Key Insights:

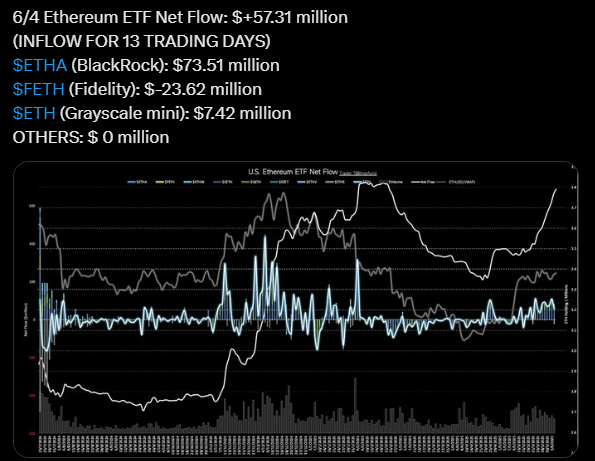

- Ethereum ETFs recorded 13 straight days of inflows, totaling $57.31M on June 4, with BlackRock leading contributions.

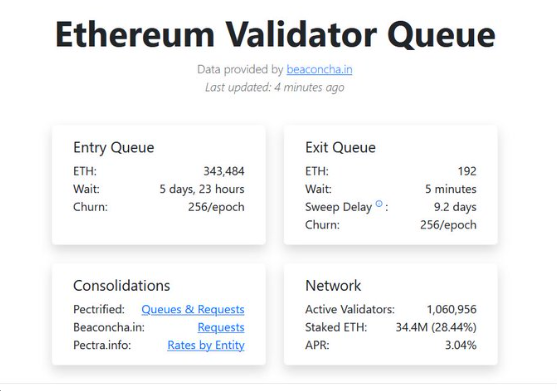

- Over 340,000 ETH worth $900M entered the staking queue, the highest since 2023, signaling long-term confidence.

