- The Cardano price surged past $0.70 with a 10.6% volume spike, signaling strong buyer interest and short-term bullish momentum.

- Open interest rose 0.68% as long positions dominated Binance with a 2.7x long/short ratio, indicating bullish trader sentiment.

- ADA hit $0.705 after breaking key support at $0.675; in price discovery mode, the next resistance lies near $0.71.

Cardano (ADA) has attracted traders and analysts as it gives strong bullish readings at various points in time. ADA has now surpassed $0.70 with more substantial trading volume and a more positive market.

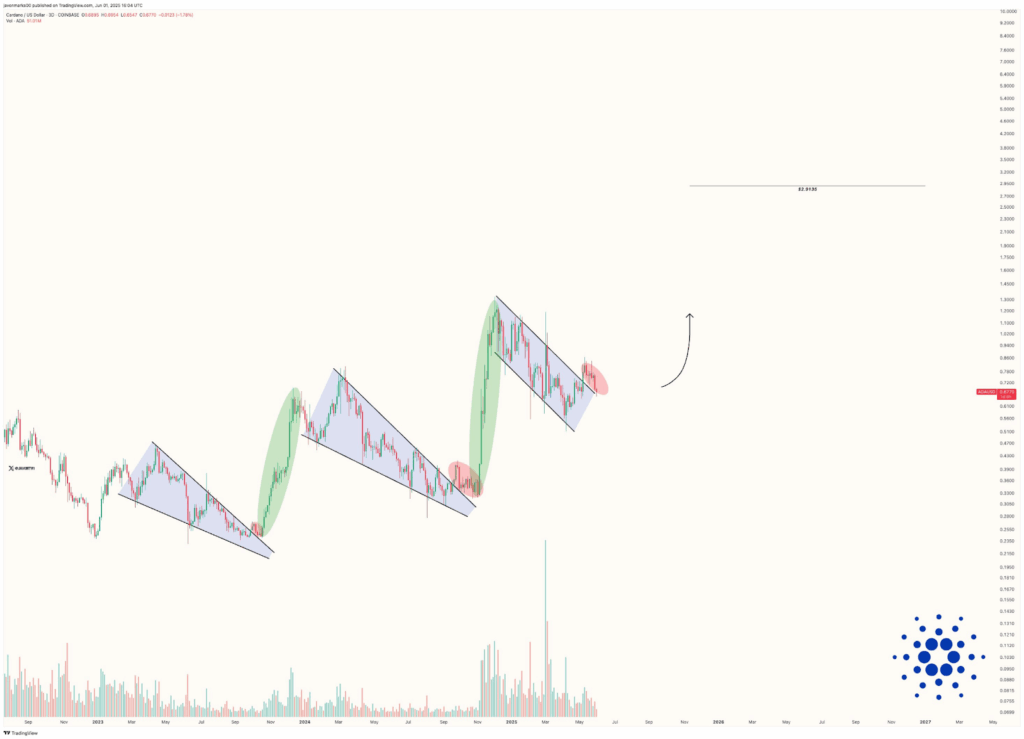

Investors are looking at how the coin might grow in the long run, with the possibility that it might hit $5 within the next 3 years.

Current Market Structure and Momentum

In the past few days, the ADA/USDT pair has been moving upwards as it registers higher highs and higher lows on shorter-term charts.

It began when the price broke out after being in a consolidation phase near $0.6750 and got stronger as volume went up. As the cost of ADA rose to reach its peak at $0.705, a minor correction followed.

The on-chain volume increased by 10.6% during the past 24 hours, which means that ADA’s 24-hour volume is now over $683 million.

Higher volumes indicate that both short-term and retail investors are now participating more. The growth allowed the price to rise, keeping ADA valued above $0.68. ADA is currently higher than $0.690, which acts as a key base for bulls.

According to derivatives information, open interest for ADA increased by 0.68%, and its market cap grew by 1.64%. These changes indicate that more investors are investing in ADA-related offerings, which means they believe the positive trend will continue.

Traders Going Long on the Cardano Price

Binance and OKX data indicate that traders mainly take long positions. Binance has a long/short ratio above 2.7, and OKX’s ratio is about 2.09.

This means that most people in the retail market think the price will go up. The top traders are also invested mainly in long positions, but with more even exposure.

Sometimes, when important resistance points are not broken, the market can experience sharp falls. The liquidation data confirms that most shorts were cleared out during the rally, and the last hour brought more long liquidations. It points to a quick sell-off, which may imply traders are cashing in their profits after ADA’s rise.

Cardano Price Indicators Show Bullish Strength on Higher Timeframes

On 4-hour charts, we see that the MACD indicator is now crossing from red to green and making a bullish signal. MACD is holding steady at 0.0045, and the signal line is spotted at -0.0079.

This histogram suggests that stocks are gaining positively and moving up. If the price stays above key support, there may be more room for this currency to rise.

The relative strength index (RSI) is now 49.54 and is moving upward. This shows that RSI is being moderated, without any pressure to sell. RSI has surpassed its 14-period average, which shows that buyers are increasingly dominant right now.

So long as RSI gets higher but does not pass 70 (the overbought level), there is still space for ADA to increase.

The debate that ADA could reach $5 by 2025 is mainly influenced by both technical and broader market cycles. In the past, Cardano performed strongly when the market rose. In 2021, during a significant bull market, ADA reached its highest price of $3.10.

ADA would have to more than double six times to reach $5. The process could succeed when the market is suitable, development in the ecosystem goes smoothly, and investor interest grows.

Even if the short-term picture looks bullish, wider acceptance, stronger economies, and improvements on the network will influence where prices go long term.