Key Insights:

- Whales resumed ETH buys, with 1,700 ETH withdrawn from Binance in a fresh $3.1M move.

- ETH inflows to accumulation wallets hit record highs, signaling rising long-term confidence.

- Ethereum’s May 7 Pectra upgrade brings one-tap swaps, token gas fees, and biometric access.

Ethereum may be gearing up for a fresh rally as whales quietly return, and accumulation wallets hit record highs. At the same time, the May 7 Pectra upgrade is set to boost usability and mainstream appeal, possibly reigniting demand amid long-term price support and technical strength.

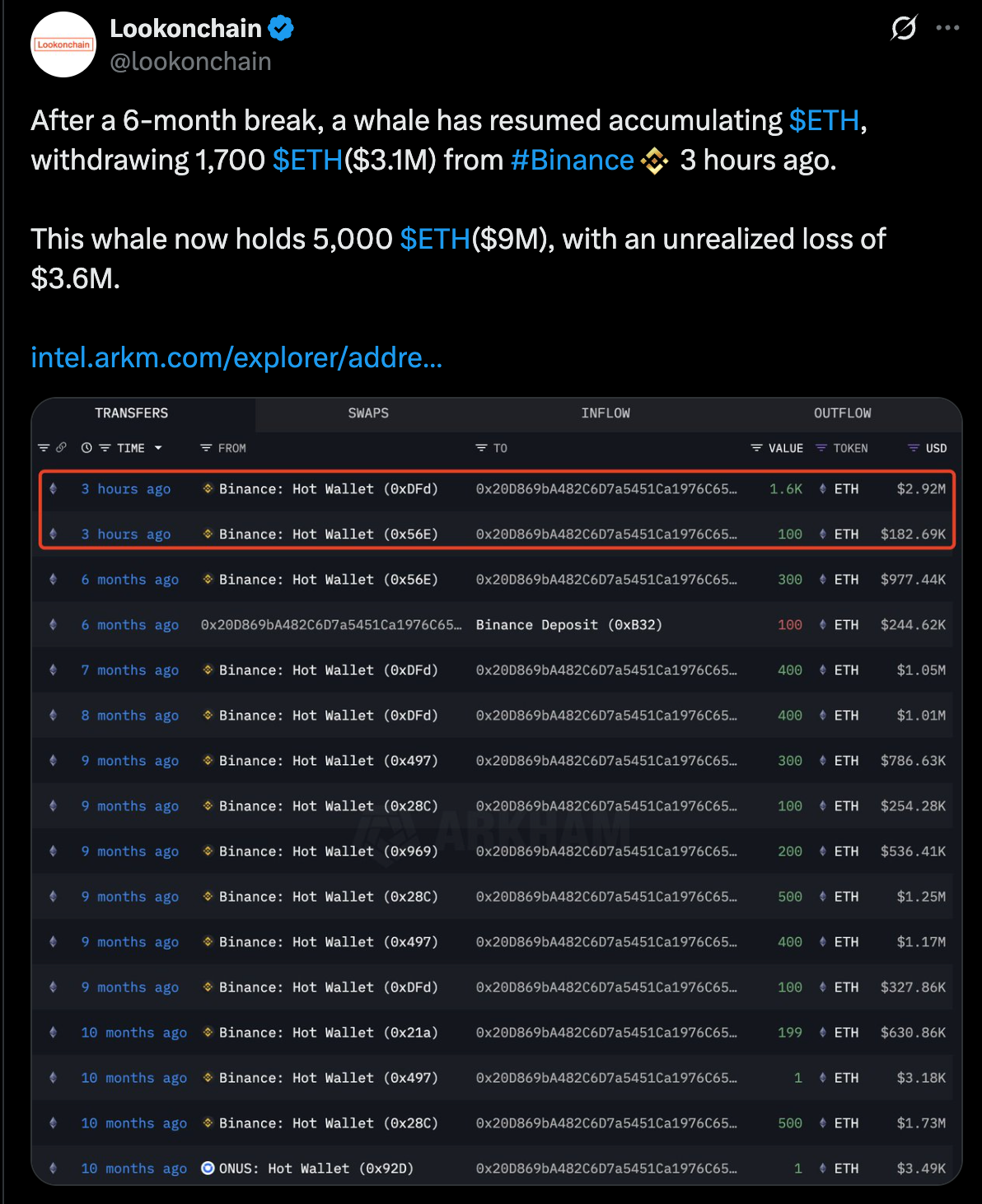

Whale Accumulation Returns After Six-Month Pause

Ethereum has seen renewed whale accumulation as one large holder resumed buying after a six-month break.

According to Lookonchain, this investor withdrew 1,700 ETH, worth $3.1 Million, from Binance just three hours ago. This move has pushed the whale’s total ETH holdings to 5,000 ETH, valued at around $9 Milion.

Although the wallet shows an unrealized loss of $3.6 Million, the new purchase suggests renewed confidence in Ethereum’s price. Most of this whale’s previous activity occurred nine to ten months ago, with multiple large ETH inflows from Binance hot wallets.

The return to accumulation may reflect changing expectations around price movement, especially as key upgrades and institutional interest grow.

