Key Insights

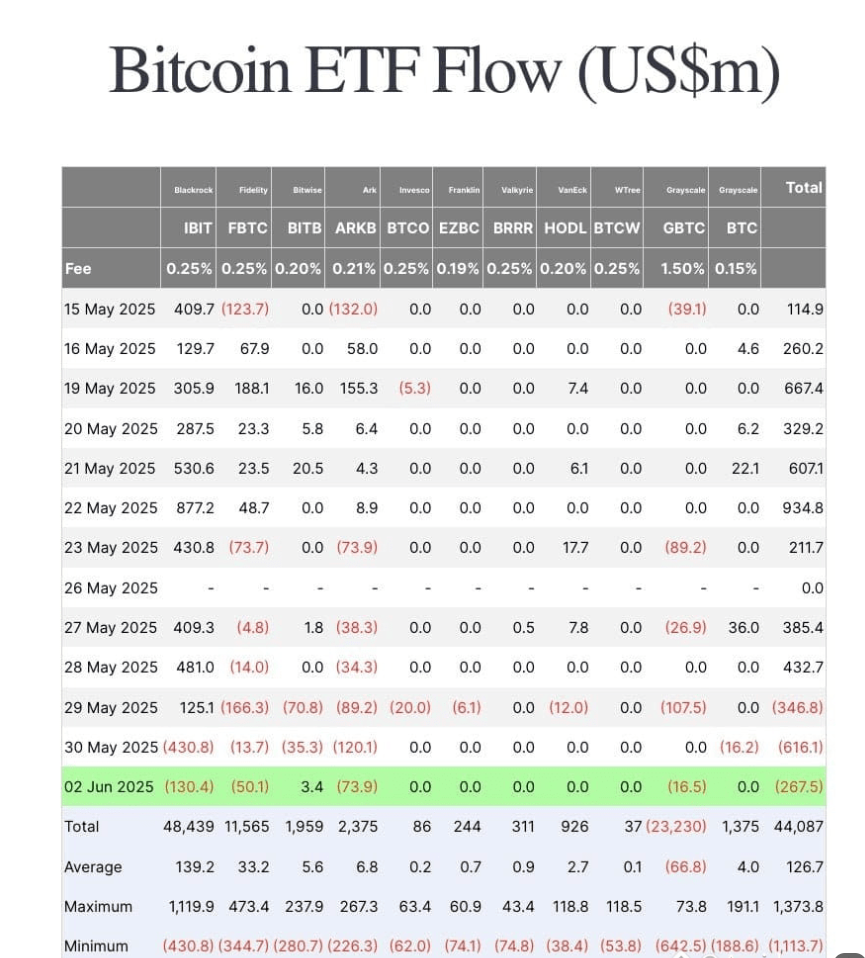

- 2,530 BTC worth $267.5M sold from spot ETFs, including BlackRock, ARK, and Fidelity

- Ethereum ETFs gain $78.2M led by BlackRock’s $48.4M and Fidelity’s $29.8M purchases.

- Ethereum ETF inflows follow a bullish breakout and key network upgrade momentum.

On June 2, U.S. spot cryptocurrency ETFs experienced significant capital movement. Bitcoin ETFs recorded $267.5 million in net outflows. Meanwhile, Ethereum ETFs saw $78.2 million in net inflows.

Fidelity and BlackRock were the biggest buyers of ETH, purchasing 30,810 ETH between them. Institutional appetite is shifting, signaling potential changes in crypto investments. As regulations evolve, this could mark the beginning of capital rotation from Bitcoin to Ethereum.

Bitcoin ETFs Lose Steam After Strong May Performance

Bitcoin ETFs had remained on a strong run in May, bringing in $5.86 billion in total monthly inflows. The growth nearly doubled April’s $2.97 billion. This helped offset earlier outflows of $4.6 billion between February and March.

However, a sharp reversal occurred on May 30 when Bitcoin ETFs saw an unusual net outflow of $616.22 million. The pressure continued into June 2, when 2,530 BTC were sold across three major issuers. It saw $267.5 million leave BTC ETFs.

BlackRock’s $IBIT led the sales with 1,240 BTC, followed by ARK 21Shares’s $ARKB with 699 BTC. Fidelity’s $FBTC was also heavily sold, totaling 474 BTC. These outflows imply that institutional appetite for Bitcoin exposure has cooled, at least in the short term.

Strategy (formerly MicroStrategy) is raising $250 million through preferred stock to buy more Bitcoin. Meanwhile, ETF market behavior is showing a contrasting trend.

The raise could be used at current prices to buy 2,351 more BTC. This would add to Strategy’s current 580,955 BTC. However, ETF data shows a near-term positioning shift, with Ethereum now seeing net institutional capital inflows.

Ethereum ETFs Attract Big Names and Big Capital

Bitcoin ETFs were red. However, Ethereum ETFs had their strongest single day of inflows on June 2, bringing in $78.2 million. BlackRock led the way with a $48.4 million ETH purchase through its spot ETF, acquiring 19,070 ETH.

Fidelity also made a significant move, buying 29.8K ETH through FETH. These transactions highlight major institutional interest in Ethereum.

Only BlackRock and Fidelity contributed to the day’s net inflows. Other issuers showed no significant ETH ETF activity. Grayscale recorded 4,289.7 ETH in outflows. Despite this, ETH ETFs saw 3,141.9 ETH in net inflows from May 15 to June 2.

BlackRock, Fidelity, and Bitwise showed consistent buying activity. Meanwhile, other players like VanEck and Franklin remained relatively flat. May was the biggest month of 2025 for Ethereum-based products, as total net ETH ETF inflows reached $564 million.

On June 2, BlackRock and Fidelity accumulated 30,810 ETH, which shows strong institutional conviction. They came when Bitcoin sold, suggesting a capital rotation based on valuation, fundamentals, or regulatory clarity.

Total ETH ETF inflows are still behind BTC on a broader scale. However, momentum is currently with Ethereum.

Technical Breakout and Protocol Upgrades Boost Ethereum Appeal

Ethereum’s ETF inflows have been strong following a bullish breakout on the ETHUSDT daily chart. The asset broke out of a descending wedge and is now consolidating near $2,592. It remains above its 200-day moving average and is holding firm despite broader market uncertainty.

Meanwhile, the Ethereum Foundation restructured its core development team, now called ‘the Protocol,’ to become more efficient and focused. This reorganization will support future upgrades, such as Fusaka, which will introduce PeerDAS (Peer Data Availability Sampling) for scalability.

This comes after the recent Pectra upgrade, which improved staking, wallet functionality, and transaction performance. Ethereum Foundation is also increasing its involvement with decentralized finance protocols like Aave, Spark, and Compound.

Instead of liquidating ETH, it has used DeFi platforms for yield generation and treasury diversification. This may reinforce investor perception that Ethereum has a long-term future and is a mature ecosystem.

Regulatory Tensions Persist Despite Growing Institutional Demand

ETF inflows notwithstanding, there are regulatory hurdles. In June, the SEC nixed two REX Shares and Osprey Funds ETF proposals. The SEC questioned the legal compliance of these ETFs, which had sought to provide exposure to staking rewards in ETH and SOL.

The concerns centred on whether the funds were investment companies and whether the filings were misleading to investors. This suggests that regulatory risks exist. However, BlackRock and Fidelity’s activity indicates that approved vehicles are still attractive.

The protocol advancements of Ethereum, combined with market confidence in these spot ETFs, seem to be growing. Institutional flows, technical patterns, and ecosystem progress are all lining up in Ethereum’s favour.