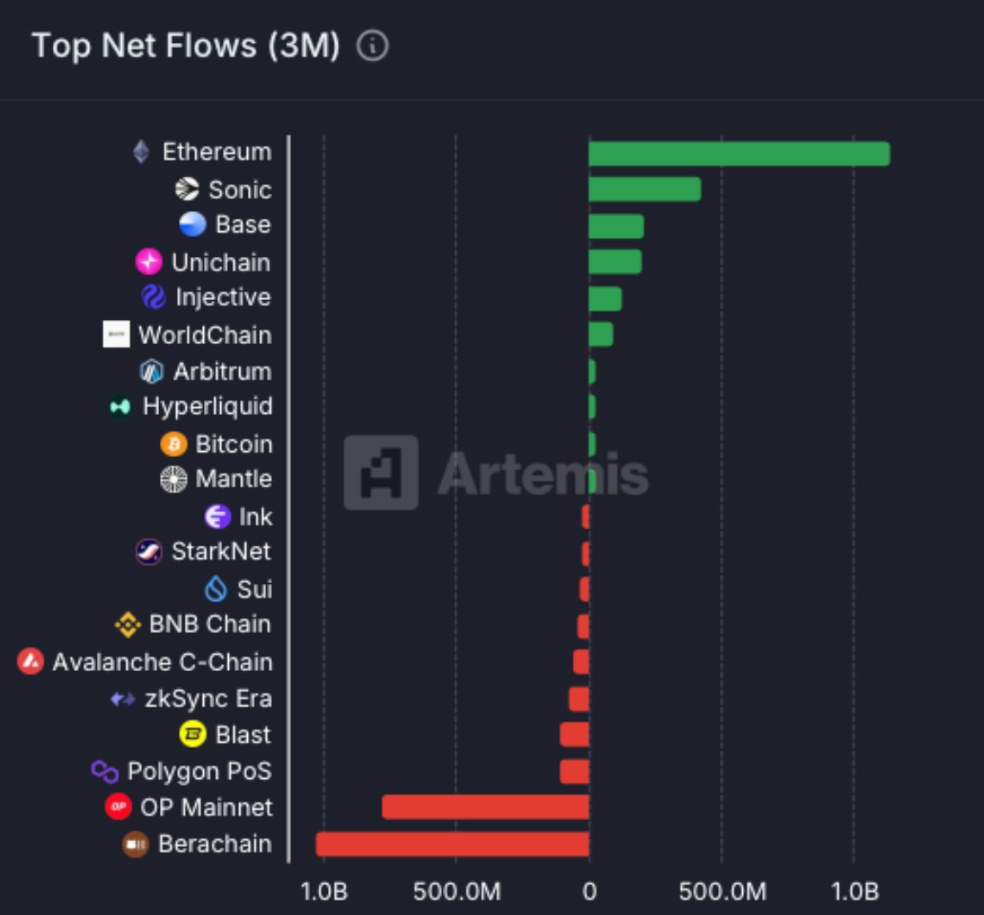

- Ethereum dominates tokenization with $9.8B in RWAs and led all chains in net flows over the last 3 months.

On June 4, Ethereum ETF inflows kept climbing, adding $57.31 million, marking the 13th trading day in a row.

As staking demand increases and capital moves from Bitcoin to Ethereum-based products, investor interest is growing steadily.

ETF Inflows Show Strength as Bitcoin Slows

BlackRock’s $ETHA led the way with $73.51 million, bringing in $57.31 million in net inflows into Ethereum ETFs on June 4. During the same session, Fidelity’s $FETH saw an outflow of $23.62 million, and Grayscale’s mini trust added $7.42 million.

Conversely, Bitcoin ETFs were only brought in by BlackRock’s IBIT, which recorded $86.92 million in inflows amid broader weakness.

ETH’s consistent ETF performance is a sign of institutional behaviour change as investors prefer regulatory clarity and yield.

Though BTC ETF flows have recently broken their accumulation streak, ETH products have kept inflows alive through market pullbacks.

ETH’s fundamentals remain strong, and sentiment is improving; these developments indicate a possible capital rotation.

The network also topped all chains in net inflows over the past 90 days, with over $1.1 billion flowing into the Ethereum network. Other chains had mixed results, with some like OP Mainnet and Berachain seeing outflows of close to $1 billion.

As such, Ethereum is still the preferred choice for capital allocators, despite short-term volatility and changing narratives.

Staking Demand Surges to One-Year High

This week, more than 340,000 ETH or nearly $900 million, entered the validator queue, its highest level since 2023. Wait times to stake have extended to five days plus, a sign that investor confidence is on the rise after recent SEC clarity.

This comes as APR has risen to 3.04%, which is also an incentive for long-term holders to commit funds to secure the network. With over 34 million ETH staked on more than 1.06 million validators, the network is in great health.

The validator base is stable, exit churn is minimal, and validator exits are processed in minutes. This balance is good for security and liquidity and is a good basis for further institutional entry.

The accumulation trend was also strengthened as ConsenSys-linked wallets also executed a $320 million ETH OTC purchase from Galaxy Digital.

There were multiple high-value transfers in the transaction, which indicated deliberate positioning rather than speculative entry.

Usually, such moves are a reflection of strategic commitments to Ethereum’s long-term development, rather than short-term market timing.

Dominance in Real-World Assets and Capital Flows

As of May 28, Ethereum is by far the leading tokenization sector, with $9.8 billion in tokenized assets on-chain. ZKsync Era has $2.2 billion, while Stellar, Aptos, and others have less than $1 billion.

That makes Ethereum the obvious winner in the real-world asset (RWA) space among all blockchain platforms. But its leadership is also apparent in broader net flows, where Ethereum beat every chain over the past three months.

Changing narratives aside, Ethereum is still attracting retail and institutional liquidity at a structural level. From the price perspective, ETH is consolidating near $2,616, up 0.30% on the day and testing the 200-day moving average.

It is the fifth test of the MA200 in recent months, and a breakout would be imminent if volume backs up momentum. However, RSI is flattening out, which means caution in the short term, even though fundamentals remain bullish.

Sentiment is still divided, but capital keeps flowing into Ethereum-linked products and infrastructure. If the inflows into ETFs continue and staking demand remains, Ethereum could break its current range and be the leader of the next market cycle.

ETH is showing strength through utility, liquidity, and growing institutional alignment while Bitcoin consolidates.