Key Insights:

- Bitcoin ETFs see inflows drop 90%, cooling from $2.72B in April to just $277M recently.

- Miners offload over 2,400 BTC worth $252M, with reserves falling to 1.8092 million BTC.

- Bitcoin RSI crosses 70, signaling overbought conditions and risk of a short-term pullback.

Data from CoinGecko shows that Bitcoin (BTC) is trading around $105,000 after a turbulent 24 hours during which it gained about 0.8%. The price has risen by around 2.4% over the past week and close to 23% over the past month. Bitcoin is up nearly 59% on a yearly basis.

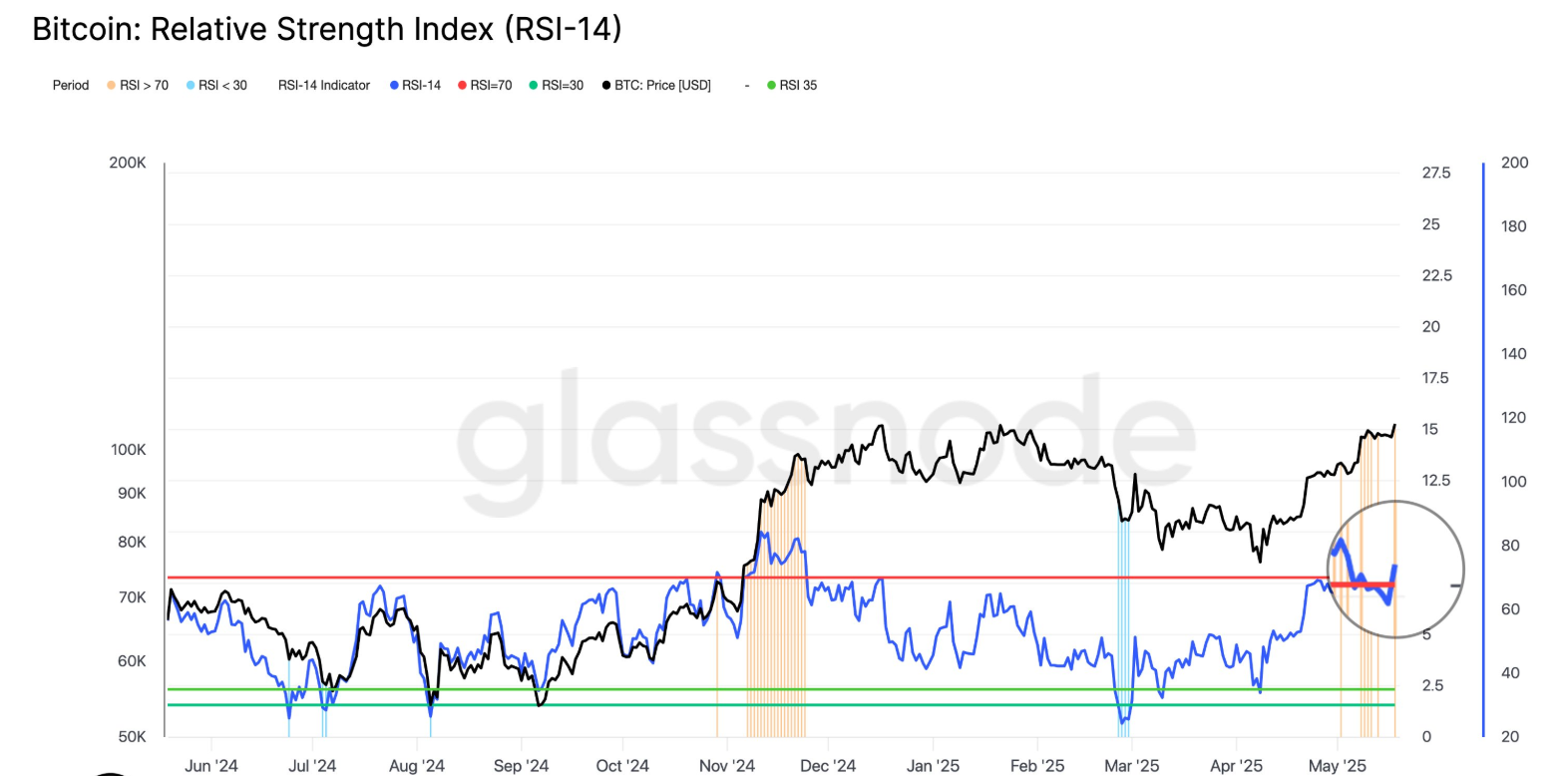

The cryptocurrency market is sending mixed signals despite the steady price recovery. On the daily chart, Bitcoin’s relative strength index (RSI), a momentum indicator, is now overbought. According to this reading, Bitcoin could be in for a pullback as short-term buyers take profit.

Meanwhile, there is caution in market activity in Bitcoin exchange-traded funds (ETFs) and among miners. There are several metrics that indicate cooling momentum and near-term headwinds.

