Key Insights:

- PlanB renewed criticism of Ethereum by targeting its Proof of Stake model and questioning its decentralization.

- Ethereum price has fallen nearly 60% since late last year, and its dominance in the crypto market has weakened.

- PlanB emphasized Ethereum’s pre-mined supply and flexible monetary policy as major concerns for long-term credibility.

This week, a new wave of criticism hit Ethereum as prominent Bitcoin analyst PlanB reignited debate over ETH’s long-term value. ETH lost approximately 60% of its value from year-end, driving its BTC trading pair to reach a historic nine-year low.

Ethereum’s dominance in the crypto market has dropped to its lowest level in five years. This shift reflects changing market dynamics and investor sentiment.

This criticism intensified as PlanB targeted Ethereum’s fundamental structure, mainly its Proof of Stake (PoS) consensus. He raised concerns about ETH’s centralization, pre-mined supply, and shifting monetary policy.

The market paid close attention to these remarks after Ethereum failed to meet expectations in the 2024 period. In contrast, ETH proponents defended the network, pointing to its increasing relevance in stablecoin transactions and real-world asset integration.

They highlighted Ethereum’s role in processing more transaction volume than traditional payment systems. Despite ongoing price pressure, the Ethereum ecosystem grows across stablecoin and smart contract usage.

PlanB Renews Criticism Against the Structure of Ethereum

PlanB criticized Ethereum’s use of Proof of Stake, arguing it increases centralization by favoring large token holders.

He compared Ethereum’s model to Bitcoin’s Proof of Work, which he believes maintains better decentralization. This view gained momentum as Ethereum continued to lose market share against Bitcoin.

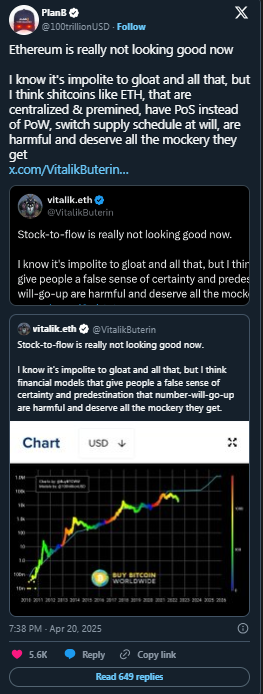

A post from Vitalik Buterin from 2022 targeted PlanB’s Stock-to-Flow Bitcoin model in an analyst’s revisit of this content. Using this reference, PlanB highlighted Ethereum’s current decline as evidence of flawed tokenomics.

The analyst suggests that adjustable supply mechanisms have impacted ETH’s decentralization. Additionally, pre-issue distribution played a role in its loss of status as a decentralized asset.

He also pointed out Ethereum’s early-stage pre-mining, where 72 million ETH were distributed before launch. He explains that such distribution has resulted in an uneven control setup inside the Proof-of-Stake system.

According to him, the system’s nature opposes decentralization while offering excessive decision-making control to a narrow group of entities.

PoS Model Raises Questions About Security

Ethereum’s transition to PoS through The Merge drastically cut its energy usage but raised concerns about long-term decentralization. Network security might suffer due to the criticism that the Pos implementation depends on rich validators for consensus.

Although more energy-efficient, this change created uncertainty about Ethereum’s future dominance. Crucible Capital executive Meltem Demirors described the switch as an error costing trillions.

She claimed that Ethereum’s switch diluted its role in GPU innovation and core protocol strength. This argument resonated with some who view ETH’s shift as a break from its original decentralized vision.

PlanB and other analysts suggest that the proof-of-stake consensus mechanism benefits large investors. At the same time, they argue that it reduces the resilience of network operations.

They believe the supply flexibility of Ethereum allows protocol changes that can impact economic policy without community consensus. The ongoing negative outlook about ETH persists because of its declining market valuation.

RISC-V Upgrade Aims to Boost Ethereum

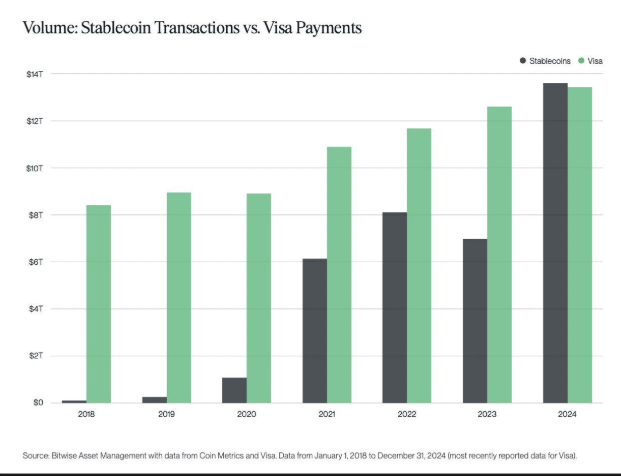

In response to the criticism, analyst Danny Marques emphasized ETH’s expanding role in digital payments and asset management. He noted that Ethereum-based stablecoins processed $14 trillion in 2024, surpassing Visa’s $13 trillion.

Marques used this to argue that Ethereum’s utility continues to grow despite market volatility. A recent Bitwise report confirmed that over 50% of the global stablecoin supply is based on the Ethereum network.

According to Marques, Ethereum’s strong position in stablecoin infrastructure makes it an influential member of financial ecosystems. This development reflects Ethereum’s integration into real-world payment frameworks and financial products.

Additionally, the Ethereum network hosts over 56% of all real-world asset value recorded on blockchains. The traditional financial market incorporates digital instruments such as stablecoins and tokenized bonds, while providing other digital instruments.

Supporters argue that this foundational role positions ETH for future adoption despite temporary price challenges. Despite the criticism, Ethereum developers continue advancing the network through performance and scalability upgrades.

Co-founder Vitalik Buterin recently proposed replacing the Ethereum Virtual Machine with RISC-V architecture. This shift could improve smart contract performance while preserving compatibility with existing code.