Key Insights:

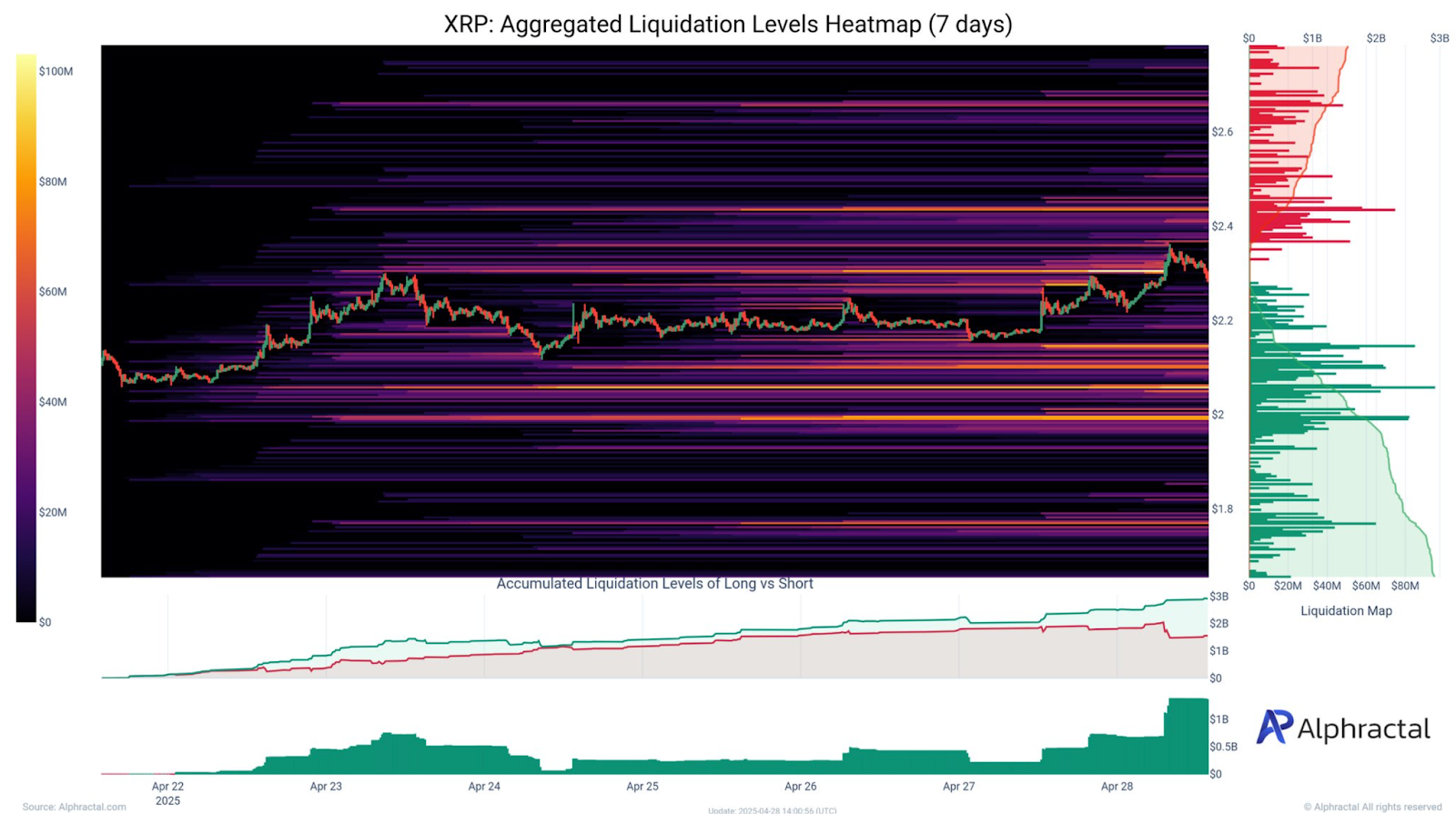

- XRP liquidation heatmaps show dense long positioning between $1.60 and $2.40.

- ProShares XRP ETF delayed to May 14, adding timing risks for traders.

- Ripple CEO highlights XRP’s real-world payment potential beyond speculation.

ETF hype is giving XRP momentum, but heavy long positioning below $2 is a cautionary sign. As the ProShares XRP ETF is delayed and liquidation zones are forming, traders are exposed to more short-term risk while Ripple continues to make progress with real-world adoption narratives.

Volatility May Be Triggered By Liquidity Clusters Near $2

Recent heatmaps of XRP liquidation levels show a high concentration of long positions below $2.

Alphractal’s one-month data shows there are unliquidated long positions accumulated between $1.60 and $2.00, with a number of visible zones reaching back to $1.40.

During sharp price swings, these areas could be targeted as they are high liquidity zones that are susceptible to liquidation.

On the one-week view, positioning is similar, with heavy long exposure just below $2.20 and smaller, more tightly packed bands at $2.40. XRP’s price is heading towards $2.40, and if it gets rejected in this area, it could quickly reverse into a downside move.

The bands are based on trader behaviour with leverage and risk placement across multiple exchanges.

At these price levels, short-term volatility tends to increase because of forced closures of leveraged trades.

ETF Delay and Market Structure Add Layers of Uncertainty

Meanwhile, ProShares Trust’s XRP ETF, which was expected to launch soon, has been postponed until May 14, 2025.

The new effective date under the Investment Company Act of 1940 is confirmed by the SEC filing.

The delay doesn’t mean rejection, but it does introduce a timing element that traders will be watching closely. XRP is nearing multi-month highs and speculative interest around the ETF is high.

Trading structure on lower timeframes is cautious. In early 2024, the last major altcoin ETF approval event saw a sharp drop in Bitcoin’s price.

Back in the day, Alphractal noted that Bitcoin retraced to $11,000 from $49,000 soon after its ETF went live, in spite of the positive sentiment.

Now they warn that XRP could follow the same path as it is “highly speculative and longs are concentrated below current price levels, which makes a pullback before continuation trend likely.”

Broader Vision from Ripple CEO Supports Long-Term Narrative

Although technical risks persist in the short term, Ripple’s leadership is still focused on broader adoption and practical use cases.

In a recent interview, Ripple CEO Brad Garlinghouse discussed how XRP could be the key to changing how people get paid.

He asked,

This statement puts a strategic layer on the ETF and trading activity. Short-term trading is based on price and liquidation levels, but Ripple is trying to redefine settlement efficiency in payroll systems and cross-border flows.

These parallel developments have resulted in the growing interest around XRP, both speculative and practical.

Traders are also watching liquidation levels and ETF dates while also paying attention to the bigger themes that could support XRP in the long term.

Whether the price rises above $2.40 or pulls back temporarily, the fact that leveraged positioning and institutional interest are focused on XRP heading into mid-May keeps it in focus.