Key Insights:

- Bitcoin Cycle Oscillator remains low, signalling no immediate overheating.

- 83.93% of Bitcoin holders are in profit at the current $94,900 price level.

- $100K target could trigger $3B+ in liquidations from overleveraged shorts.

Bitcoin’s 2025 rally continues as it trades near $95,000, with over 83% of holders in profit. Even with the strong performance, key market metrics are not indicating overheating. Also, the $100K level is critical as it could cause billions in liquidations and quick price movement.

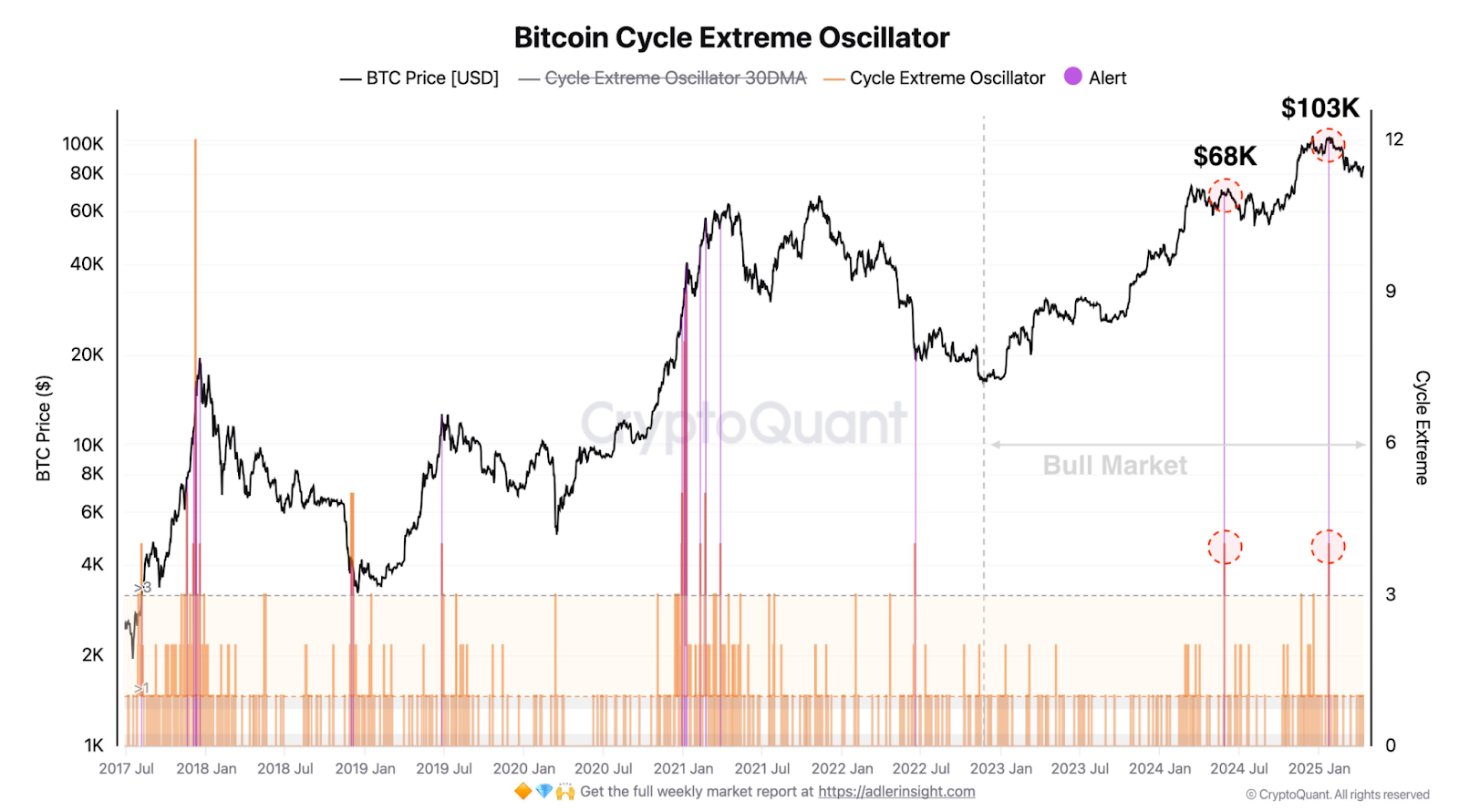

The Bitcoin Cycle Oscillator Suggests More Upside

The Bitcoin Cycle Extreme Oscillator is used to check if the market is overheating. Values above 3 in the past have indicated a possible correction. Of note, the oscillator climbed above 9 and 12 at the time of previous cycle peaks near $68,000 and $103,000.

