Key Insights:

- Bitcoin surpassed $94,000 after recording $3.18 Billion in inflows, its highest price since March.

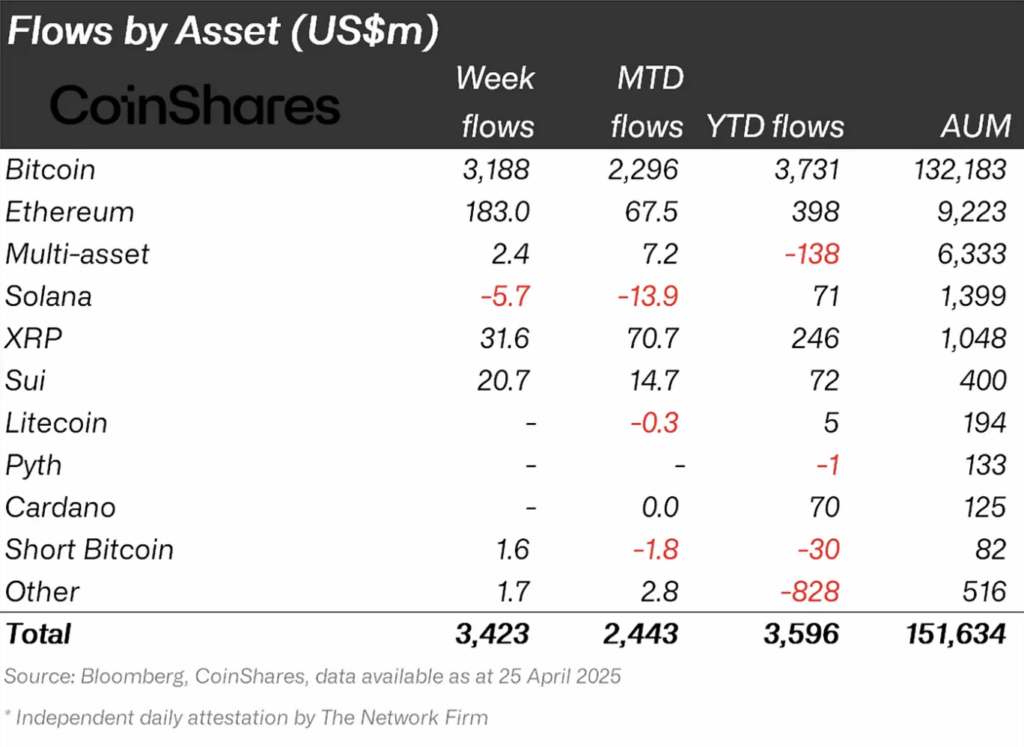

- The digital asset market attracted $3.4 Billion in inflows, marking the third-largest weekly inflow on record.

- Spot Bitcoin ETFs in the United States contributed over $3 Billion to the week’s total inflows.

The digital asset market staged a strong recovery last week as $3.4 Billion poured into cryptocurrency investment products.

Bitcoin price surged past $94,000, hitting their highest level since March and signaling renewed strength.

With rising inflows and bullish momentum, many market watchers now anticipate the possibility of a new all-time high soon.

Spot Bitcoin ETFs Record Massive Gains

Bitcoin products led the market recovery by capturing $3.18 Billion of the total weekly inflows, indicating dominant performance.

Prices rallied sharply as Bitcoin crossed the $90,000 mark, pushing further towards $94,000 by the end of the week.

Insignificant outflows stopped completely during the week, leading to a total year-to-date inflow of $3.7 Billion.

Spot Bitcoin ETFs in the United States accounted for a major portion of inflows, adding over $3 Billion during the week.

ETFs witnessed their biggest flow of funds during the past five months, which ranks second only to another record-breaking week historically.

Furthermore, whale activity intensified with a reported $110 Million in over-the-counter purchases of Bitcoin and Ethereum.

Combined macroeconomic pressures and a weakened U.S. dollar enhanced Bitcoin’s appeal as a resilient asset.

As gold prices corrected lower, many shifted towards Bitcoin, viewing it as a superior store of value.

