Key Insights:

- Ethereum transaction fees have fallen to their lowest level in five years, reaching $0.168 per transaction.

- The fee drop is linked to a sharp decline in on-chain activity and user engagement on the Ethereum network.

- Despite low network usage, Ethereum’s price recorded a modest 1.76 percent gain, closing at $1,604.70.

Ethereum transaction fees have reached their lowest level in five years, falling to $0.168 per transaction.

This drop coincides with a steep decline in network activity, despite Ethereum’s price recording a slight gain.

The situation is critical for Ethereum’s near-term direction, with analysts offering different forecasts.

Ethereum Fees Hit Five-Year Low as Network Activity Dips

Ethereum’s average transaction fee has dropped to $0.168, marking its lowest point since 2020. The reduction came after on-chain usage and user involvement dwindled.

A lower transaction volume on the network creates less congestion, enabling fee rates to decrease.

Fewer network users compete to validate transactions because the overall network traffic has decreased.

The reduction in the price of block space leads directly to lower expenses for users making transactions on the platform. This change reflects a clear shift in Ethereum’s current usage pattern.

The analytics platform Santiment shows how massively gas prices dropped. The number of active users performing transactions is lower than previous months’ levels.

This outcome diminishes mining and validation rewards, which subsequently impacts network economic dynamics.

ETH Price Sees Modest Gain Despite Market Caution

Despite the slump in fees, Ethereum recorded a 1.76% price increase, closing at $1,604.70 on April 17.

The market saw a price shift during the day while trading volume increased 5% to reach $14.49 Billion.

This suggests that interest in trading Ethereum remains, even with reduced activity on the main network.

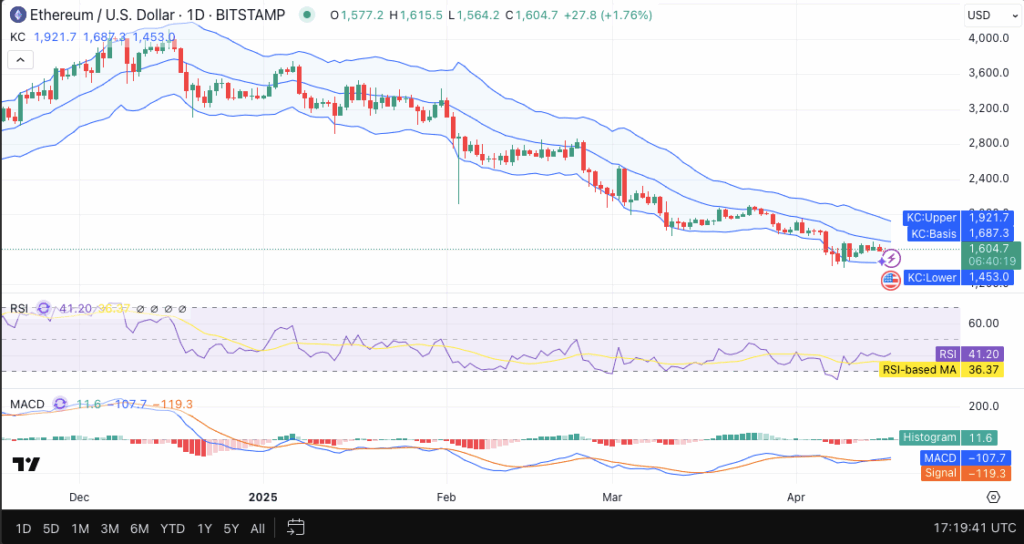

The Relative Strength Index (RSI) stands at 41.20, indicating that Ethereum is not oversold but still lacks strong buying momentum.

The MACD histogram showed early signs of recovery, with its positive value reaching +11.6. Traders should maintain caution because the MACD line stays beneath the signal line.

Ethereum is still trading within a long-term descending channel, confirmed by the Keltner Channel bands on the daily chart.

The price currently maintains a position near $1,584.34, which falls inside the lower band rather than $1,921.70 within the upper band.

The current arrangement demonstrates that the bearish pattern continues even though prices show temporary growth.

Analysts Offer Contrasting Outlooks Amid Ethereum Price Uncertainty

Analysts have offered mixed views on Ethereum’s short-term prospects.

According to analysts, weak market demand creates low fees, but some investors view this situation as favorable for buying Ethereum before a potential price increase.

Merlijn The Trader, highlighted Ethereum’s historical trends, pointing out past recoveries during similar low-activity phases.

According to him, the present market situation represents an effective opportunity to buy ETH because selling out of panic would likely prove unbeneficial.

Crypto Caesar recognizes the ongoing pattern as crucial to the development of a bullish expansion.

He notes Ethereum is testing key support zones, which often precede upward moves.

He chooses optimism over the low fees combined with trading activity reductions.

The experts display split perspectives about the current market direction. While one side focuses on low demand, the other sees structural support.

This division adds complexity to Ethereum’s immediate price forecast.

Ethereum Derivatives Show Weak Market Sentiment

The funding rate data from Coinglass shows Ethereum’s derivatives market leaning towards neutral or slightly bearish sentiment.

Since early March, the open interest (OI)-weighted funding rate has remained negative or near-zero, suggesting limited appetite for long positions in Ethereum futures.

The derivatives market reflects the market’s diminishing interest in ETH spot operations.

The growth in trading activity maintains a level position, indicating no clear market momentum. Market participants appear uncertain about Ethereum’s near-term path.

The fee cut measures do not directly impact long-term holders, but they swiftly alter short-term market perceptions.

Market prices will probably maintain their current direction or face additional downward movement as trading levels stay minimal.

A swift increase in user activity has the potential to produce an immediate alteration of present market behavior.

Ethereum’s support near $1,600 has held firm despite broader market weakness.

This interference stage operates as both a mental and technological inhibition, hindering additional deterioration.

Ethereum could attempt to break out of its descending channel if it continues to hold.