Key Insights:

- The latest Hbar news reveals that the U.S. SEC is set to disclose its decision on the spot HBAR ETF filings.

- Despite the listing of HBAR ETPs in the European market, the HBAR price still appears bearish and could drop by 25%.

Hbar news is gaining traction amid growing anticipation around the U.S. Securities and Exchange Commission’s (SEC) upcoming decision on a spot HBAR ETF listing. So far, only two spot HBAR ETF applications have been submitted in the United States—one by Canary Capital and another by Grayscale.

Hbar News: SEC’s Decision on Spot HBAR ETF Filings

According to recent reports, the SEC’s decision on both filings is expected on June 11, 2025.

Meanwhile, 21Shares is making waves after launching a new HBAR ETP on Euronext Amsterdam and Euronext Paris. With this move, 21Shares joins Valour in offering HBAR-based ETPs in Europe.

Following this listing, traditional traders and investors can now access Hedera’s native token without needing to interact directly with crypto-native infrastructure.

Both HBAR news has been garnering massive attention from the crypto community, as they highlight the growing interest of traditional investors in Hedera’s native token.

Despite these positive developments, the HBAR price remains unchanged, currently trading near $0.168, with a modest 0.67% increase over the past 24 hours. During the same period, strong interest from investors and long-term holders has led to a 25% surge in trading volume.

This rising trading volume, when combined with the price surge, indicates strong upside momentum in the asset.

Hedera (HBAR) Price Action and Technical Analysis

According to expert technical analysis, HBAR appears bearish, and given the current market structure, it is poised to continue its prolonged downtrend in the coming days.

The daily chart reveals that the asset has been in a downtrend following the breakdown of an ascending channel pattern. With the continuous price decline, it lost the horizontal support level at $0.174, but has since successfully retested that level.

Based on recent price action and historical patterns, the HBAR price could decline by 25% and reach the $0.128 level in the near future. However, this is only likely if the asset remains below the $0.175 level; otherwise, the trend may shift.

On the other hand, the HBAR price could soar by 25% and reach the $0.22 level in the future. This bullish outlook would only emerge if the asset breaches the resistance level and closes a daily candle above $0.176.

As of now, HBAR’s Relative Strength Index (RSI) stands at 41, indicating that the asset is near the oversold area and showing weak strength. This suggests limited bullish momentum and a higher probability of continued downward pressure unless strong buying interest emerges.

On-Chain Metrics Flashes a Bearish Sentiment

This bearish price action is further strengthened by the recent activity of traders and investors, who have been found betting on the bearish side, according to the on-chain analytics firm Coinglass.

