Key Insights:

- Bitcoin rose to approximately $96,890 on May 1, 2025, marking a 2.90 percent daily increase.

- The rise came despite a net ETF outflow of $56.23 Million, ending a two-week inflow streak.

- Bitcoin Whales accumulated over 43,100 BTC between April 13 and 27, indicating strong buying interest.

Bitcoin maintained upward momentum on May 1, 2025, because investors continued to purchase coins despite recent withdrawals from spot ETFs.

During this 24-hour period, Bitcoin surged to $96,890, as its value increased by 2.90%. This move highlighted confidence among Bitcoin Whales, even as market data showed short-term hesitation.

A combination of withdrawals from Fidelity’s FBTC and Ark & 21Shares’ ARKB reached the exact amount of BlackRock’s inflows, leaving the market with $267 Million in withdrawals.

The $56.23 Million net money exodus signaled the conclusion of a two-week period in which ETFs generated profits.

Bitcoin’s resilience indicated that large-scale holders were consistently interested in buying Bitcoin.

BTC remains above $95,000 while technical analysis shows positive signs against bearish market forces.

The temporary market corrections lasted only briefly, as whale transactions helped force a quick market recovery. A price increase above $95,870 allowed Bitcoin to exceed $100,000.

Bitcoin Whales Accumulate Aggressively Amid Mixed ETF Activity

Bitcoin Whales continued accumulating aggressively as institutional ETF behavior showed divergence.

BlackRock spearheaded new acquisitions in the market as ETF entities briefly released money from their funds.

Last week, BlackRock’s IBIT purchased 25,430 Bitcoins worth $2.4 billion through LookOnChain data.

Through this buying activity, IBIT increased its BTC holdings to 601,209 units, thus demonstrating long-term Bitcoin investment beliefs.

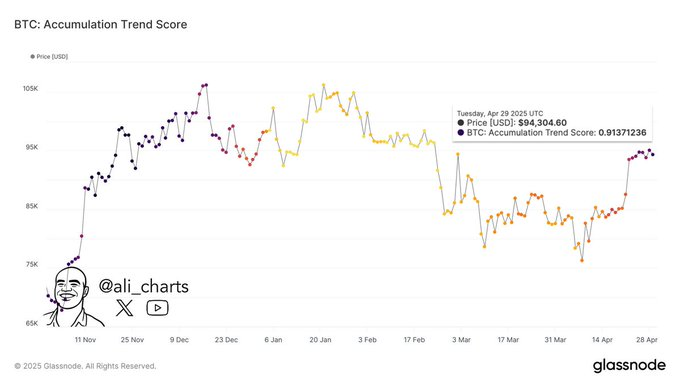

Bitcoin whale accumulation resulted in more than 43,100 newly acquired BTC across the network during the April 13 to 27 period.

Through his analysis, Ali Martinez demonstrated an industry trend that pivoted toward buying and holding assets.

The Accumulation Trend Score almost achieved a value of 1 because larger investors now have more purchasing power in the cryptocurrency market.

The score suggests conviction remains strong among Bitcoin Whales despite short-term market fluctuations. Price pressure shifted upward, strengthening potential price growth in the future.

Bitcoin Price Holds Above Key Support Level

The price of Bitcoin remained on the upper side of the Realized Warm Supply indicator at $94,550, indicating that medium-term owners were actively supporting it.

Strong accumulation from Bitcoin Whales supported this zone, limiting downside moves. The market responded positively to short-term selling activity, resulting in stable technical conditions.

The Bollinger Bands (BB) demonstrated that Bitcoin was approaching an elevation to $99,491 on its chart, indicating intensifying bullish activity.

RSI remained at 69.88 as it rested below the overbought threshold, demonstrating robust market momentum, which maintained control.

A reduction in volatility is expected after traders detect the overbought conditions.

Whale order heatmaps indicated that resistance appeared around the $97,600 area. According to CoinGlass, a surge of focused whale transactions worth $96,000 resulted in robust areas of support.

Trading activities within whale interest areas created strategic points that would determine possible breakout situations or consolidation patterns.

