks Price Drop

Large ADA holders reduced their positions by over 100 million coins within one week, triggering market-wide attention. Following a short price recovery period, the market experienced downward pressure.

It reached its minimum point of $0.51 in April. The participants viewed this action as profit extraction following a brief market rebound.

The sizable dump has questioned major market participants’ confidence in the long term. As this adjustment occurred, the price stabilized between $0.63 and $0.65.

The consolidation spanning $0.63 to $0.65 has recently displayed weakening signs, leading to a price drop to $0.6205. According to their analysis, leading analysts noticed that the whale selloff triggered potential rises in market volatility.

The price decline triggered market volume variations, indicating deteriorating short-term market demand. The current market support may be at risk if more selling occurs because it could break essential technical elements. This might accelerate price lowering.

Cardano Technical Indicators Signal Bearish Trend

Despite moderate weekly gains, Cardano’s technical setup reflected growing downside risks across several indicators. The Relative Strength Index (RSI), which displayed a value of 44.31, signaled neutral market momentum that approached oversold territory.

The indicator indicated weak demand growth because sellers maintain their trading authority. Current market analysis pointed to bearish trends because the MACD line stayed under the signal line during this short-term period.

The measurement in the histogram has become marginally positive to 0.0048, yet overall momentum levels remain minimal. Such an early signal cannot develop into a sustainable market recovery without additional strong buying power shortly.

According to Chaikin Money Flow, the reading shows 0.02, indicating a weak flow of capital into the market. The overall force of value accumulation is weak since this value stays above zero.

Market uncertainty persists across wider sectors, even though recovery aspects can be identified sporadically.

ADA Liquidity Drops as Supply Shrinks

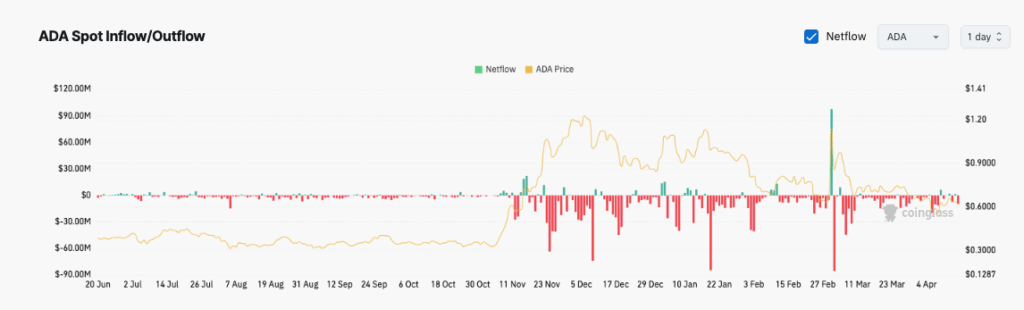

Recent on-chain data revealed consistent ADA outflows from exchanges since November 2024, suggesting longer-term holding activity.

These net outflows indicated that participants moved ADA to private wallets rather than engaging in short-term trades. The decreasing exchange supply indicates that market liquidity will decrease, resulting in reduced price fluctuation.

Major outflows occurred during high-volatility events, particularly in March and January, affecting ADA’s short-term trend. Suppliers engaged in substantial selling activities that decreased prices as the market faced uncertainties.

The overall trend showed more ADA-exited exchanges than entered during the observed periods. However, small amounts were entered during times of market increase.

The pattern of declining exchange supply suggests that most participants expect longer-term value from ADA despite current short-term weakness. Lower exchange activity leads to decreased market liquidity.

This produces exaggerated price movements during periods of market decline. A rapid change in market sentiment would result in prices moving firmly up or down.

Cardano Developments Fail to Lift Price

Recent remarks by Cardano founder Charles Hoskinson suggested several network developments that could impact the project’s future direction. The plan includes new ecosystem enhancements and potential collaboration opportunities to accelerate adoption within multiple industrial sectors.

These emerging network prospects have failed to produce distinct price changes in the present market. These announcements made consumers feel more optimistic but failed to result in lasting market price increases.

The difference between basic network operations and market valuation exists because market participants exhibit conservative movements in the present trading period. Trading participants prefer additional confirmation signals before implementing bullish price actions.

Cardano’s broader market position remains mixed, with modest gains quickly erased amid pressure from large selloffs. The cryptocurrency market reacted strongly to whale transactions because its value decreased from $0.6557 to $0.6205.

Further signals will be needed to determine whether ADA can recover or continue its decline soon. Cardano price action now hovers at a crossroads between a possible breakout and further decline, depending on near-term developments.

The combination of technical and on-chain data suggests weakening conditions, but they have not established confirmation for a breakdown. If it continues declining below $0.6200, the ADA price might decrease toward $0.60 support.