Key Insights:

- Bitcoin (BTC) supply in loss drops below 2%, signalling near-universal profitability.

- $1.45B in leveraged long positions could be wiped out near $102,700.

- Sentiment hits six-month high, echoing patterns before past market peaks.

At press time, BTC was trading around $104,000 as almost all holders are in profit. But below $102.7K, there are $1.45 Billion in long positions at risk.

Sentiment is at a peak since late 2024, and price patterns have indicated previous declines following steep rises. Should traders be on the lookout for signs of a correction?

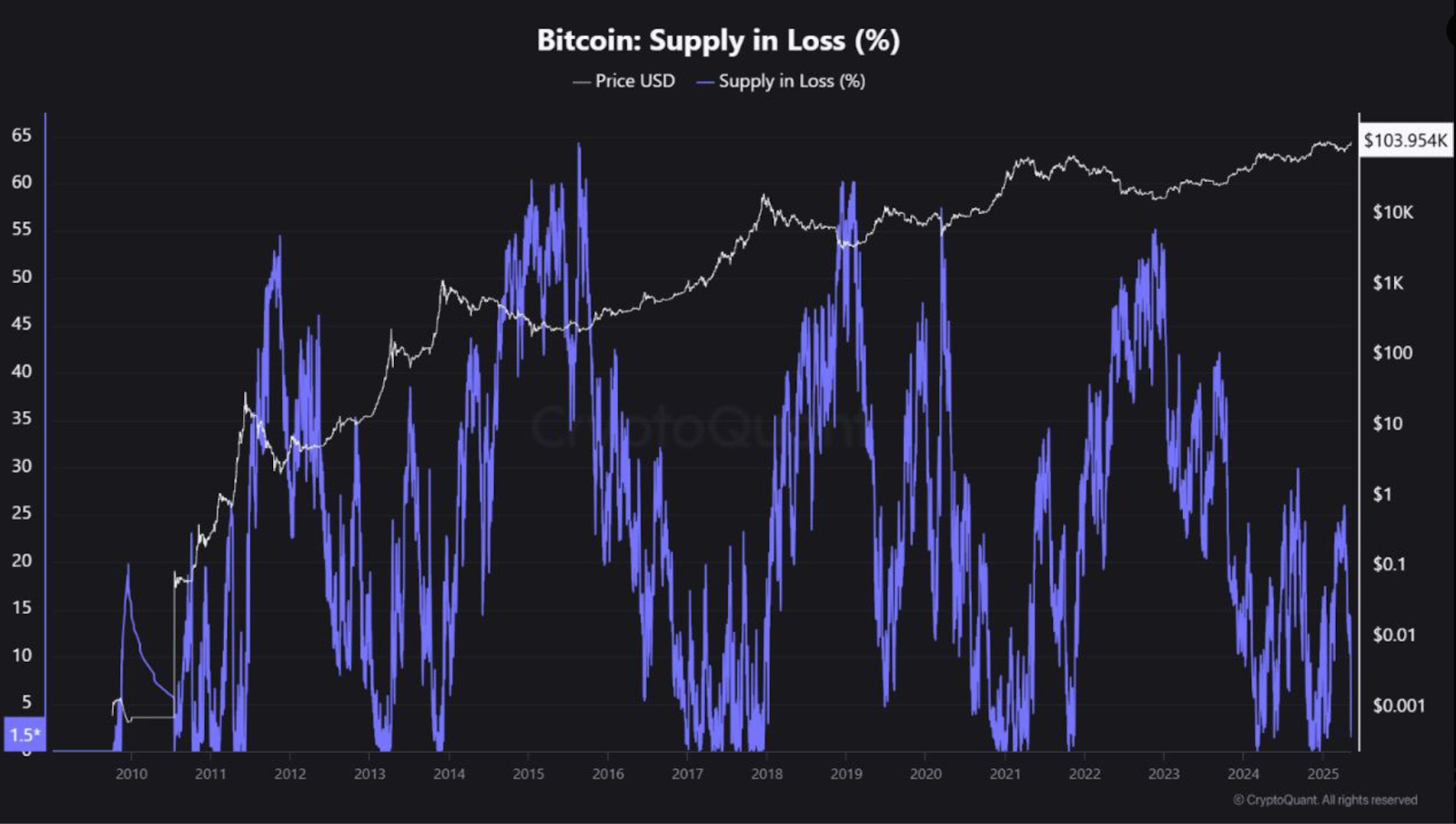

BTC Supply in Loss Hits Historic Low

The percentage of BTC supply in the red has fallen below 2%, one of the lowest amounts ever seen. According to the CryptoQuant chart, almost all Bitcoin holders are in profit. In the past, such a situation has tended to arise close to major market peaks.

When Bitcoin becomes so profitable as this, it can be a sign of investor overconfidence. Previous cycles reveal that price pullbacks occur when less than 5% of holders are in the red.

For example, the same levels were observed at the 2021 and 2017 peaks, which were followed by sharp corrections. The current BTC price is over $104,100, a good rally from previous months.

However, as profits increase, selling pressure may return. Investors may begin to take profit, especially those who have held through lower price ranges.