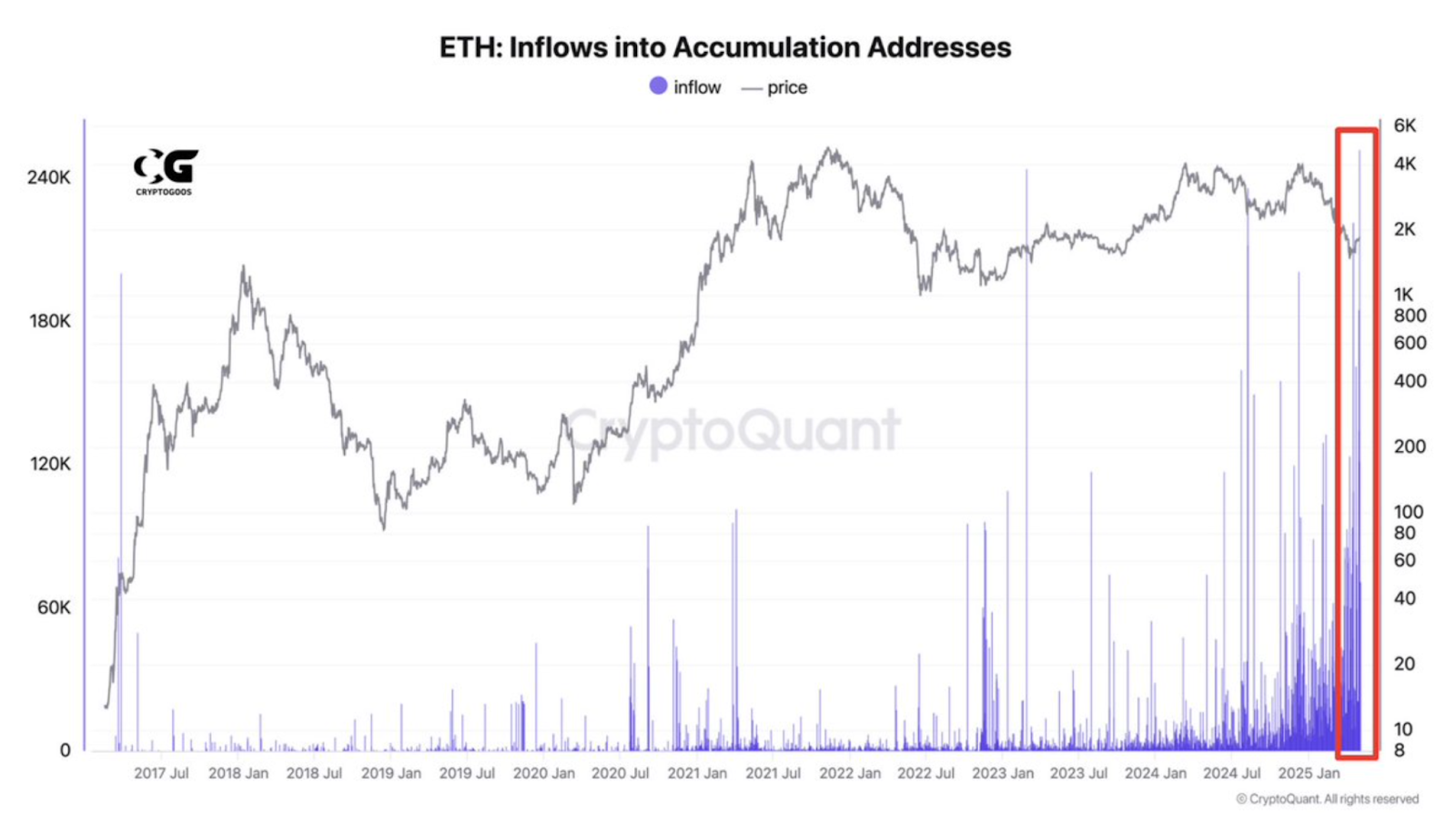

Inflows Into Accumulation Wallets Hit New Record

Supporting the whale activity is a sharp increase in ETH inflows into accumulation addresses. Data from CryptoQuant shows a surge in inflows to these addresses, reaching levels never seen before. The recent spike is visibly marked on the chart, showing a steep rise in the volume of ETH moved to long-term holding wallets.

This activity often signals that holders are moving coins off exchanges to hold for longer periods. These patterns are usually seen when investors expect a future price increase. The chart reveals that previous accumulation spikes often preceded major price recoveries or continued bullish trends.

While ETH’s price has remained under pressure in recent months, the consistent rise in inflows may show rising long-term interest despite near-term uncertainty.

New Ethereum Upgrade Set to Launch May 7

Ethereum is also preparing for a key upgrade called “Pectra,” which is scheduled to go live on May 7. This upgrade focuses on user experience and includes features such as one-transaction swaps, bundled actions like deposit and borrow, and dApp spending caps. It also introduces seedless wallet recovery, gas payments with tokens, and even biometric approval options.

These changes are expected to make Ethereum easier and safer to use. Developers and users have long pointed out that the current process of managing wallets and transactions can be complex.

By improving usability, Pectra could attract more mainstream users and developers. This may increase the use of ETH in decentralized applications and raise demand for the token.

Ethereum also remains the leading platform for tokenizing real-world assets (RWA). As stated in a recent post, “Ethereum continues to serve as the primary hub for RWA tokenization.” This is supported by the ecosystem’s maturity, strong developer base, and infrastructure reliability.

Large financial institutions and platforms are increasingly using Ethereum for tokenising assets like real estate, bonds, and equities. This keeps Ethereum at the center of blockchain adoption in traditional finance.

As more assets are brought on-chain, the demand for ETH as a base settlement asset could continue to rise.

ETH Price Sits in Historical Buy Zone

Technically, Ethereum has reached a level that some analysts refer to as a long-term buy zone. A log regression chart from TradingView shows ETH touching its lower trend band, which has historically acted as a key support. Similar touches in the past were followed by long rallies.

ETH is now priced near $1,800 and sits just above the lowest curved support line on the long-term chart. Previous market cycles show that when ETH taps this zone, it tends to reverse direction and start climbing.

Though past performance doesn’t guarantee future results, the alignment of technical support with increasing accumulation and upcoming upgrades provides context for renewed whale interest.