Key Insights:

- Bitcoin approaches $112K, with analysts warning of either a breakout toward $150K or pullback to key $94K and $80K zones.

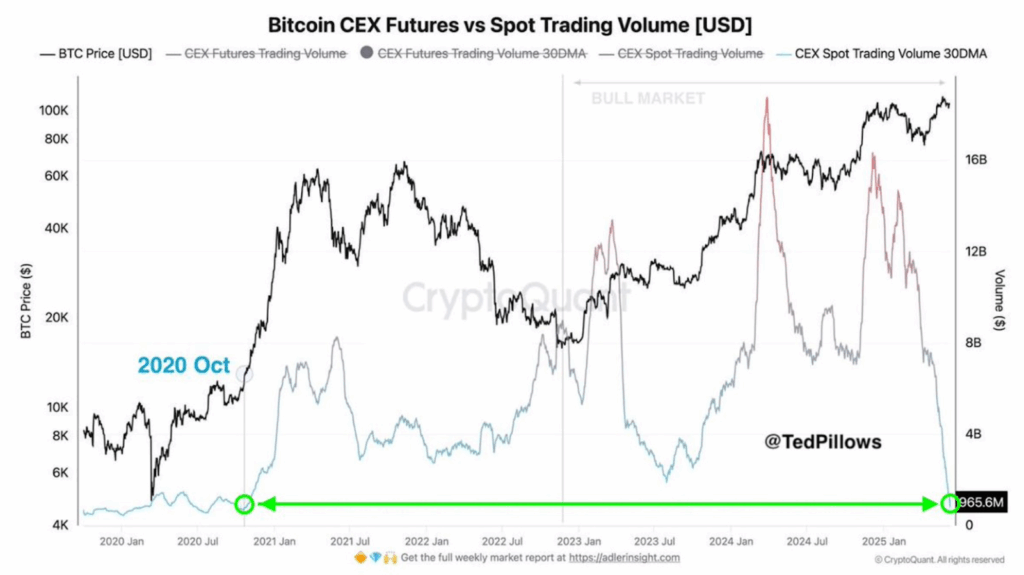

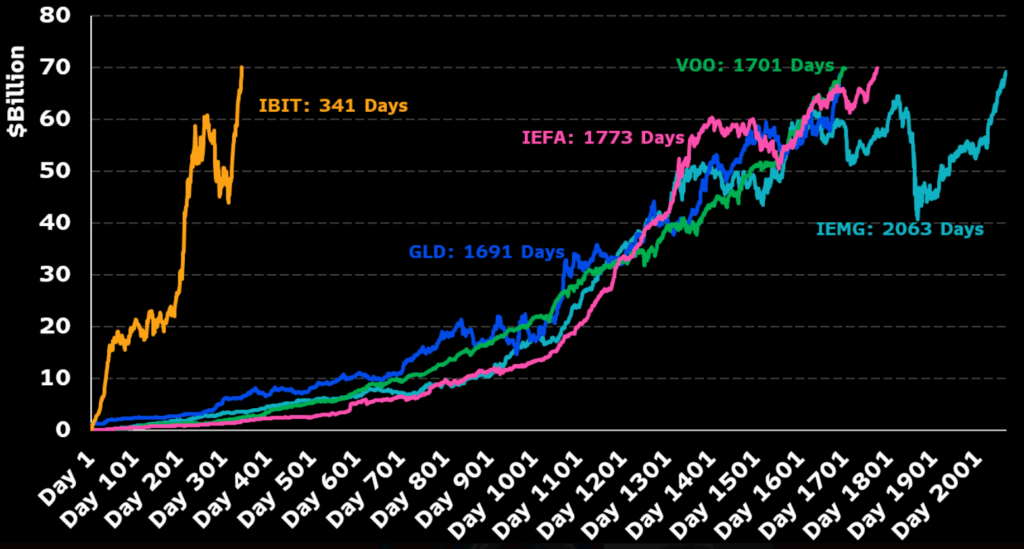

- Spot and futures trading volumes fall to 2020 levels, signaling caution despite Bitcoin ETFs reaching $70B in assets.