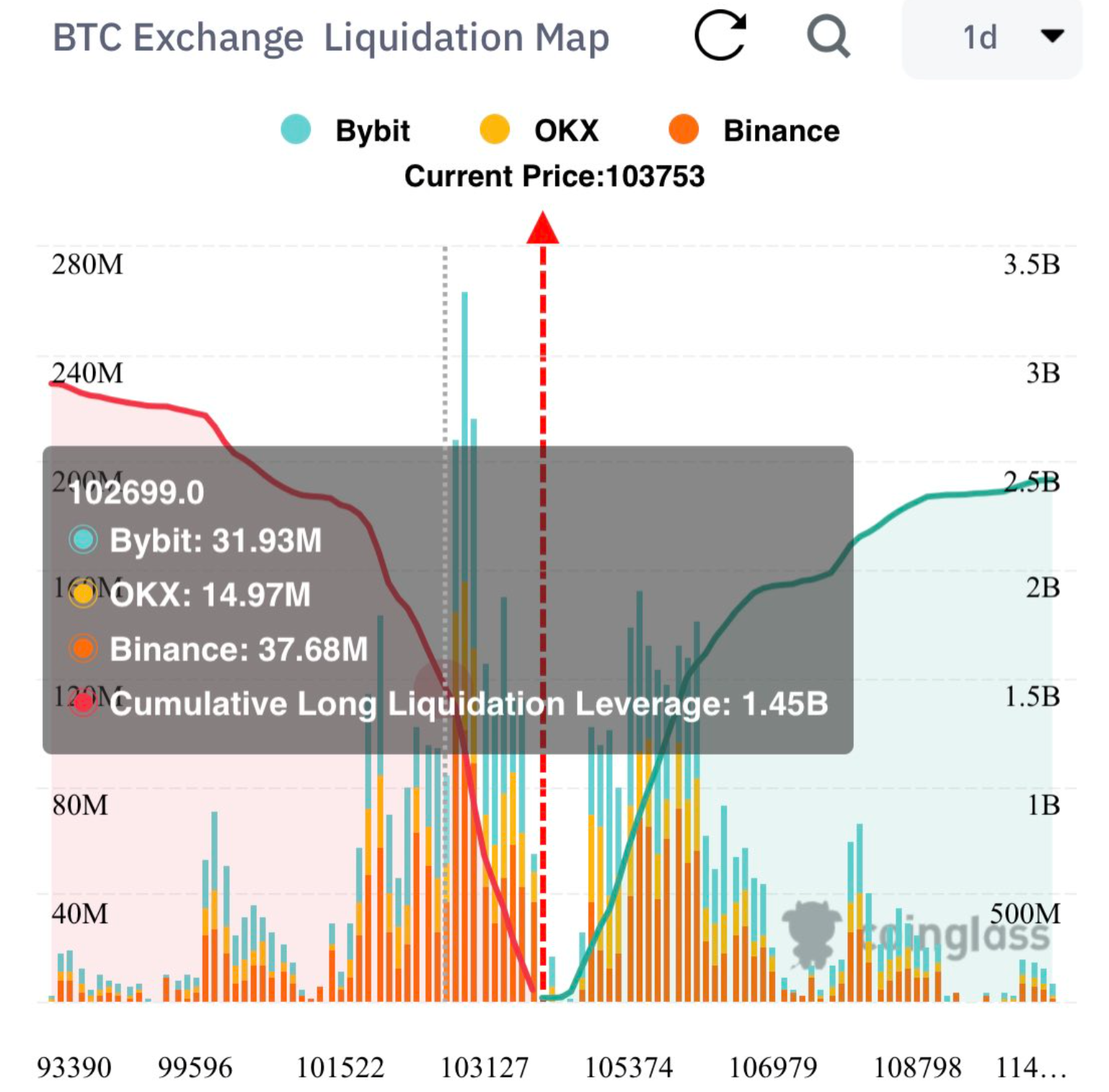

$1.45 Billion in Longs Could Be Liquidated Near $102.7K

If BTC drops to $102,700, long positions worth $1.45 billion could face liquidation. This risk is based on data from Coinglass.

These leveraged positions are clustered on leading exchanges: Binance ($37.68M), Bybit ($31.93M), and OKX ($14.97M).

The liquidation map shows high risk right below current price levels. With BTC traded above $104,000, a decline of less than 1% can initiate massive liquidations. This configuration demonstrates how sensitive the market is at the moment.

Trading traders in a hurry can incur losses by using leverage. This can lead to a cascading effect as positions are automatically closed. That would add selling pressure and may drive prices down quickly.

The map shows high trading volume between $101,500 and $103,100. This suggests that this price range is crucial for immediate support.