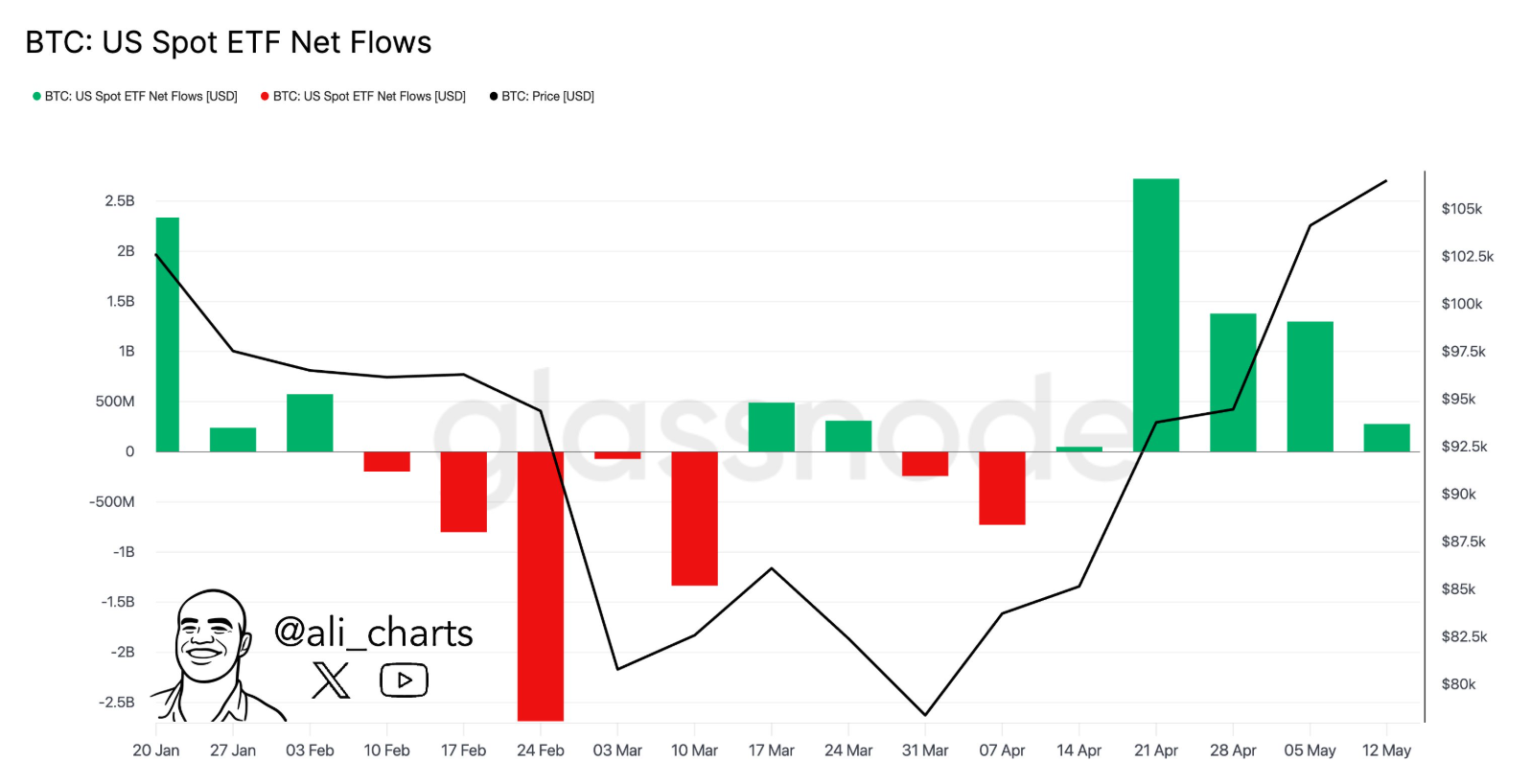

ETF Flows Decline After April Surge

Net inflows into US spot Bitcoin ETFs have slowed sharply. While weekly ETF inflows hit $2.72 billion in late April, the latest data available shows inflows of around $277 million. This is almost a 90% reduction in net investment into Bitcoin related ETFs.

The lack of interest in ETFs could be due to market participants taking profits or moving capital to other sectors. Large inflows in the early part of 2024 helped BTC to break above $100K. The recent decline may be a pause in institutional buying or a more cautious stance by large investors.

It has been evident that ETF flows are correlated with the movement of the Bitcoin price. BTC’s price shot up during the period of strong inflows in April. However, the price gains started to plateau as the inflows slowed in May, indicating that the rally may be losing strength unless new capital comes in.