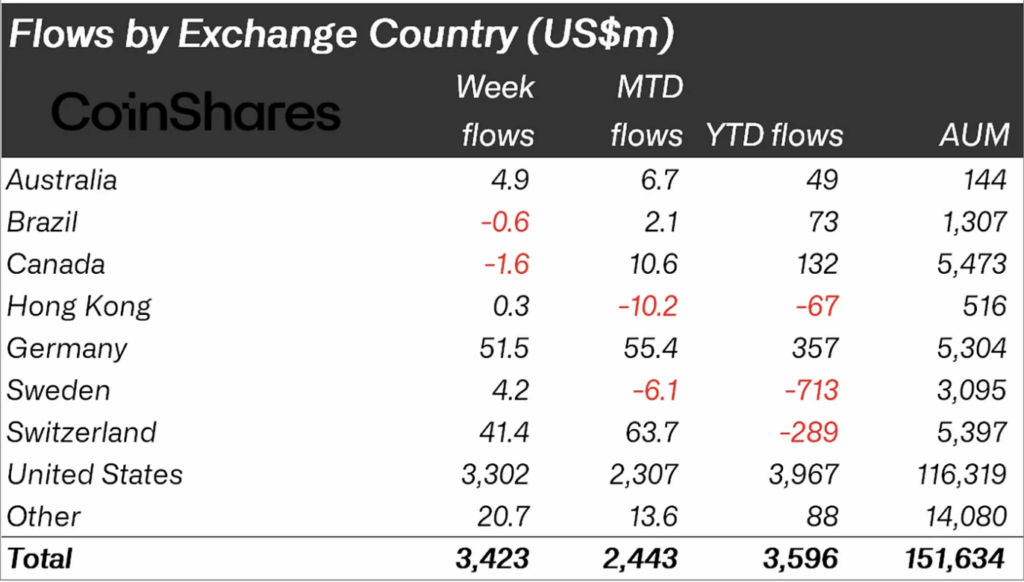

The US led the regional Bitcoin inflows by investing $3.3 Billion, yet Germany invested $51.5 Million, and Switzerland allocated $41.4 Million.

Spot Ethereum ETFs See Fresh Inflows

Ethereum investment products pulled in $183 Million last week to stop a nine-week streak of withdrawals, thus demonstrating robust market faith.

ETFs tracking spot Ethereum on the U.S. market delivered $157.1 Million in positive net inflows during the week, marking their first such increase since February.

The restored focus on Ethereum led altcoins to obtain fresh momentum across their market.

Ethereum market price started rising, and at the same time, investors became more optimistic about future network developments and general market adoption potential.

While Bitcoin captured most of the market spotlight, Ethereum’s quiet rebound suggested a broader appetite for large-cap digital assets.

Market activity regarding Ethereum derivatives extended past previous highs, indicating traders expect future prolonged expansion.

Although Bitcoin’s dominance remains strong, Ethereum’s rebound hinted at diversification across leading digital assets.

The iShares ETF products from BlackRock received the most significant influx of funds from investors because institutional demand was increasing.

ARK and Fidelity captured $621 Million and $574 Million from investors, respectively, although these figures demonstrate the rising demand for moderate, better-performing products.

Solana Faces Outflows Despite Market Recovery

While Bitcoin and Ethereum enjoyed strong inflows, altcoins presented a mixed picture, with XRP and Sui gaining but Solana facing outflows.

Investors’ willingness to buy XRP investment products rose to $31.6 Million because of regulatory technicalities and growing institutional interest.

The investment interest in new blockchain environments grew evident as Sui funds secured $20.7 Million.

Against the market trends, Solana experienced a $5.7 Million outflow, separating it from all other major digital asset investments that gained capital.

The Solana-based investment vehicles lost capital while the broader market was recovering, showing that investors demonstrated risk-averse behavior toward Solana.

The market trend showed investors choosing assets because they displayed more dependable stability or better-defined growth potential.

Excluding the main U.S. capital movements, minor positive flows were detected in Australia, Sweden, and Hong Kong.

Meanwhile, blockchain equities, particularly Bitcoin mining ETFs, also experienced renewed interest, recording $17.4 Million in net inflows.