This metric is still at a low level, well below the level that has historically triggered sell-offs. It implies that even though Bitcoin had a strong rally in 2025, the market is still not overheated.

It must flash a warning only when the oscillator rises sharply from its current level. Past trends don’t predict future results, but traders often take note when this metric is nearing 3 or higher.

The oscillator had previously hit alert zones in early 2021 and late 2024, which coincided with major tops. In mid-2025, there’s no such spike, which could indicate that there is still room for further movement before any overheating signal appears.

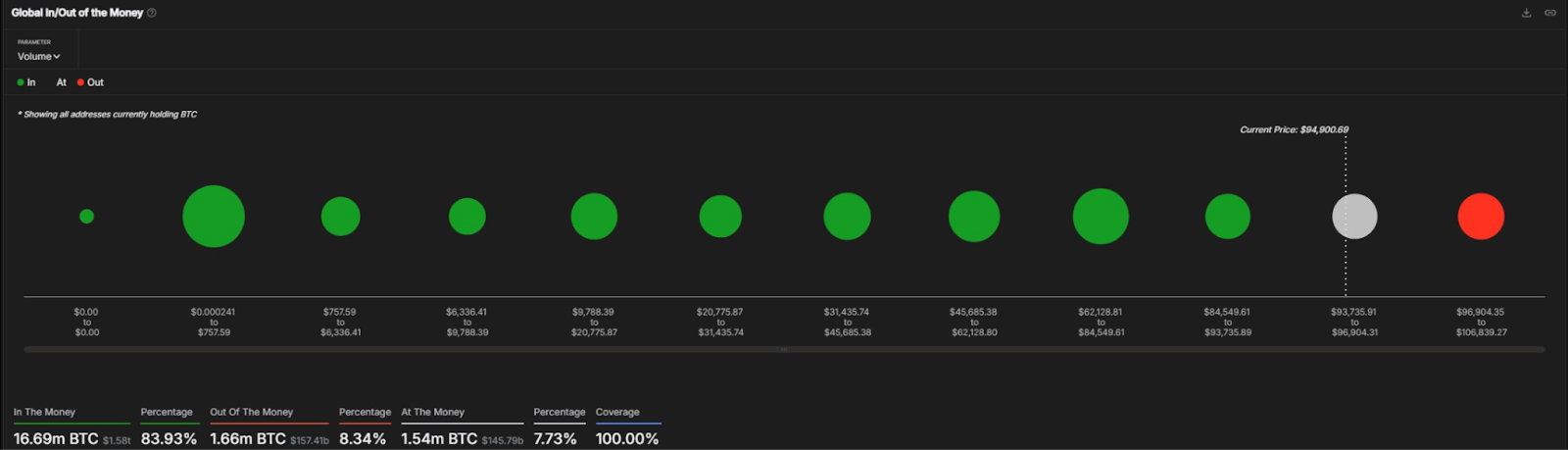

Over 83% of Bitcoin Holders Are in Profit

Meanwhile, Bitcoin is trading at about $94,530, with 83.93% of all tracked Bitcoin wallet addresses in profit at this price level. This comes out to around 16.69 million BTC held by profitable addresses and is valued at around $1.58 Trillion.

At the same time, 7.73% of the wallets (1.54 million BTC, or about $145.79 Billion) are at breakeven. Currently, only 8.34% of Bitcoin addresses with 1.66 million BTC worth around $157.41 Billion are at a loss.

This is a strong position for the market. With the vast majority of holders in profit, there is less of an immediate need for them to sell. Those addresses that purchased BTC between $84,549 and $93,735 are now comfortably in the money.

But there is a small segment between $96,904 and $106,839 that may have resistance, as these holders may sell when their position becomes positive.

Many long-term holders are well-positioned as the concentration of green zones is between $6,000 and $85,000. Even as the price nears new highs, this structure can provide stability.