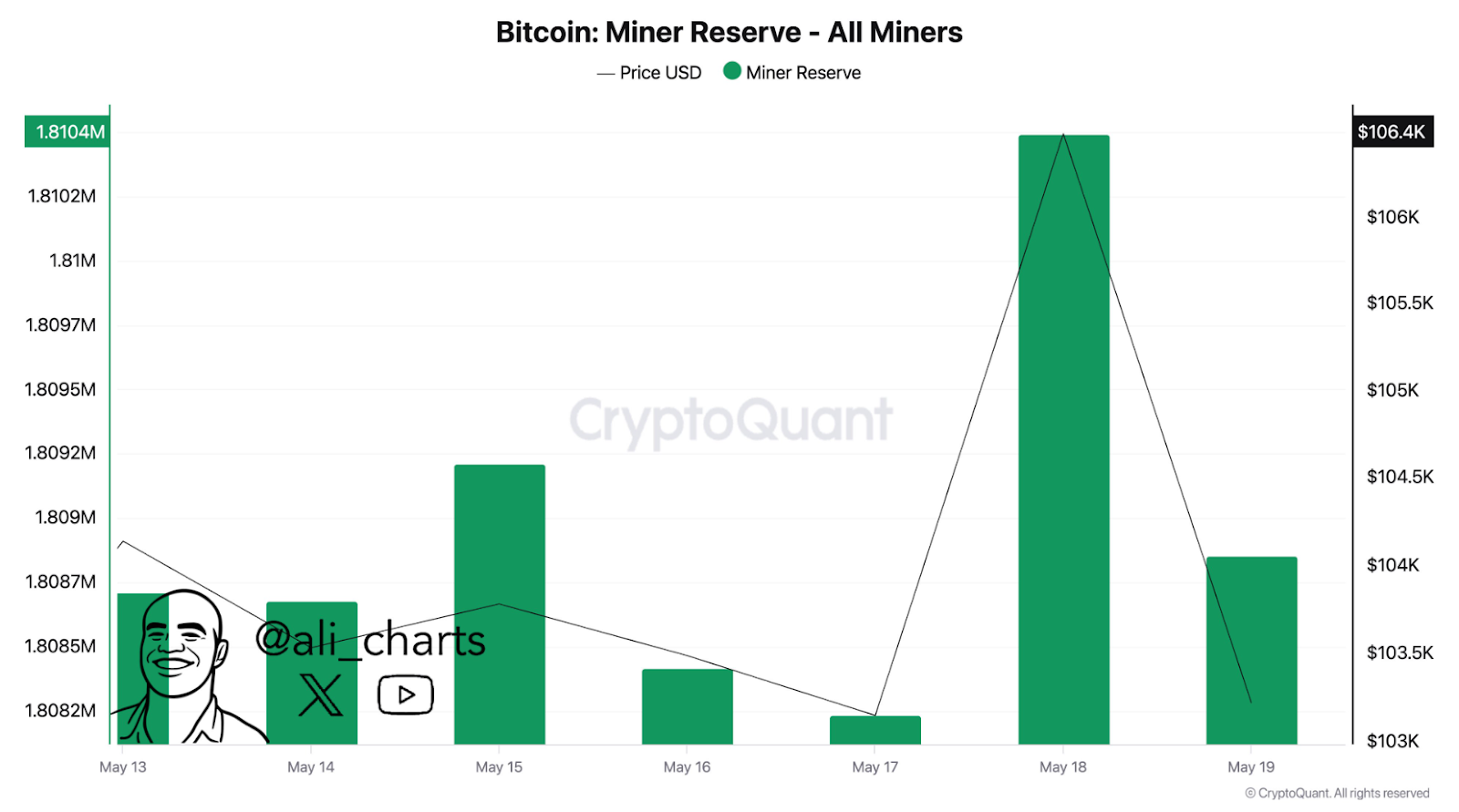

Miners Sell Over 2,400 BTC as Reserves Fall

Bitcoin miners sold over 2,400 BTC in the past 24 hours, worth over $252 million in market value. The rise in BTC prices often leads to miners realizing profits, and this spike in selling coincides with that.

CryptoQuant reported that the miner reserve, which tracks the total BTC held by mining firms, plunged drastically between May 17 and May 18. The number dropped from 1.8104 million BTC to 1.8092 million BTC before recovering slightly. This type of movement indicates miners are selling coins and moving them to exchanges.

Selling Bitcoin in large scale by miners can put downward pressure on its price. In the event of a sharp decline in reserves, it could mean that miners are anticipating lower prices in the future or are taking advantage of recent gains.

BTC RSI Signals Overbought Conditions

According to technical data, Bitcoin’s RSI has broken above the 70 level, indicating that the asset has become overbought. Traders expect a cooling off period or a short term correction when this happens.

BTC’s RSI-14 has been elevated for a few sessions as per Glassnode charts. Additionally, the RSI has been rising in tandem with the price trend over the past two weeks.

While, RSI values will often correct or consolidate sideways when they remain high without new inflows or trading volume support.

Similarly, the RSI readings are in line with the current cooling of ETF flows and miner selling. This means that unless new buyers enter the market, BTC could face resistance above $105K.

Bitcoin Dominance Chart Suggests Possible Drop Ahead

Separately, CryptoCove also shows Bitcoin’s dominance in the total crypto market is in a bearish wedge pattern. It appears that a potential ABC corrective wave is forming, which could lead to a drop in BTC market dominance from the current 63.92%.

The b wave of the pattern is nearing completion and if it is a typical Elliott Wave correction, the c wave may dominate lower towards the 60% level. If traders rotate funds out of Bitcoin and into other crypto assets, this could be good for altcoins.

If inflows wane and selling activity picks up, BTC price movements may become more volatile as dominance falls. This also applies to the broader market, where traders seek higher returns on smaller cap assets when Bitcoin’s momentum stalls.