Key Insights:

- Bitcoin reserves on centralized exchanges have fallen to 2.6 million, the lowest level since November 2018.

- Public companies have acquired nearly 350,000 Bitcoin since the U.S. election, with accelerated purchases in 2025.

- Fidelity reports that institutional demand is increasing, pushing more Bitcoin off exchanges and reducing available supply.

Bitcoin reserves on exchanges have plunged to their lowest point in over six years, signaling major structural changes.

As reserves continue to fall, institutional players are accelerating their purchases, adding fresh pressure to already tight supply.

The overall trend suggests growing accumulation while spot demand remains inconsistent.

Bitcoin Reserves Hit Six-Year Low

Bitcoin reserves on all centralized exchanges have dropped to 2.6 million, reaching their lowest level since November 2018.

The exchange reserves experienced their most severe drop since November 2018 because public companies have been withdrawing, while long-term holders lock their coins in offline storage.

The circulating supply of Bitcoin decreased because more than 425,000 Bitcoins units left exchanges starting in November 2024.

Since the U.S. election, public companies have received 350,000 Bitcoins through regular monthly purchases that exceeded 30,000 coins during 2025.

During this period, Bitcoin achieved its highest value point at $95,000, matching the market trend of increased BTC prices.

Higher market demand and limited supply availability cause the exchange data to exhibit extended periods of ownership from investors.

According to Fidelity Investments, institutional investors are showing increasing interest, which accelerates Bitcoin’s exit from exchange wallets.

Corporate Bitcoin purchases show firm conviction because this trading activity has depleted Bitcoin reserves available for retail transactions.

At the present rate, the market supply and liquidity are anticipated to face increasing pressure.

Whale Activity Drops as Retail Rises

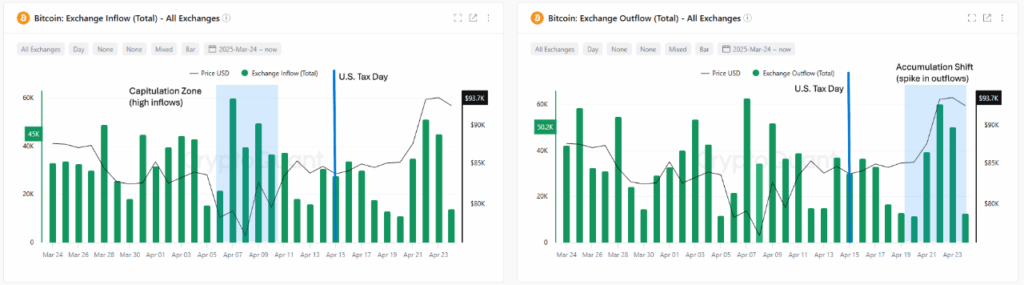

Binance presents evidence of large purchasing activities following a limited price drop on its platform during April.

The exchange Binance received more than 15,000 Bitcoin from April 6 through April 10, indicating traders engaged in selling and extracting profits from the market.

Bitcoin prices remained at $85,000 to $87,000 throughout that specific financial period.

Bitcoin left Binance at a rate of 15,000 during the April 19-23 period, which caused the price to reach above $93,000.

The changing behavior indicates people store their coins in wallet custody rather than seeking market sales.

Reducing exchange balances through decreased supply normally leads to positive market price pressure.

The Exchange Whale Ratio decreased to less than 0.3 on April 23, showing that big investors participated less in purchasing activities.

The increasing retail investment contributes to more stable market momentum because it represents higher participant numbers.

Market resilience grows stronger whenever major entities cut their wallet operations while smaller wallets take over funds.

Bitcoin Buying Momentum Drops Sharply

The historical accumulation trend of long-term holders remains constant, but short-term purchasing demand has lost its purchasing speed over the recent weeks.

The active purchase of Bitcoin spot decreased by 146,000 coins over the last 30 days.

The falling numbers of 488000 indicate consumption hesitance after March’s lower figure, 311000.

Since October 2024, demand momentum has decreased by 642,000 Bitcoins relative to existing holder numbers.

The breakdown of new customer participation indicates wider market disengagement, which usually supports price stability during market upticks.

A lack of increased buying power makes the price likely to encounter strong resistance at its highest point.

The trading positions based on leverage were reduced between $82,000 and $88,000 to protect traders from overextension and short-term uncertainties.

The market gained stability after this liquidation, which produced stronger hands due to market price resets.

Above $92,000, the position of short sellers becomes exposed, while triggers of positive movement can lead to a swift price surge.

ETF Buying Weakens Market Breakout Chances

The US Spot Bitcoin ETF demonstrated reduced flow activity beginning in March 2023, as it only attracted a limited amount of investments during the last month.

The 2025 Bitcoin sales circus implemented by ETFs amounted to a total of 10,000 Bitcoin disposals, while they eagerly accumulated coins heavily during early 2024.

At this point, the amount of Bitcoin ETFs purchased last year reached 208,000.

ETF daily transaction activity has been between -5000 Bitcoin and +3000 Bitcoin, whereas during past bull runs it reached +8000 Bitcoin.

The weak continued purchasing behavior by ETFs reduces the probability of a strong market breakout.

Market participants require fresh signals of institutional buying strength to gain widespread belief on a grand scale.

The USDT market capitalization increased by $2.9 Billion over the last two months, indicating moderately positive liquidity conditions.

However, the current market capitalization levels do not reach the critical threshold of $5 Billion, which prompts sustained Bitcoin price surges.

Increased liquidity inflows seem necessary for developing a bullish market trend.