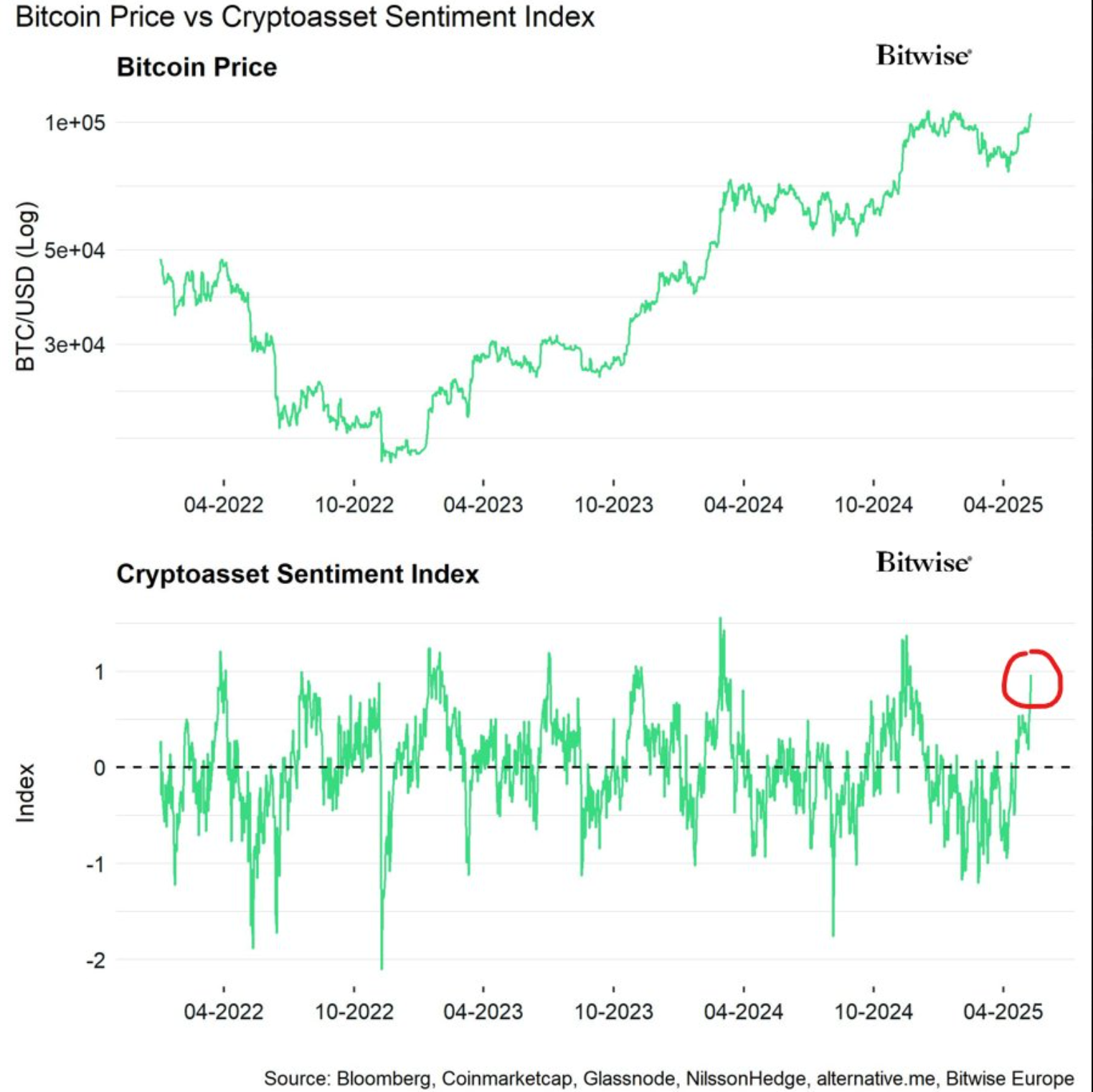

Sentiment Index Reaches Six-Month High

According to the Bitwise Cryptoasset Sentiment Index, investor mood is at levels last seen in late 2024. Per the chart, the sentiment index has just risen above 1, which means very bullish sentiment.

Since early 2023, BTC has seen a strong price surge. At the start of that rally, it was trading below $30,000.

Sentiment is most of the time a laggard. When the investors get over-optimistic, market tops are not far off. The sentiment level is in early November 2024, on the eve of a price dip. Overconfidence can increase the risk, particularly if traders disregard the downside threats.

Simultaneously, the price has been on an upward trend since April 2023. It’s now almost $104,000 with a few consolidation periods in between. These pullbacks have been minor and brief thus far, but the increase in sentiment could indicate that the rally is getting overextended.

Pullback May Be Near According to Recent BTC Price Action

According to the recent chart from TradingView, BTC has gained almost 42% from the $74,000 level. This rally has been consistent with occasional 4% corrections along the way. These small drops were experienced in April and early May, followed by renewed buying pressure.

Trackers of these patterns are indicating that another pullback may be developing. The chart contains downward arrows indicating similar 4% declines following powerful upward trends. If the trend persists, BTC may correct to about $99,600 or even less.

Even a little drop would have a significant impact on altcoins. More often than not, a 4-5% drop in Bitcoin has been followed by 10-15% corrections in other crypto assets. This correlation means current levels are dangerous for leveraged traders and altcoin investors.

The market could be overextended with the high level of long positions and the low supply of losses. And if prices fall below $102,700, the $1.45 Billion in long liquidations may accelerate a fall. That risk becomes even more apparent when sentiment is too bullish.