Key Insights:

- Meta Platforms shareholders massively rejected a proposal to allocate a portion of its $72 billion cash reserves to Bitcoin.

- The “Bitcoin treasury assessment” proposal, which sets Bitcoin up as an inflation hedge, received only 0.08% shareholder support.

- Meta CEO Mark Zuckerberg’s voting power (61%) likely affected the proposal’s rejection.

Meta Platforms Inc., the parent company of Facebook and Instagram, has rejected a shareholder proposal to spend a portion of its multi-billion-dollar cash reserves on Bitcoin.

The decision was disclosed in a May 28th regulatory filing, and shows some ongoing resistance within Meta and many other major corporations when it comes to accepting Bitcoin as a treasury asset.

While this vote might come as a surprise to some, it shows the ongoing tension between traditional corporate finance and crypto.

Proposal Gets Just 0.08% Support

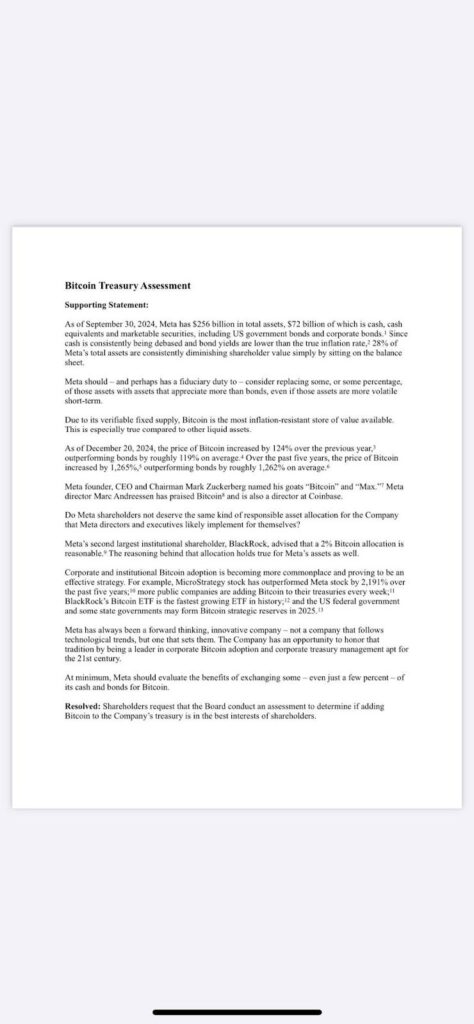

The proposal, which has been dubbed the “Bitcoin treasury assessment,” was spearheaded by Bitcoin advocate Ethan Peck. He urged Meta to consider allocating part of its $72 billion cash reserve to Bitcoin as a hedge against inflation.

However, the plan gained only a little bit of traction with only 3.92 million shares or just 0.08% of the total cast in favor. In contrast, nearly 5 billion shares voted against the move.

Meta CEO Mark Zuckerberg, who controls approximately 61% of the company’s voting power, likely played a role in the rejection. No official comment has been made by Zuckerberg or Meta’s board regarding the vote. However, Bitcoin is likely coming nowhere near the company’s balance sheets, for now.

Peck’s Case for Bitcoin

Ethan Peck, who submitted the proposal through his family’s Meta shares, framed Bitcoin as a modern alternative to cash and bonds, especially with rising inflation.

In his supporting statement, Peck warned that Meta’s current treasury strategy, which is heavily reliant on cash and low-yield bonds, is eroding shareholder value.

“Since cash is consistently being debased and bond yields are lower than the true inflation rate, 28% of Meta’s total assets are consistently diminishing shareholder value,” he argued.

He also referenced BlackRock’s research, which shows that a 2% Bitcoin allocation could offer a reasonable balance between risk and reward for institutional investors.

Despite the strong convictions behind his case, shareholders clearly did not align with Peck’s arguments, at least not yet.

The Pattern of Rejection in Big Tech

Meta isn’t the only tech giant where Peck has pushed for crypto adoption. Similar Bitcoin proposals he led have also been rejected at Microsoft, with another vote upcoming at Amazon. At Microsoft’s annual meeting in December, shareholders similarly voted down a Bitcoin allocation proposal.

Meanwhile, Amazon investors are expected to lend their opinions on a 5% Bitcoin treasury allocation proposal later this year. These consistent rejections show that many tech giants still see Bitcoin as too volatile or speculative for treasury use, especially when compared to less “risky” financial instruments.

Public Firms Are Still Betting on Bitcoin

While Meta and its peers are hesitant, other companies are moving forward with Bitcoin.

According to data from BitcoinTreasuries.NET, 116 public companies now hold Bitcoin on their balance sheets. GameStop and Sweden’s health-tech company H100 are among the latest entrants.

One of the pack leaders is MicroStrategy, which holds an eye-watering 580,250 BTC that was worth approximately $60.9 billion at the time of writing.

Other major holders include Marathon Digital and Tesla, each with over $1 billion in Bitcoin. These companies aren’t just passively holding Bitcoin either. Many are actively raising capital to increase their positions.

Like MicroStrategy, for instance, which continues to issue convertible debt to buy more BTC.

The surge in Bitcoin’s price has only added fuel to the fire. The cryptocurrency recently hit a new all-time high of $111,965, which stands as a more than 50% increase since early April.

Trump Media & Technology Group recently announced plans to raise $2.5 billion to invest in crypto, and Blockchain Group revealed a €63.3 million bond sale.

Overall, whether Meta and other Big Tech firms will eventually follow in MicroStrategy’s footsteps remains to be seen. What is clear, however, is that the divide between early adopters and latecomers continues to get wider.