Key Insights:

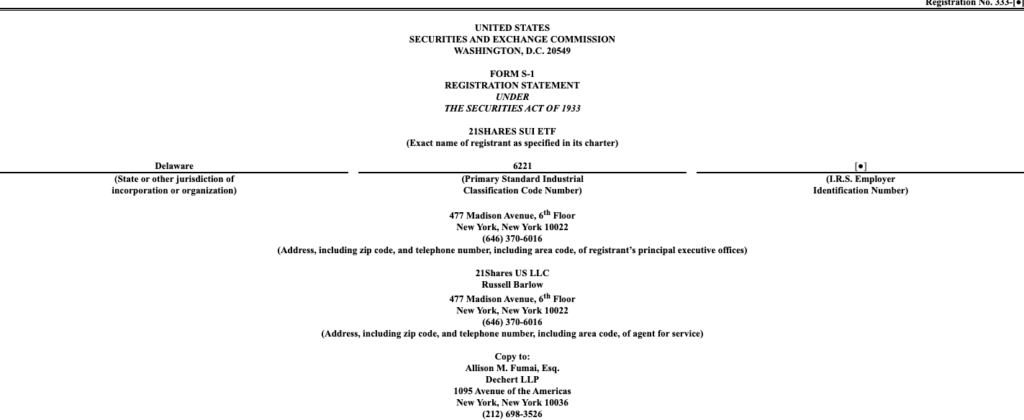

- 21Shares has filed with the SEC to launch a spot ETF based on the market price of the Sui (SUI) token.

- The proposed ETF will hold SUI in custody with Coinbase and will use a benchmark index for daily valuation.

- Unlike other filings, the 21Shares SUI ETF will not include staking and will process share transactions entirely in cash.

Asset manager 21Shares has proposed with the SEC to launch a spot exchange-traded fund tied to Sui (SUI).

This move comes as part of the expanding crypto ETF race in the United States. The filing also includes a strategic partnership with the Sui blockchain to strengthen market presence.

SUI ETF Proposal Marks Strategic Expansion by 21Shares

21Shares continues to grow its crypto ETF lineup by proposing a spot ETF tracking the market price of Sui (SUI).

The fund maintains SUI assets at Coinbase while using an index to determine daily asset valuation.

In contrast to other funds on the market, the ETF provides no staking functionality because it concentrates solely on price exposure.

While Canary Capital included staking in its Sui ETF filing, 21Shares opted to keep its structure straightforward.

The company maintains its cash-based method of share redemption for its available US ETFs. The S-1 filing reflects 21Shares’ effort to simplify crypto access through regulated products.

Sui’s strategic partnership works to extend global blockchain reach and stimulate new interest in the developing blockchain ecosystem.

Through this collaboration, the partnership could enhance crypto adoption in regions where market demand for crypto is emerging. As part of this strategy, 21Shares leverages its existing global presence to scale quickly.

SUI’s European ETP Momentum Signals Strong Demand

21Shares already offers a Sui Staking ETP in Europe, launched in July 2024, showing early confidence in the asset’s potential.

Managed assets controlled by VanEck’s Sui ETP and other products total $400 Million. According to CoinShares data released recently, the inflow total reached $72 Million in the current year.

Recently, Sui ETPs received an inflow of $20.7 Million among the total $72 Million that entered this week, indicating fast-growing investor participation.

The strong performance of Sui network-related products confirms growing interest among users in the Sui ecosystem.

Growing financial interest in these cash inflows has led to an intense focus on Sui’s blockchain infrastructure capabilities.

Sui gained 8.36% in value on May 1 to reach $3.70 during the trading session. This latest price surge occurred during a favorable weekly performance exceeding 16%, making it one of the top-performing digital assets.

Sui maintains the status of the eleventh-largest cryptocurrency worldwide at present with its $12.3 Billion market cap.

Crypto ETF Filings Accelerate as Regulatory Environment Shifts

21Shares is not alone in its push for new ETFs, as over 70 filings are under review by the SEC.

Several financial firms, including Bitwise, Franklin Templeton, REX Shares, and Grayscale, actively seek to launch ETFs connected to the digital currencies Solana and XRP, Dogecoin, and other cryptocurrencies. Among the proposed ETFs are Polkadot, Hedera, Avalanche, and Litecoin.

The approval chances for new ETF proposals are decent, according to Bloomberg analysts Eric Balchunas and James Seyffart, who identify Solana and Litecoin as leaders.

Growth in market activity and user adoption sustains XRP, Dogecoin, and Hedera as firms pursue them for adoption. Specialists expect swift approvals due to positive indications in present-day regulatory procedures.

SEC officials, led by Paul Atkins, are currently taking an innovative stance on the new policy enacted by the previous governing party.

The SEC has shown positive changes by ending court lawsuits and developing better relations with cryptocurrency companies.

Firms are accelerating their product releases and filing applications because of newly implemented updates.