- Institutional inflows into crypto funds hit record highs in May, with BitMine also acquiring 100 BTC for its treasury.

Bitcoin is flirting with resistance levels amid a cautious US inflation print and political heat in the US. BTC is at a critical technical junction, currently sitting just below the $110K – $112K resistance range. This zone, according to analysts, could be the one that decides if Bitcoin will surge to new highs or experience a sharp retracement.

Despite overall network activity and volumes signaling consolidation, institutional interest is growing while spot ETF inflows continue to rise.

Bitcoin Flirts with Resistance as Traders Watch $112K Zone

Bitcoin is trading at $109,480, just 2% off its previous all-time high of around $112K. Technical patterns indicate that a decisive break above this level could take prices to $135K – $150K.

But, rejection at this resistance could cause a short-term pullback towards $100K or lower to $94K and $80K support levels.

However, analysts like Crypto Patel are cautious, opening short positions with tight stop losses, saying that the market is overbought.

Moreover, the multi-year charts show an ascending wedge with the neckline resistance. In past cycles, this area has been a reversal zone.

Bitcoin continues to stay above its long-term trendline support, which is bullish for the medium to long-term investors. The strength of volume indicators also shows, but recent metrics suggest the hesitation of the market near these key price levels.

Spot Volumes Drop, Futures Activity Plummets to 2020 Lows

Spot and futures volumes at CEX have plummeted, with futures volumes back at October 2020 lows. TedPillows noted this as a possible ‘HODL mode’ among investors, something that’s common during market indecision or in transition.

A decreasing leverage, as indicated by the current futures to spot volume ratio, will decrease the volatility but will also make the immediate breakout potential less effective.

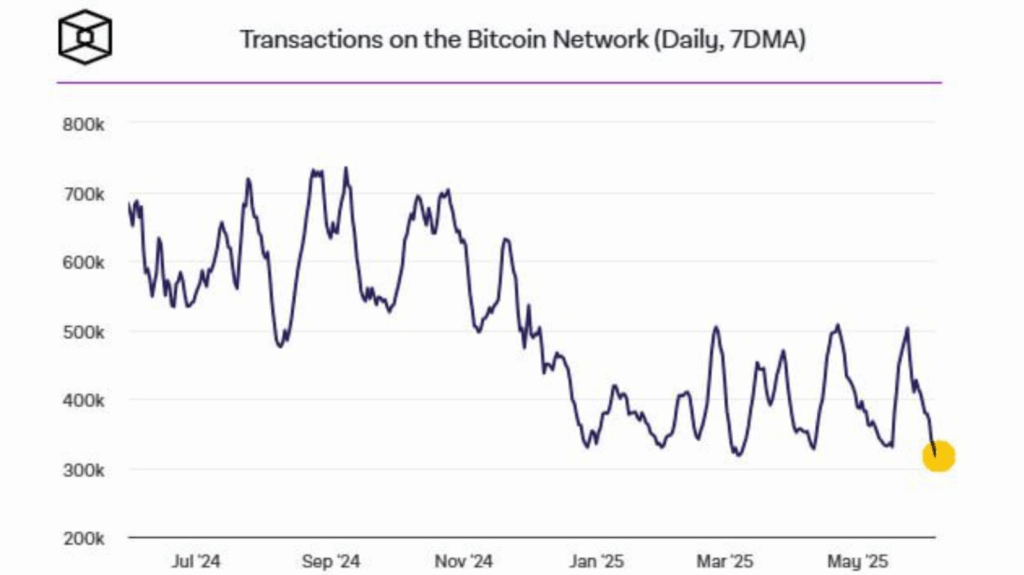

But daily Bitcoin network transactions have also fallen to levels not seen since late 2023. While institutional allocations are rising, this slowdown in on-chain activity is divergent from the capital inflows.

Lower activity can be taken as consolidation, but there is still space for sudden big moves once volatility returns. Weak volumes have not been enough to weigh on price, as there is strong ETF accumulation and treasury purchases.