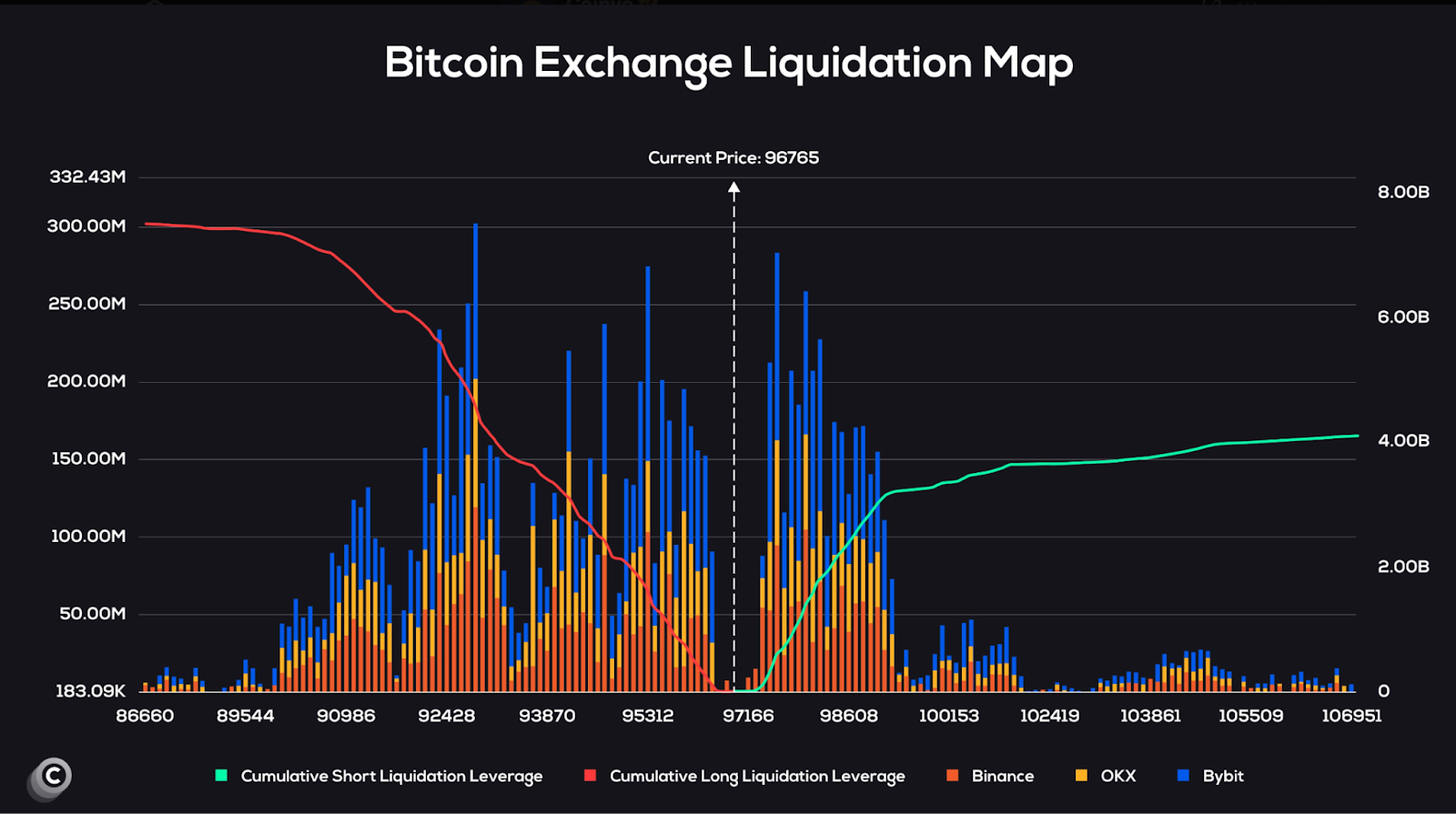

$100,000 May Trigger Over $3 Billion in Liquidations

Moreover, the Bitcoin Exchange Liquidation Map shows high concentrations of leverage just below and slightly above $100,000. As shown, the current price is $96,765. But if Bitcoin rises to $100,000, it could cause more than $3 Billion in liquidations.

Most of these liquidations are overleveraged short positions. Exchanges automatically close these positions when the price is near liquidation levels, and this can create a sharp price move. The price magnet of the liquidation zone can accelerate momentum in either direction.

At the moment, cumulative short liquidations are higher than long ones. Stacked short liquidations between $95,000 and $100,000 are shown on Binance, OKX, and Bybit. If price breaks this range, forced buying could take it up very fast.

Forced moves like this are common in volatile markets. Sudden jumps or drops are more likely when liquidation levels are concentrated in a narrow price range. At this setup near $100,000, there is a possibility of a sharp movement if the price pressure continues to increase.