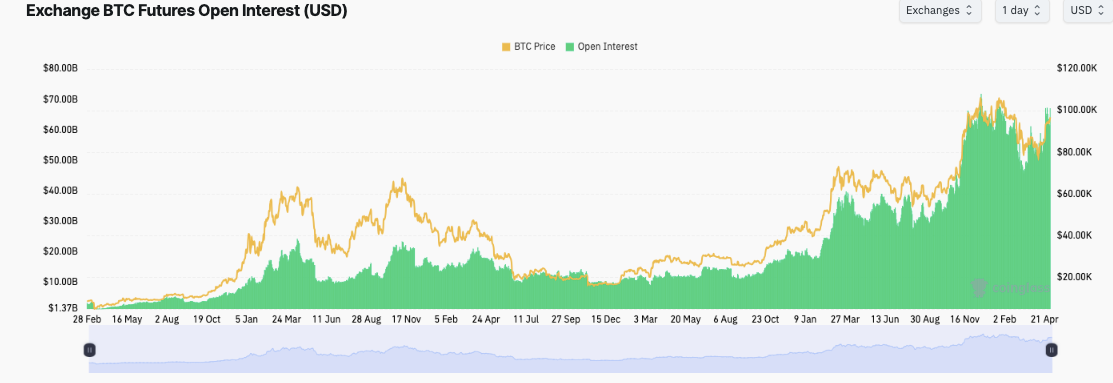

Bitcoin Open Interest Hits Record High

Bitcoin’s future Open Interest (OI) reached its highest point in history, reaching above $100 Billion.

Market volatility and the opening of exchange-based positions caused open interest to rise significantly. OI increases short-term price volatility and supports price strength.

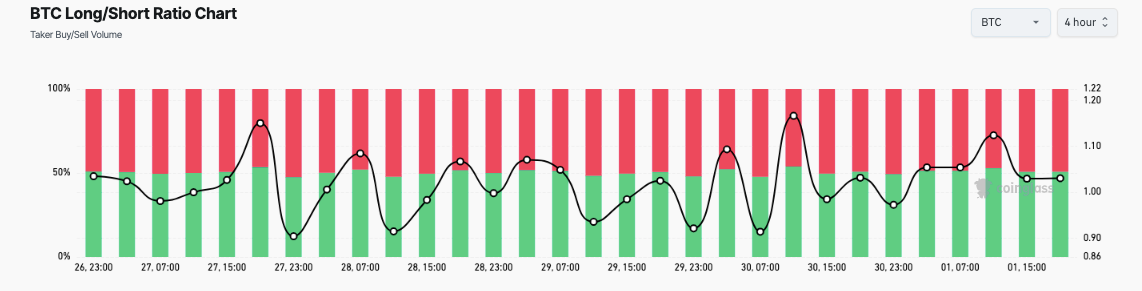

The BTC Long-Short Ratio exhibited equilibrium when resting near 1.05 on the 4-hour time frame, which indicated traders had neutral outlooks.

The equilibrium between long and short trader positions decreases the risk of sudden market liquidations, producing stability in the current bullish trend.

Market participants show cautious behavior with their leverage utilization when market conditions become volatile.

Buying pressure peaked when the Chaikin Oscillator hit 312, indicating the strong purchasing dominance in this market rally.

This metric aligns with Bitcoin Whales’ behavior and growing volume at key support levels. Expect the trend to rise as market feelings maintain their position over resistance barriers.

MVRV Test Signals Potential Uptrend Ahead

Ali Martinez described how the Bitcoin MVRV ratio verifies the 1-year Simple Moving Average (SMA) test.

A definitive move through the SMA should indicate an upward projection, which may lead to $114,230. The level shares its position with the succeeding MVRV-based main target.

Meanwhile, the Net Unrealized Profit/Loss (NUPL) shows long-term holders in the “denial” phase. The prior step demonstrates an atmosphere of uncertainty because it arises before crucial market changes take place.

However, Bitcoin Whales’ actions suggest forward-looking conviction despite current psychological hesitation.

A successful price close beyond $95,870 could initiate a push for Bitcoin to reach $100,000.

Technical evidence and an ongoing accumulation pattern create favorable conditions for this possibility.

The solid market environment, together with whale backing, has the potential to push BTC prices towards new levels.