Key Insights:

- VanEck has filed for the first-ever spot BNB ETF with the SEC, signaling increased interest in altcoin ETFs.

- The filing follows VanEck’s previous move to create an AVAX ETF, showing its broader focus on altcoin-based products.

- The BNB ETF application comes amid a surge of over 70 active altcoin ETF filings currently under SEC review.

VanEck has officially filed for a BNB ETF with the SEC, marking the first attempt at a spot ETF for Binance Coin. The filing reflects a growing push among asset managers to bring altcoin ETFs into the mainstream amid recent market optimism.

As interest in crypto ETFs grows, attention is now turning to whether BNB could benefit from this momentum.

VanEck’s BNB ETF Move Marks New Altcoin ETF Era

VanEck submitted the necessary documents for a BNB ETF after registering a statutory trust in Delaware a few weeks ago. The company continues to demonstrate stability in its altcoin market strategy by taking a similar action after establishing an AVAX ETF earlier. The BNB ETF filing arrives during a surge in similar applications, with over 70 altcoin ETF proposals now in progress.

The BNB ETF stands out due to BNB’s large market cap and established presence in the crypto ecosystem. BNB’s position seems unaffected by the uncertainty surrounding the approval since the broad exchange network continues to expand.

The application filing continues the forward momentum in the overall altcoin ETF movement, regardless of SEC guidelines.

Various market analysts predict the SEC will issue decisions about these ETF applications during October.

The BNB ETF is unlikely to be decided in the near term, but market participants are already reacting. The current regulatory climate shows better conditions than when exchanges delisted BNB.

BNB Gains Momentum After ETF Filing

The announcement of the BNB ETF coincided with renewed optimism across the crypto market and strategic appearances by industry leaders.

CZ of Binance, along with Jan Van Eck, took part in Token2049 but did not schedule panel participation or arrange direct interactions at the event.

Certain statements made during the conference suggested that Binance might collaborate with VanEck.

Despite Binance’s past legal issues in the U.S., the BNB ETF filing shows the firm’s renewed interest in American financial products. A few US-based platforms halted their BNB support operations during 2023 due to regulatory nuances.

Reestablishing BNB trading on Kraken alongside other platforms transforms public opinions about its authenticity.

This filing aligns with prevalent industry developments at the same time. The effective launch of Bitcoin ETFs enabled additional altcoin products to enter the market.

As the regulatory climate evolves, the BNB ETF could be among the first to benefit from this shift.

Minimal Buying Pressure Seen in BNB Price

BNB closed at $598.44 on May 5, gaining 2.12% on the day amid rising attention to the BNB ETF news. The token shows confined price movements since it has failed to achieve a substantial breakout from this cycle. Potential market transformation can occur from ETF filing timing as momentum builds in the marketplace.

The present technical market signals show a neutral market state. The Relative Strength Index (RSI) measures 50.48 percent, but the RSI-based moving average reaches 52.28 percent.

Market sentiment shows neutral trends because purchasing and selling power remain equal in the current market conditions.

The Moving Average Convergence Divergence indicator displays bearish characteristics because the MACD line rests at 0.50 while the signal line stands at 1.17.

A histogram reading of -0.67 indicates weak downward momentum, even though cross-moves might happen soon. This setup could lead to a bullish crossover if the BNB ETF news drives more activity.

According to the +0.07 reading of the Chaikin Money Flow indicator, BNB shows minimal buying pressure. A value above zero generally reflects capital inflows, and this small gain may become significant if the BNB ETF news accelerates demand.

The trend remains weak at present, but it might change swiftly due to decisive regulatory developments.

BNB Futures Show Prolonged Bearish Bias

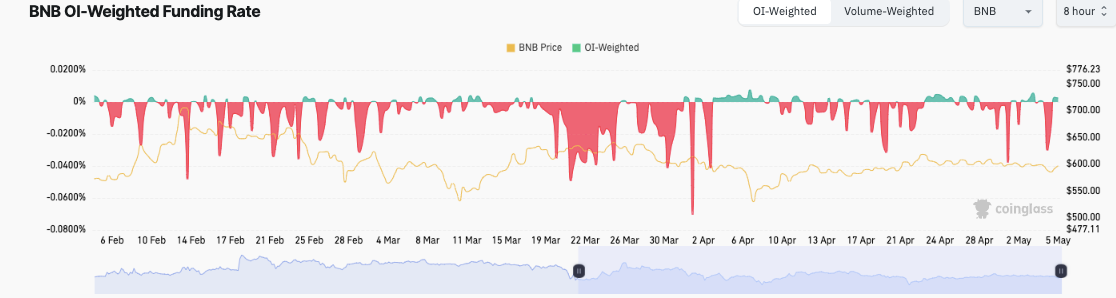

Coinglass data shows that funding rates for BNB perpetual futures have remained negative since March. Shorts pay the longs over time because of this funding rate pattern, demonstrating bearish market expectations from traders using leverage.

Market sentiment includes bearish and bullish opinions, according to the occasional funding rate positivity shown in the data.

The market indecision is evident in the stable pattern of Open Interest (OI) numbers. Participants are waiting for more substantial triggers, and the BNB ETF could be that catalyst. As news circulates, attention may return to whether BNB can break through its recent resistance.