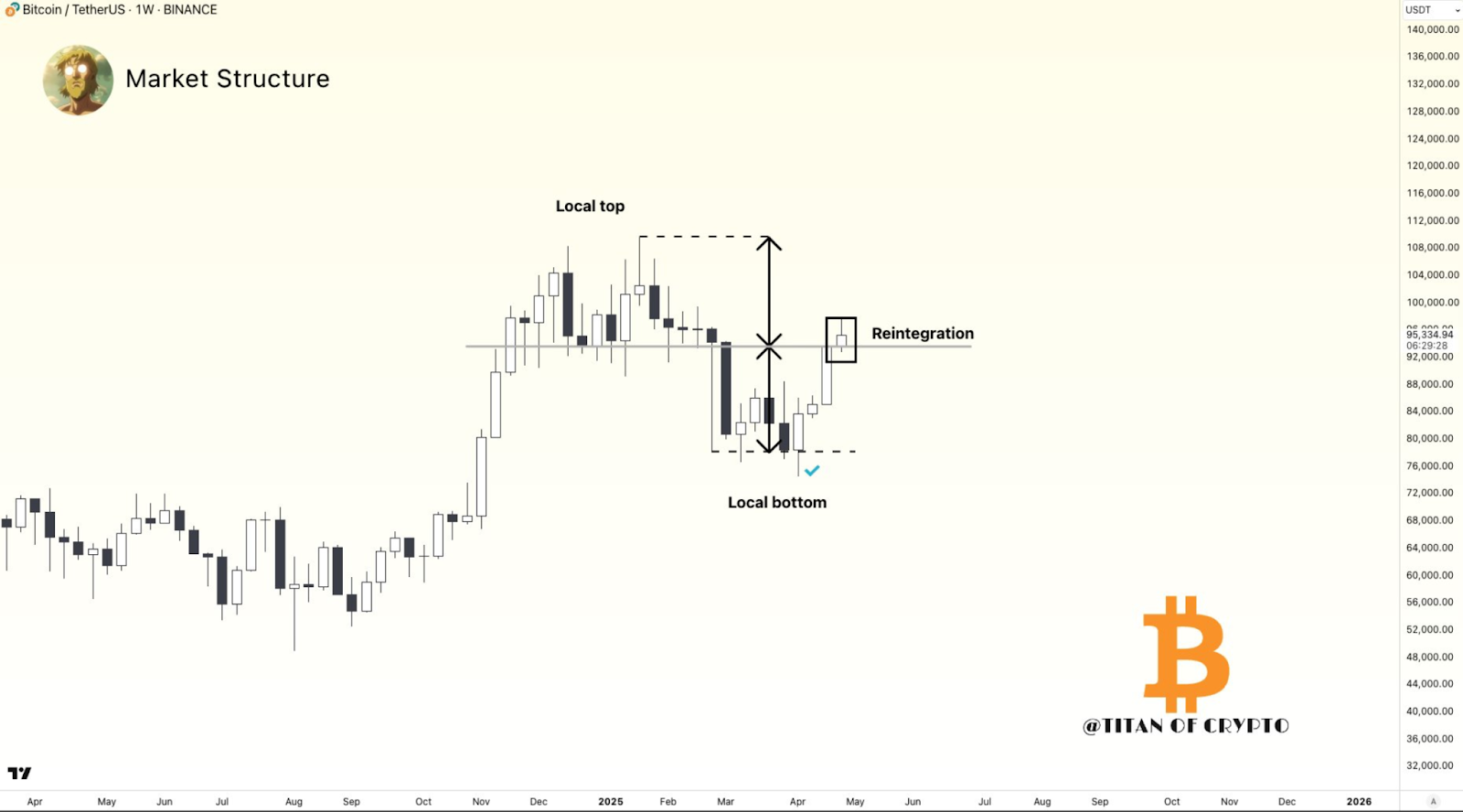

Market Structure Shows Bitcoin in Recovery Phase

On the other hand, Bitcoin is rebounding from a local bottom, according to a recent chart from Titan of Crypto. The structure is a local top followed by a sharp decline, bottoming near late March 2025. The price has been moving upwards again after finding support.

The reintegration phase is where price recovers lost levels. Often, this phase confirms if the market will continue its trend or if it will be rejected. Bitcoin is stabilising above the key level of $92,000 as of the latest candle.

The reintegration zone between $92,000 and $96,000 is critical. If Bitcoin can hold above this area, it will open the door for a move towards new highs. But if the price were to fall back below $90,000, the market could test lower support levels again.

This structure indicates the market is not overheated and may be set up for continuation. The price action doesn’t look like a blow off top, but rather a healthy recovery. This also aligns with oscillator data and liquidation levels, and for now, it appears to be a steady, upward trend.