Highlights:

- DOGE nears $0.176 liquidation zone with $6B in short positions at risk.

- Falling wedge formation hints at a potential 3x breakout move.

- MACD crossover and trendline break show bullish momentum returning.

Dogecoin is approaching a key price level at $0.176, which could result in a breakout and large-scale short liquidations. Additionally, technical indicators like a MACD bullish crossover and a falling wedge pattern indicate the market is starting to rise.

DOGE Targets $0.176 Amid Rising Liquidation Risk

Dogecoin (DOGE) is back in the spotlight again, as price action is grouped around a key technical level. Traders are now watching $0.176, based on recent market data, where a breakout could trigger millions in liquidations. Short positions built up below this level are now vulnerable with leverage.

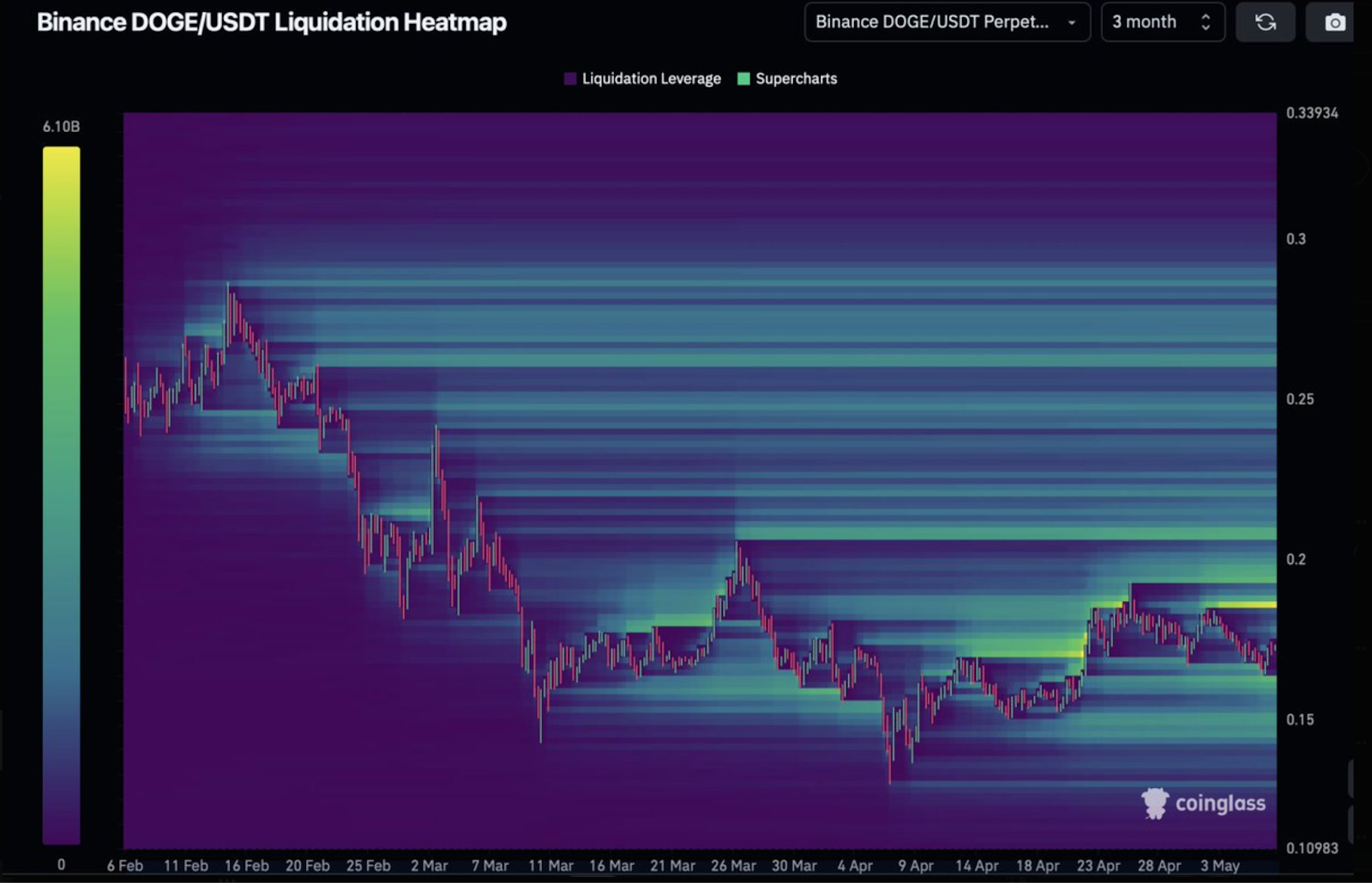

Looking at the Coinglass DOGE/USDT liquidation heatmap, it is clear that there are intensity zones around $0.176. This level has been resisted multiple times in April and early May.

With volume building and price continually testing this zone, a clean breakout above it could cause short sellers to close out quickly, exerting upward pressure.

The broader trend formation strengthens the bullish argument, as the liquidation data points to a possible breakout.

Falling Wedge Breakout Structure Mirrors Previous Bull Runs

Additionally, a multi-month falling wedge pattern on DOGE’s chart is one of the clearest signals. This has been a pattern that has preceded large upside moves. In fact, a previous wedge breakout resulted in a 3x spike in the DOGE/Total pair.

Price is now nudging against the wedge’s resistance line, and the setup is similar to what preceded DOGE’s 300% rally.

The falling wedge is a bullish pattern where price compresses over time. It can trigger rapid moves when broken to the upside. At the moment, DOGE was testing the upper trendline and is starting to break above near-term resistance, increasing the likelihood of a breakout.

