Key Insights:

- SOL breaks above $171 with a target of $180 after forming an ascending triangle pattern.

- Two whale transfers move over 1.38M SOL ($235M+) between unknown wallets within 24 hours.

- Solana leads in daily active users and gains new institutional support through Apollo’s ACRED fund.

Solana is gaining strength as it breaks through a key technical level, with major wallet transfers and greater network activity helping the move. The token broke through $171.87, and analysts believe it could reach $180 soon. Indicators, transaction data, and the growth of the ecosystem show more people are engaging in the market.

SOL Breaks Out of Triangle With Eyes on $180

According to the chart posted by Ali_charts, Solana has moved above an ascending triangle on the 15-minute chart. The breakout puts SOL at $171.87, and possible Fibonacci targets are up to $181.65. Resistance points are found at $175.06, $176.86 and $179.47.

Such a technical structure usually appears during periods of consolidation and can point to a further rise in price when it is broken above.

After SOL retested $167 and began to rise, it climbed past Fibonacci retracement points at $169.05 and $170.98.

Although the price briefly dropped from its top, SOL remains above the level it previously struggled to break. If the price remains above the triangle, a revisit to $172 may show strength and could lead to a move toward $180.

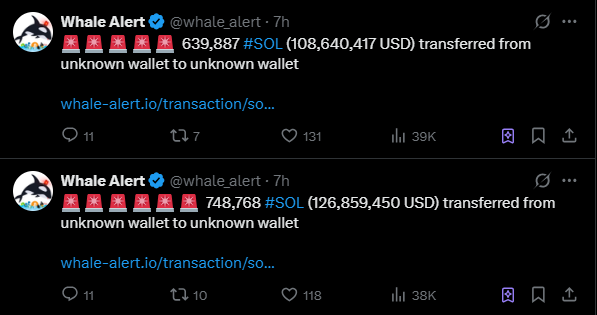

Whale Transfers Exceed $235 Million in 24 Hours

It is also clear from on-chain data that large sums of capital are moving more frequently. The last day saw two major transactions tracked by Whale Alert.

In the first transaction, 748,768 SOL, equaling $126.86 million, was sent and in the second, 639,887 SOL, valued at $108.64 million, was moved.

Both transactions were made from wallets with no known identity and sent to wallets with no known identity, which is usually a sign of wallet reorganization, OTC deals or moving funds within the same organisation.

If there are no exchanges involved in transferring huge amounts, it may mean the holders are not rushing to sell.

Overall, the two transfers added up to more than 1.38 million SOL, which is worth more than $235 million. Even though no inflow was seen, the movement indicates that large capital is still being placed in the network.

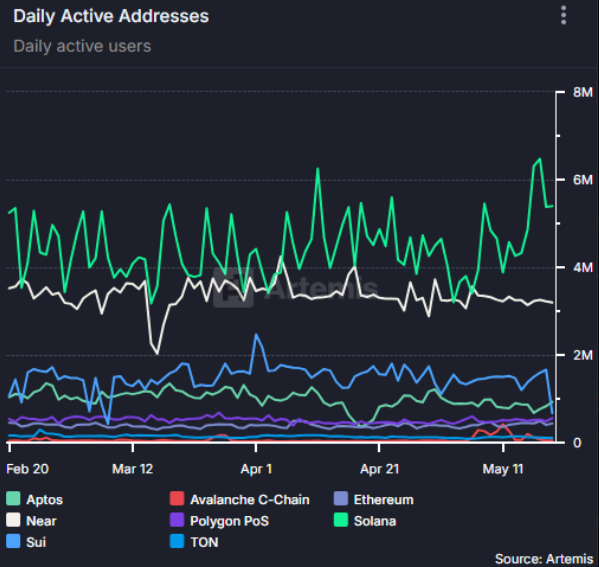

Solana Tops Network Activity With Over 5.4 Million Daily Users

Additionally, the amount of network activity has risen significantly. Artemis reports that Solana has the most daily active users among all Layer 1 blockchains.

In mid-May, Solana’s daily active addresses surpassed 5.4 million, which is more than 1.7 times the number on Near, which stood at 3.2 million.

Unlike Ethereum, Sui, TON, Aptos and Polygon PoS are all used by less than 1 million daily users. The increase in users is a sign that DeFi and on-chain trading applications on Solana are highly sought after.

A rise in users is often caused by both cheaper fees and speedier transactions. The efficient way Solana handles activities continues to draw both developers and users, helping maintain regular engagement among users.

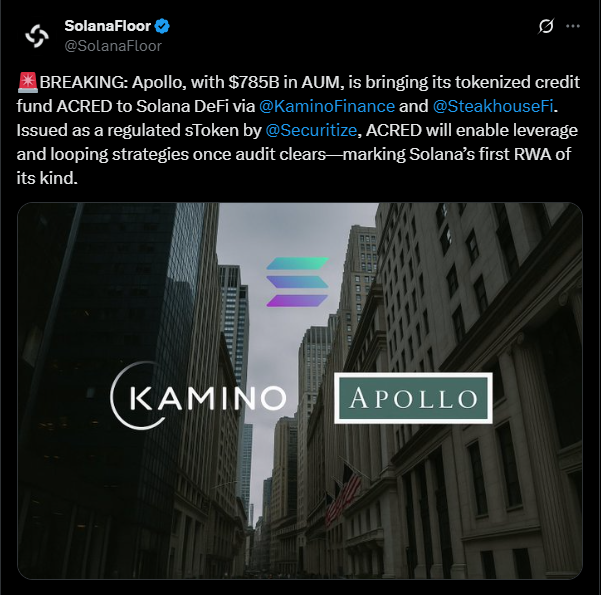

Institutional Credit and Private Trading Volume Expand Solana’s DeFi Reach

More institutions are now participating. With $785 billion in assets, Apollo Global Management is introducing its tokenised credit fund ACRED on Solana. The fund will be managed through Kamino Finance and SteakhouseFi, with Securitize issuing a regulated sToken for it.

