Key Insights:

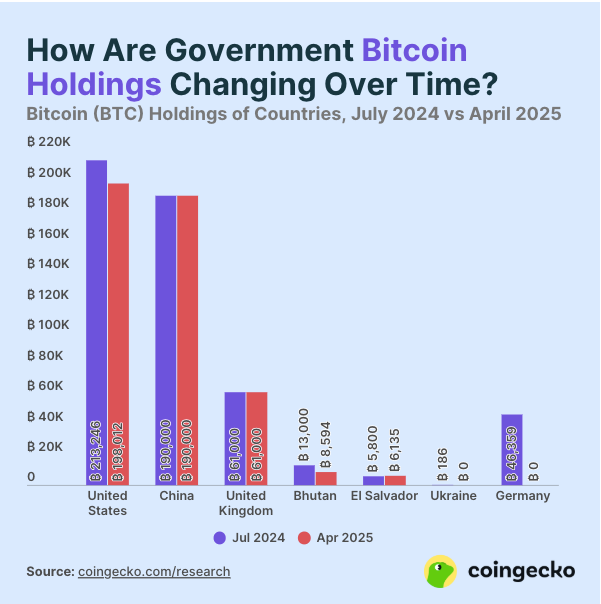

- Governments worldwide have reduced their Bitcoin reserves significantly between July 2024 and April 2025.

- The United States remains the largest holder but has liquidated part of its Bitcoin reserves to address fiscal challenges.

- China has maintained its Bitcoin holdings at 194,000 BTC despite strict crypto trading and mining activities bans.

Governments worldwide have significantly reduced their Bitcoin holdings, marking a strategic shift in the growing cryptocurrency ecosystem.

New data from CoinGecko shows a sharp decline in global Bitcoin reserves from July 2024 to April 2025.

This change reflects different approaches among countries as economic pressures and market opportunities evolve rapidly.

US Bitcoin Reserves Drop Amid Liquidations

The US remains the largest holder of Bitcoin among global governments, but has reduced its reserves significantly over the past months.

August 2024 started with 210,000 BTC belonging to the US government until April 2025, which reduced it to 198,012 BTC.

The authorities reported that asset liquidation from forfeiture proceedings allowed the government to solve financial problems.

The government primarily acquires Bitcoin through seizures from criminal activities and occasionally from open-market purchases when necessary.

Despite the reduction, the United States still controls the largest share of Bitcoin held by any government globally.

The Bitcoin sales occurred as part of economic strategies focused on stabilizing finances and improving monetary liquidity.

Market analysts believe that the US liquidation impacted Bitcoin’s short-term price dynamics but supported governmental budget needs.

Moreover, the United States actively explores blockchain innovations while adjusting its Bitcoin strategy.

According to their analysis, the economic situation might drive experts to recommend extra asset liquidations.

China Holds Bitcoin Reserves Without Trading

China holds the second-largest government-owned Bitcoin stockpile, with 194,000 BTC unchanged since July 2024.

Most Bitcoin in the country’s reserve originated from the seizure of the 2019 Ponzi scheme called PlusToken instead of active market engagement.

Despite possessing huge Bitcoin assets, China upholds its restrictive crypto trading and mining regulations.

Interestingly, China has refrained from liquidating its Bitcoin, signaling a wait-and-see approach rather than active trading.

The government made this decision as part of its internal policies concerning seized digital assets, enabling them to monitor other regulatory efforts more effectively.

The government continues enforcing crypto mining prohibition in the country by suppressing occasional mining activities in rural locations.

China adopts a strategic viewpoint toward digital assets yet chooses not to participate in international crypto market operations.

The Chinese government continues to develop public digital currency systems and works to stop the expansion of both centralized and decentralized cryptocurrencies.

Thus, China’s steady Bitcoin holdings contrast sharply with the US’s more flexible approach.

Governments Adopt Different Bitcoin Reserve Strategies

The United Kingdom ranks third in government-held Bitcoin reserves, maintaining a stable stockpile of 61,000 BTC since mid-2024.

The United Kingdom acquired Bitcoin through financial crime investigations by seizing assets resulting from unlawful financial activity.

Officials have made no significant moves to sell or increase their Bitcoin reserves during this period.

Bhutan has taken a different approach, acquiring 8,594 BTC by operating state-owned Bitcoin mining farms.

Bhutan’s primary method differs from other countries because it prioritizes organic growth over market-driven acquisitions when building Bitcoin reserves.

The country’s mining efforts reflect a national strategy to leverage renewable energy sources for Bitcoin production.

El Salvador continues to aggressively expand its Bitcoin holdings, with a reserve of 6,135 BTC as of April 2025.

Under President Nayib Bukele’s leadership, El Salvador followed a daily policy of Bitcoin purchases.

This approach positions El Salvador uniquely among governments, as it uses Bitcoin integration to attract tourism and investment.

Each country’s approach to Bitcoin reserves highlights the diverse strategies evolving in the global crypto landscape.

Different governments select between asset sales as their main strategy or adopt accumulation or stabilization tactics for their Bitcoin investments.

Collectively, these varying policies contribute to the overall decline in global government-held Bitcoin reserves.

Bitcoin Prices Rise Amid Economic Shifts

Bitcoin prices surged 11% between April 20 and April 26, reaching a two-month high of nearly $94,000.

The market value of Bitcoin elevated when President Donald Trump made implied remarks about lowering trade barriers.

Additionally, Bitcoin exchange-traded funds (ETFs) witnessed a net inflow of $3.1 Billion during the same period.

Over the week, the S&P 500’s 7.1% gain further contributed to optimism surrounding risk assets, including Bitcoin.

However, market analysts caution that Bitcoin’s sustained rally depends heavily on macroeconomic developments and liquidity conditions.

Significant inflows into spot Bitcoin ETFs suggest growing confidence, but consistency remains crucial.

Experts predict that Bitcoin could surpass the $100,000 mark by May if favorable trends continue.

Still, Bitcoin must show clear independence from traditional market movements to maintain new highs.

Furthermore, ongoing discussions about US interest rates and Federal Reserve policies will influence Bitcoin’s short-term performance.

Thus, while the recent surge in Bitcoin prices offers strong momentum, challenges persist amid broader economic uncertainty.

Bitcoin’s success in setting a new all-time high will likely require persistent inflows and supportive monetary policies.

During this period, the cryptocurrency market remains affected by worldwide fiscal decisions and trade policies.