Key Insights:

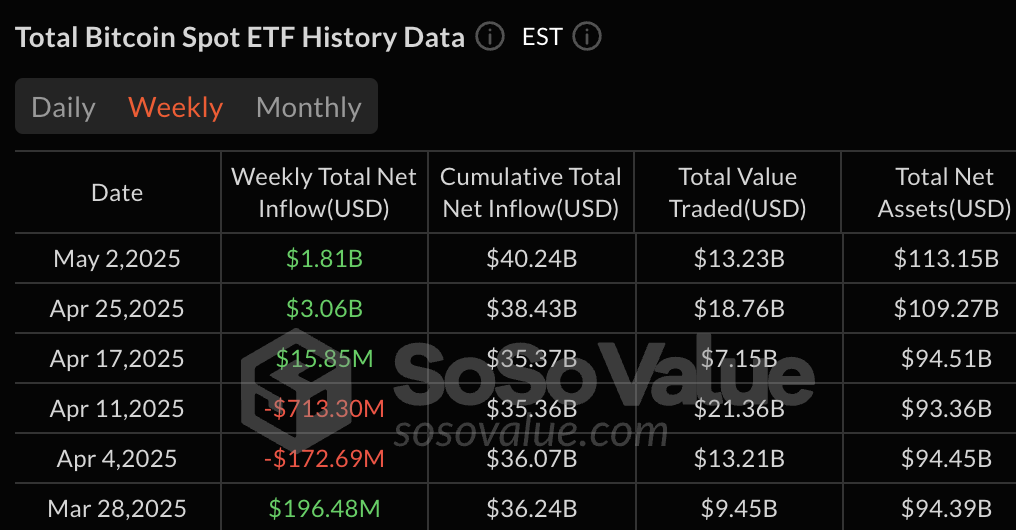

- Weekly inflows to US Bitcoin ETFs dropped to $1.81 billion as Bitcoin’s price fell below $95,000.

- This marks a 40.8 percent decrease from the previous week’s inflow of $3.06 billion.

- Despite the weekly slowdown, total net assets across all Bitcoin ETFs increased to $113.15 billion.

Weekly inflows to US Bitcoin ETFs fell sharply to $1.81 Billion as Bitcoin price dropped below $95,000. US Bitcoin ETF funds experienced their biggest weekly decline, reaching $1.81 Billion.

The prior week recorded $3.06 Billion in inflows. Despite this slowdown, total net assets across all Bitcoin ETF funds rose to $113.15 Billion.

During most of April, the investment flow rate demonstrated strong growth. However, this period ended with an inflow decline reaching $1.81 Billion.

Current data revealed a countervailing trend because falling prices and decreasing trading volumes have led to this reduction in activity. Total cumulative inflows reached $40.24 Billion, even though the amount decreased.

The total value traded during May 2 reached $13.23 Billion, down from $18.76 Billion a week ago. The trading volume during daily operations reached only $2.90 billion on May 2.

The trading volume concerning average daily value fell from $3.75 Billion to $2.65 Billion. This indicates a declining market demand.

BlackRock IBIT Leads Bitcoin ETF Market

BlackRock’s IBIT led all Bitcoin ETFs on May 2, recording $674.91 Million in net inflows for the day. IBIT holds $59.64 Billion in net assets, making it the largest Bitcoin ETF fund. It dominates the market with a 52.7% share.

Since its launch, IBIT has amassed total inflows of $43.68 Billion. This solidifies its dominance in the Bitcoin ETF market.

Despite a dip in daily investment numbers, IBIT continued to grow. Investors have shown a strong preference for large and liquid fund options.

On May 2, the fund earned a price gain of 0.09%, setting it above other competitors. BlackRock’s consistent performance shows stronger results than other ETFs during that period.

Per data analysis, weeks of slower market conditions didn’t suppress the dominant role IBIT plays in advancing its sector growth. The fund continues to draw significant capital inflow while less popular ETFs face difficulties keeping investors loyal.

The increased market faith in BlackRock’s offering demonstrates that investors choose it. However, the market exhibits reduced activity overall.

Fidelity FBTC Holds Despite Zero Inflows

On May 2, Fidelity’s FBTC received zero new investments, demonstrating an end to fund cash inflows. It remains the second-largest Bitcoin ETF, managing $19.28 Billion in total assets as of the latest update.

The fund’s price dropped minimally by 0.02%, yet the trading volume remained stable. Since its inception, the fund has attracted $11.65 billion through continuous capital growth.

Despite lower weekly inflow indicators, the fund continues to hold its position as an essential member among crypto assets. Despite the absence of new daily capital, the fund maintains its position at the top, indicating strength in resisting market fluctuations.

The recent performance of FBTC shows market-wide cooling trends, with its solid asset accumulation going strong. The fund remains inactive as no recent profits have been recorded.

It is waiting for market sentiment to improve or for prices to rise. The fund is a stable mass yet remains inactive regarding new capital additions.

Grayscale’s GBTC Faces Continued Outflows

GBTC under Grayscale has experienced continuous investment withdrawals, totaling—$22.75 Billion since its first launch. Still, the fund remains the third-largest Bitcoin ETF with $18.47 Billion in net assets. The fund demonstrates a strong foundation despite ongoing withdrawal activities.

No investors injected funds while the price stayed stable in GBTC during the observation period of May 2. In contrast to IBIT’s rising investor interest, GBTC continues to receive continuous fund withdrawals.

GBTC maintains strong market dominance because of its prolonged presence in the market and historical positioning. The fund remains stable due to its significant total assets. However, newer exchange-traded funds have outpaced their growth performance.

Outgoing funds from GBTC show changing market preferences. However, investors have not entirely left it behind.

Smaller ETFs Show Mixed Results as Market Stabilizes

Several smaller ETFs showed limited movement during the week, with little change in daily inflows or price. ARKB from Ark has grown significantly, now holding $4.45 Billion in assets. Despite this, it has attracted $2.65 Billion from new investors, reinforcing its market presence.

The total assets under management at Grayscale’s BTC stand at $4.14 Billion because the fund hasn’t seen recent inflows. Despite no new investment on May 2, BITB from Bitwise maintains $3.75 Billion in assets. This indicated its steady retention of capital.

The funds operating at mid-tier levels maintain a steady business without chasing rapid growth. These funds show growth at a slower pace while providing constant support to their assets.

VanEck’s HODL, Valkyrie’s BRRR, and Invesco’s BTCO are among the top ten funds by market capitalization. Their assets total $1.42 billion, $591.40 million, and $524.47 million, respectively.

Valkyrie’s BRRR saw the biggest price decline at -0.08% in daily movement. Meanwhile, BTCO and HODL remained unchanged in value. The operating funds stay stable despite reaching a point of decreased expansion.