The divergence indicates that long-term holders are accumulating while traders are cautious in the short term. Therefore, any breakout would probably require fresh volume strength to be sustained.

Institutional Flows Drive Optimism Despite Mixed Market Metrics

According to Morningstar, crypto fund net assets hit an all-time high in May as they saw over $7 billion in monthly inflows. This confirms that institutional appetite for digital assets as hedging tools in an increasingly unstable macro environment is growing.

At the same time, BlackRock’s IBIT ETF reached $70 billion in assets in 341 days, the fastest-growing ETF in history. IBIT was highlighted by Eric Balchunas to have beaten previous records set by GLD and others by a wide margin.

On the other hand, Robert Mitchnick of BlackRock says that this ETF growth continues to attract more institutions and wealth advisors.

But despite that, adoption is still in its infancy, indicating there is more long-term upside.

BitMine Immersion Technologies also announced its first step into Bitcoin treasury strategy by purchasing 100 BTC. The company acquired the coins using the proceeds from recent capital raises and with confidence in BTC’s long term value proposition.

Corporate accumulation of such helps to build a floor for Bitcoin prices, especially when paired with institutional ETF demand.

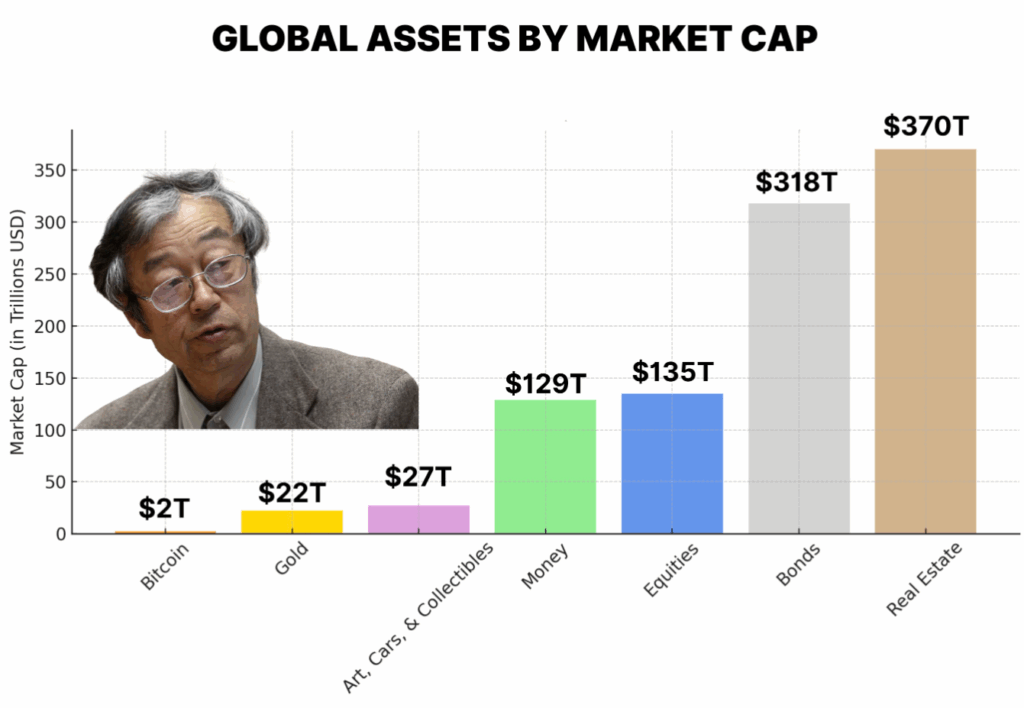

Bitcoin’s Market Cap Still Trails Major Asset Classes

Bitcoin, which has now hit $2 trillion in market cap, is still tiny compared to other global asset classes. The cryptocurrency runway for long-term growth is real estate, bonds, and equities, all of which are greater than $100 trillion.

Although the ETF activity and corporate involvement are on the rise, the Bitcoin Conference noted that this gap is indicative of early-stage adoption. Long-term holders are being supported by these comparisons, but price action is still dependent on short-term technical dynamics.