After audits are done, ACRED will help with leveraging and looping strategies. This is the first time Solana has integrated a real-world asset (RWA) like this. Having credit systems built into blockchain can help advanced DeFi users use their capital more efficiently.

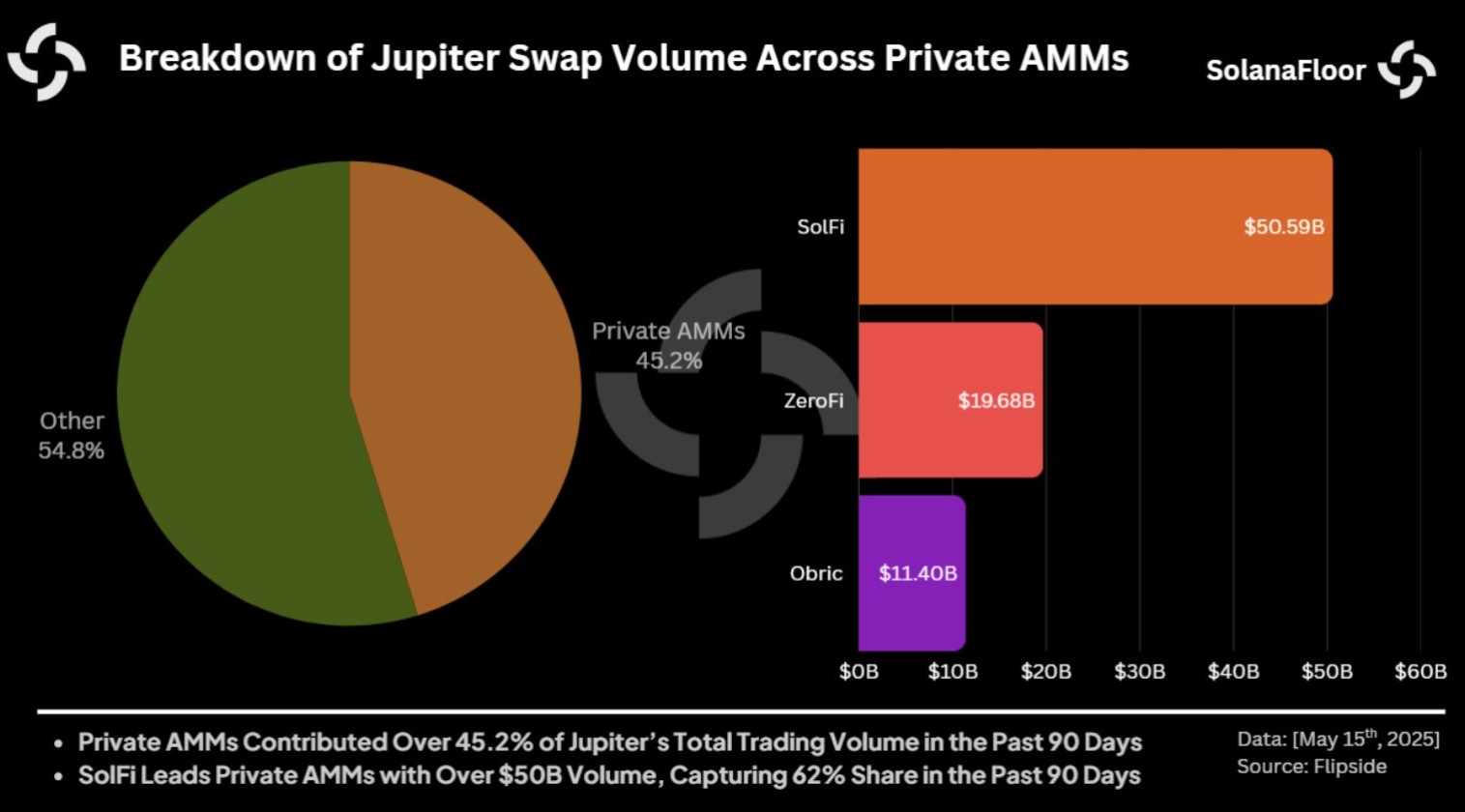

At the same time, the amount of private liquidity is increasing. Private automated market makers (AMMs) accounted for 45.2% of the total trading volume on Jupiter Exchange in the past 90 days, according to a report from SolanaFloor.

SolFi processed over $50.5 billion, making up 62% of the private AMM area. ZeroFi added $19.68 billion and Obric brought $11.40 billion to the market.

The data indicates that most Solana DEX trading is handled by private liquidity protocols which adds more depth to trading for institutional and private investors.