Key Insights:

- Bitcoin surged by 3.44%, briefly crossing $87,700 before settling above $87,100, showing renewed market momentum.

- Fundstrat’s Tom Lee expects Bitcoin to rise further now that market deleveraging has eased and pressure has reduced.

- Gold reached a record high in early April and continues to gain amid growing global economic uncertainty and volatility.

Bitcoin (BTC) surged by 3.44%, briefly surpassing $87,700. It later stabilized, holding above $87,100. Meanwhile, gold hit a new all-time high in early April and continues its upward momentum.

Experts debate whether Bitcoin will continue its upward momentum or undergo a deep correction. Shifting market forces play a key role in determining its next move.

Bitcoin Breaks Resistance Amid Market Rebound

Bitcoin value rose to $87,700 this Sunday after surpassing previous market boundaries and then regressed slightly. BTC maintained trading at over $87,100 despite its temporary price reduction because continued buying signals persist.

Since the start of last week, the token’s price has climbed 4.56%, indicating that buying pressure continues building. The technical indicators show an upward trend, which suggests initiating a new business cycle.

The Relative Strength Index demonstrated 57.72 strength. This exceeded its moving average of 50.12 because it continues growing upward. The MACD line now surmounts the signal line, since the indicator displays increased momentum through green histogram bars.

The Aroon indicator showed both Aroon Up and Aroon Down at 0%, confirming the breakout due to strong bullish momentum. Market participants indicated that Bitcoin successfully moved beyond its previous period of consolidation.

Market sentiment has turned positive according to trader signals, which prompt immediate reactions on their part.

Lee Predicts Bitcoin Growth Over Gold

Fundstrat’s Tom Lee expressed confidence in Bitcoin’s long-term potential and sees room for growth compared to gold. He believes the recent deleveraging period has held Bitcoin back, especially during weekend trading. Now that the pressure is off, he expects Bitcoin to climb further.

Lee pointed out that BTC lagged behind gold while institutions were selling off digital assets to manage risk. As gold steadily climbed, Bitcoin remained under $85,000 until this weekend’s surge.

The relaxation of deleveraging constraints makes him believe that crypto assets can succeed as an alternative to the United States dollar.

According to Lee, Bitcoin has significant upside as the market rebalances, and traditional assets face mounting pressure.

He views BTC’s current level as a base for further gains, not the peak. According to his assessment, Bitcoin can achieve equal value to gold over the following few years.

Gold Prices Rise as Markets Falter

Gold achieved its highest-ever price point at the start of April while sustaining its growth trajectory due to rising market demand. Research shows market participants buy safe-haven assets due to stock and bond market instability.

Joe Kernen noted gold’s consistent upward movement as Bitcoin struggled to break through resistance. Gold exhibits stable pricing patterns alongside a significant decline in equity market values of the S&P 500 and Nasdaq.

The commodity is the preferred choice for value storage during financial distress, particularly as inflation anxiety increases. Kernen believes that under current market conditions, gold will climb to reach $4,000 per ounce.

Market conditions favor strong gold prices as central banks maintain high demand. Additionally, global uncertainties continue to grow, reinforcing gold’s stability.

The combination of economic changes, rate prediction, and geopolitical events has increased the demand for precious metals. Non-dollar assets show that gold holds the top position in performance records for the current year.

Bloomberg’s Mike McGlone Warns of BTC Collapse

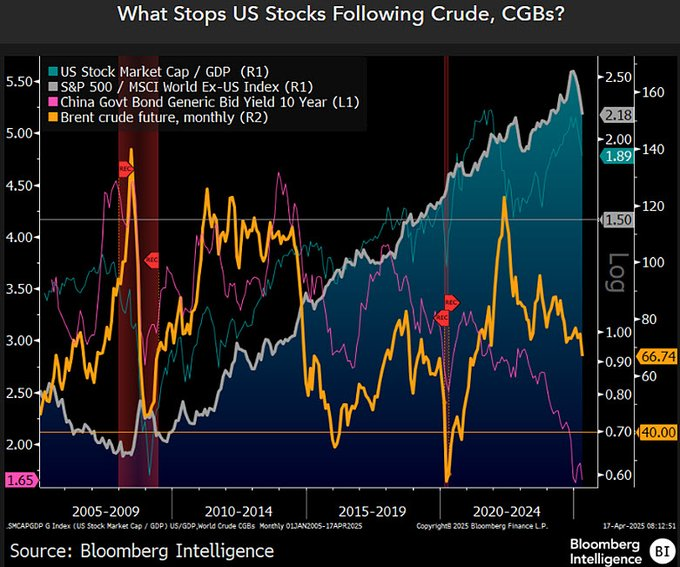

In contrast to bullish views, Bloomberg Intelligence’s Mike McGlone sees a bleak path for Bitcoin in the near term. He predicted that Bitcoin could collapse to $10,000, citing its correlation with broader financial markets.

According to McGlone, the combination of a deflationary recession will result in downfalls across all risk assets, including cryptocurrency.

According to him, the S&P 500 index has a target of 4,032 while crude oil prices may settle at $40 per barrel. These expectations reflect his bearish stance on macroeconomic trends and their influence on BTC.

According to McGlone, Bitcoin could fall sharply from its $100,000 projection to just $10,000. This prediction highlights concerns over market volatility and shifting economic conditions.