Key Insights:

- Charles Hoskinson has proposed a $100 million sovereign fund to support Cardano’s DeFi ecosystem.

- The fund would allocate treasury assets into Bitcoin and stablecoins such as USDM to generate passive income.

- The Cardano price prediction based on our analysis is a potential drop to $0.50 if the $0.60 support fails to hold.

Cardano price prediction models remain active as founder Charles Hoskinson proposes a $100 million sovereign fund to stimulate DeFi growth.

The price hovers near critical support at $0.60, while leveraged traders hold bullish positions despite persistent spot price weakness.

Analysts now assess whether these contrasting forces may trigger the long-anticipated ADA breakout from a prolonged bearish pattern.

Hoskinson Proposes Treasury Shift to Stablecoins

Hoskinson’s proposal would diversify Cardano’s treasury by allocating 5% to 10% into Bitcoin and yield-generating stablecoins like USDM.

This would create passive income through staking, enabling a recurring buyback of ADA tokens to strengthen the ecosystem.

The feedback loop could potentially generate $1 billion over the next decade, building deeper liquidity for DeFi participants.

Ethereum and Solana currently lead DeFi markets due to high stablecoin-to-TVL ratios, which Cardano aims to replicate with this fund.

Including Bitcoin as a hedge against fiat-stablecoin risks adds diversification, reducing dependency on centralized monetary systems.

This approach could position Cardano as a stronger DeFi competitor while reducing long-term treasury exposure to ADA price volatility.

However, the community governance model presents a significant obstacle to swift execution of the proposed strategy.

Some members have raised concerns about the scale of ADA sales required to fund diversification. The potential sell pressure from converting nine-figure sums could impact short-term market confidence in ADA.

Cardano Price Prediction Warns of ADA Price Drop

The Cardano price prediction shows signs of weakness as ADA trades just above the $0.60 support zone after multiple failed breakout attempts. The 0.236 Fibonacci retracement level holds, but momentum indicators reflect declining strength across both RSI and MACD.

These indicators confirm fading bullish sentiment as the price continues to face pressure from recent resistance rejections.

The Relative Strength Index fell below the neutral 50 mark, signaling a loss of buyer dominance in current market conditions.

Meanwhile, the MACD widened its gap below the signal line after forming a death cross earlier this month. If the Cardano price breaks below $0.60, a decline toward the $0.50 level could unfold, erasing recent gains.

Technical analysis highlights the $0.60 level as a vital support, reinforced by historical demand since late 2024. A drop below this threshold could eliminate the bullish 1.618 Fib extension target of $1, which indicates a potential 80% upside. This scenario would delay any significant upward movement, extending the falling wedge pattern into a deeper correction phase.

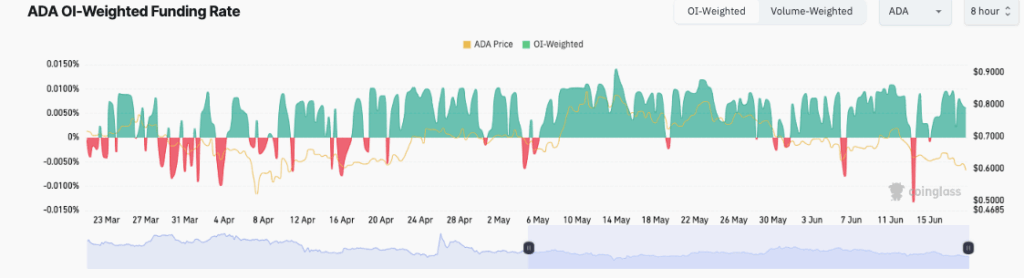

Cardano Funding Rates Stay Positive Despite Drop

Open Interest-weighted funding rates for Cardano remain positive throughout June despite the declining spot price and growing technical risks.

This indicates leveraged traders continue to favor long positions, expecting a reversal in the short-to-medium term. Such persistent optimism creates a potential setup for a short squeeze if traders rapidly unwind losing positions.

The consistent green bars in OI-weighted funding charts since early May reflect confidence in the ADA price outlook across futures markets.

Yet, the divergence between spot and derivatives performance signals a disconnect that could trigger sharp volatility. If futures sentiment remains overly bullish, any market shock could lead to an abrupt repricing.

Cardano price prediction hinges on balancing this optimism with macro and technical conditions as the ETF decision on July 15 approaches.

A favorable outcome could act as a key catalyst, attracting institutional attention and strengthening demand for ADA in traditional markets. Until then, ADA remains vulnerable to downside risks while traders monitor both on-chain developments and external factors.

ADA continues to navigate a critical juncture where both technical and fundamental indicators shape the near-term Cardano price prediction. If the proposed Bitcoin-backed fund gains support, it could shift long-term sentiment and stabilize future price movements.