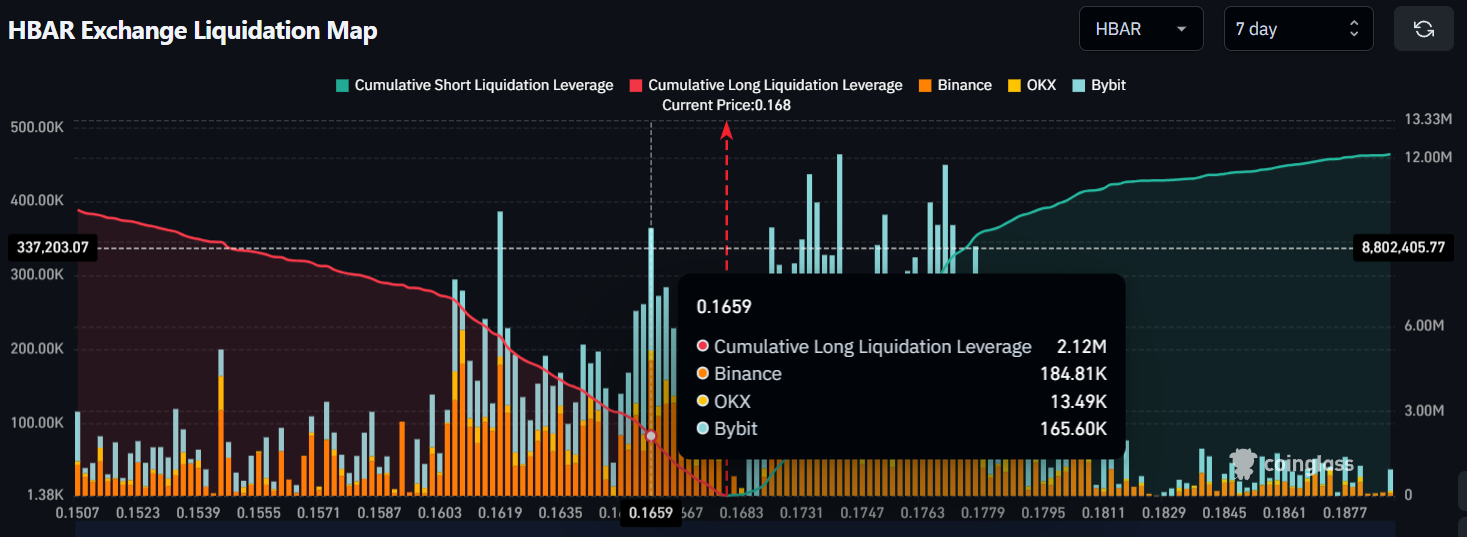

Data reveals that traders are currently over-leveraged at $0.1659 on the lower side (support) and $0.174 on the upper side (resistance).

At these levels, they have built $2.12 million worth of long positions and $3.98 million worth of short positions, indicating that sellers are currently dominating.

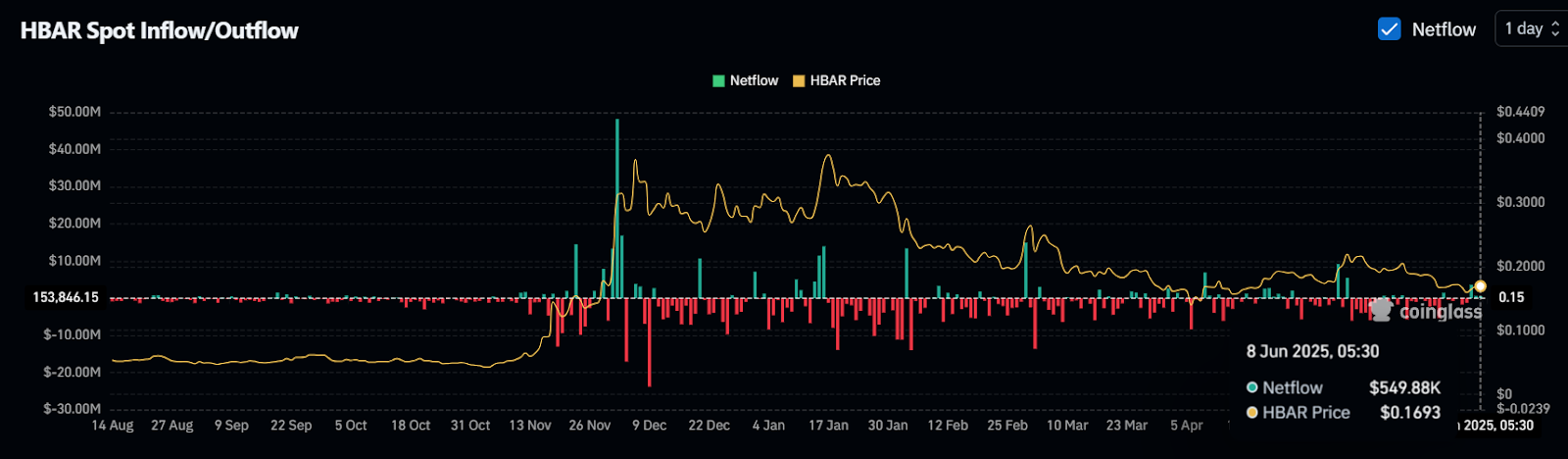

Meanwhile, investors and long-term holders have been found dumping HBAR tokens. Data from spot inflow/outflow shows that exchanges have witnessed an inflow of $550k worth of HBAR tokens over the past 24 hours.

This substantial inflow into exchanges hints at a potential sell-off by investors and is further a bearish signal.