Key Insights:

- PEPE fell 2.25% to $0.000007142 as $4.28M is bought by wallets linked to Tornado Cash.

- Analyst Chandler targeted $0.0000014 as the key 0.382 Fibonacci retracement level.

- Price formed the double on the 4h chart while RSI shows neutral momentum.

In the last 24 hours, PEPE rose by 0.77%, with its price trading at $0.000007219.

The company’s market capitalization is $3 Billion, also down by the same margin.

However, the daily trading volume is up 2.53% to $501.2 Million.

The price movement comes as attention turns to unusual buying activity from wallets associated with Ethereum withdrawn via Tornado Cash.

Blockchain analytics firm Lookonchain, reported that in the last eight hours, five wallets spent $4.28 Million to buy 611 billion PEPE.

About 15 days ago, these wallets withdrew ETH from Tornado Cash.

Speculation has arisen as to whether the buyers of these funds were involved in past exploit activity, due to the timing and source of these funds.

Unusual Wallet Activity Raises Eyebrows

The five wallets have raised new questions about possible market behavior driven by non-transparent actors.

Because Tornado Cash is used to anonymise crypto movements, links to such platforms can be closely monitored.

In recent hours, these wallets have withdrawn ETH before accumulating large PEPE positions.

These transactions have raised speculation about whether these wallets are associated with hacking events due to the timing of these transactions.

But there is no direct confirmation of this. It seems that the purchase was made at a time when the broader market is weak.

This activity may have played a part in the recent uptick in trading volume.

However, the price is down, which might mean that buying interest is not strong enough to push PEPE higher, at least for now.

Short-Term Patterns Suggest a 25% Rally

The short-term chart patterns indicate that PEPE is currently trading at a critical level.

Analysis of the 4-hour chart shows a double bottom formation around $0.000005500 to $0.00005700.

This is a bullish reversal setup that needs a break above resistance to confirm.

Resistance sits around $0.000007624. If it does break out successfully above this, it could go towards the $0.000009067 mark, which is about 25% higher.

The target for this target is the half-range height of the double bottom pattern plus the neckline breakout zone.

Meanwhile, the chart shows neutral momentum as the Relative Strength Index (RSI) is near 50.

That implies that price can go in either direction, depending on volume and broader market sentiment.

Technical Analysis Points to Mid-Range Fibonacci Targets

Furthermore, according to analyst Chandler, PEPE is looking at the 0.382 Fibonacci retracement level on a separate chart.

It is set at around $0.0000014. The Fibonacci retracement tool is used to find possible price reaction zones during market corrections or rallies.

This implies that traders are taking a look at the mid-level resistance following the recent pullback from early 2025 highs.

The chart has a history of moving quickly once certain resistance levels are cleared, and the current price is still a long way below the peak.

Furthermore, PEPE has bounced from similar setups in 2023 and early 2024 historically.

Trading volume is slightly up, but not yet at the levels seen in stronger rallies.

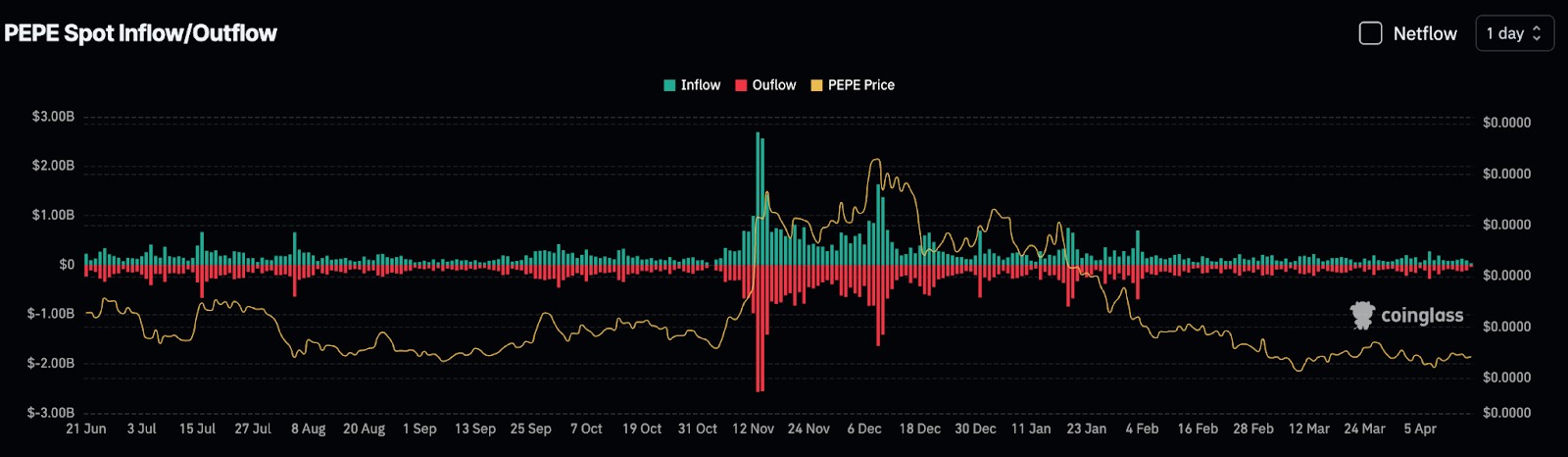

Inflow and Outflow Trends Suggest Continued Selling Pressure

Conversely, according to CoinGlass on-chain data, PEPE experienced consistent net outflows over the past few weeks. Red bars on the chart show outflows.

The red dominance indicates that more tokens are being taken out of exchanges and possibly into wallets.

Even with the net outflows, PEPE’s price has been trending lower since January.

This could suggest that the outflows are not from accumulation but from holders exiting to private wallets to sell at some later time.

Overall market weakness has been followed by a steady downward path of the yellow price line.

A recovery in price might take stronger inflows or the demand at support levels.

Volatility is likely to stay until then, and with the presence of big, unidentified buyers in the market.