Key Insights:

- HBAR price prediction on the weekly time frame appears bullish and could soon hit the $0.33 mark in the coming days.

- A crypto expert suggests that HBAR could reach $0.50 and even $1 if it maintains the $0.13 support level.

- Exchanges have witnessed an outflow of a significant $18.50 million worth of HBAR tokens, indicating potential accumulation.

Hedera’s native token is retesting after posting notable gains over the past month. On the daily chart, it continues to form a higher high and higher low pattern, with the current price sitting at a higher low, indicating a potential continuation of its bullish momentum.

Current Price Momentum

At press time, HBAR was trading near $0.19 and had recorded a modest price surge of over 0.15% in the past 24 hours.

The ongoing volatility in the crypto market has caused traders and investors to hesitate in participating in the asset, leading to a 7.5% drop in trading volume during the same period.

Hedera (HBAR) Price Action and Technical Analysis

According to expert technical analysis, HBAR’s price prediction appears bullish and is on the verge of continuing its upward momentum in the coming days. On the daily time frame, the asset is moving in a higher high and higher low pattern. With the recent price correction, the current price has reached the higher low level, indicating a potential upside rally in the coming days.

The current level plays an important role in the upcoming move, as the asset is receiving support from the 200 Exponential Moving Average (EMA) on the daily time frame. However, if market sentiment shifts and the price falls, not only could the 200 EMA be breached, but the bullish continuation pattern may also fail, potentially leading to downside momentum.

HBAR Price Prediction

Based on recent price action and historical patterns, if market sentiment remains unchanged and the asset holds above the 200 EMA, the HBAR price prediction suggests that the asset could see a price surge of over 25% until it reaches the next resistance level at $0.25.

On the other hand, the HBAR price prediction could turn bearish if it fails to hold the 200 EMA and closes a daily candle below it. If this happens, there is a strong possibility of downside momentum of over 25% until it reaches the $0.138 level in the future.

As of writing, HBAR’s Relative Strength Index (RSI) stands at 50, indicating a neutral market stance with no clear bullish or bearish momentum. In this case, traders are either waiting for a shift in sentiment or for whale interest to move in either direction.

Expert Eyes $0.5 — $1 for HBAR

Looking at the daily and weekly charts, a well-known crypto expert shared a post on X (formerly Twitter) stating that a massive rally is loading for HBAR. In the post, the expert noted, “Price is holding the critical support at $0.130 — a confirmed base here could trigger a major upside move toward $0.50–$1.”

This shows a bullish sign for HBAR holders, as it has been gaining attention from experts.

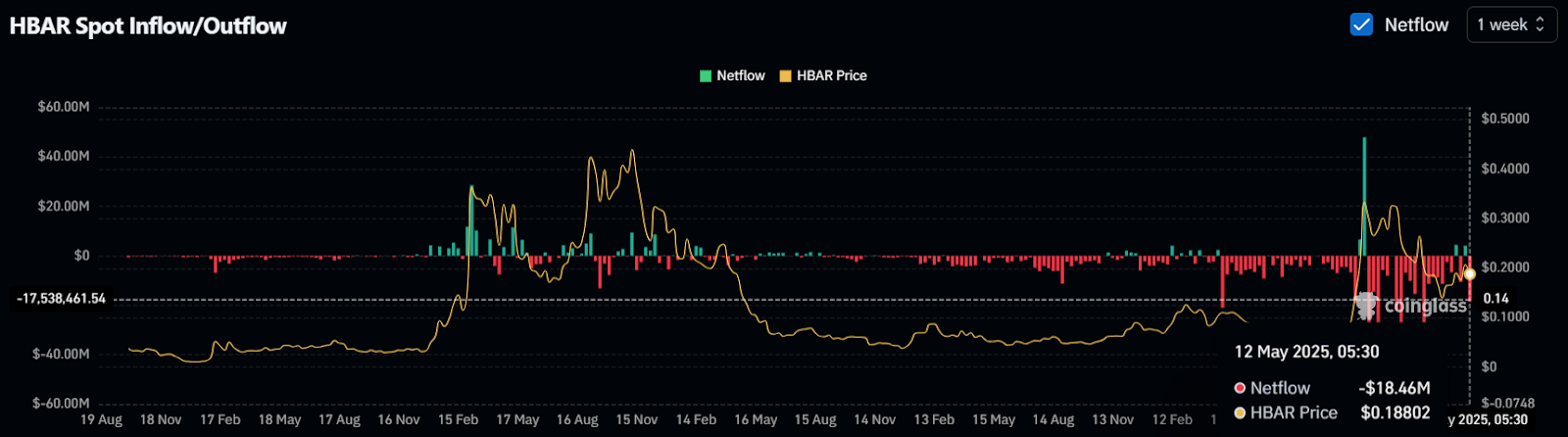

$18.45 Million Worth of HBAR Outflow

In addition to this, whales and long-term holders have been accumulating the tokens, as reported by the on-chain analytics firm Coinglass. They have seized the recent correction as a buy-the-dip opportunity.

Data from spot inflow/outflow reveals that exchanges across the globe have recorded an outflow of a significant $18.46 million worth of HBAR tokens over the past seven days.

This substantial outflow during the market correction indicates potential accumulation by investors and long-term holders, which could cause buying pressure and reduce further downside momentum.