Additionally, this structural signal is consistent with other shorter-term indicators that are also beginning to move.

MACD Crossover and Trendline Break Confirm Momentum Shift

Furthermore, Dogecoin has broken above a descending trendline that had capped price since early May when zooming in to the 4-hour timeframe. The MACD (Moving Average Convergence Divergence) indicator is also showing a bullish crossover at this break.

After several days of declining price and shrinking volume, MACD crossover often indicates exhaustion in selling pressure. With MACD lines flipping up, momentum is on the side of buyers.

Traders using Heikin Ashi candles, which are known for filtering out noise, are also seeing consecutive green candles, which means continued buying. This bullish technical alignment could have a cascade effect in liquidations as the $0.176 zone approaches.

On-Chain Metrics Show Weakness in Supply and Cautious Accumulation

While there is technical optimism, on-chain data shows mixed sentiment. Netflows for DOGE have been mostly negative since early March, according to CoinGlass. This is a bullish signal, as it means more DOGE is leaving exchanges than coming in, but the scale of withdrawals has been decreasing over time.

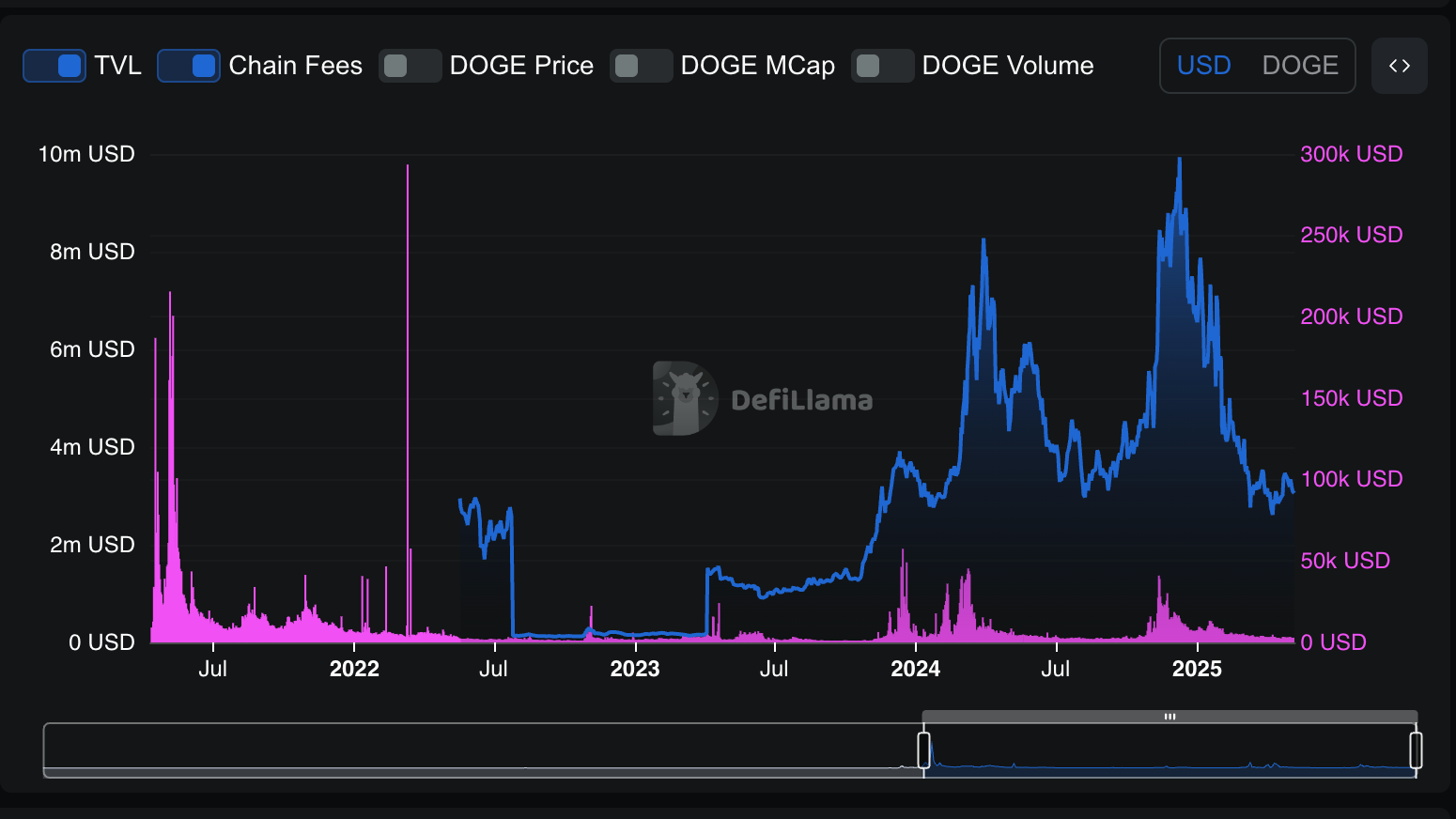

According to data from DeFiLlama, the total value locked (TVL) in Dogecoin-based decentralized apps remains low, under $3.5 Million. Chain fees and activity have also fallen since the beginning of 2025, indicating lower utility use than in previous spikes.

The price, however, has stayed steady above $0.15 for a few weeks now, even as broader utility lags.

Why $0.176 is Important in the Short Term

$0.176 is now a psychological and technical level with multiple signals aligning. The liquidation heatmap shows over $6 billion in leveraged positions around this zone. If DOGE breaks this line decisively, those positions will unwind quickly.

It could also reset short-term price expectations and put DOGE back in the spotlight.

Momentum indicators, structural signals such as the wedge, and liquidation setups all point to DOGE being ready to make a directional move, and that move could begin at $0.176.