Key Insights:

- Polkadot has stabilized at $3.58 after falling 22 percent from its May highs.

- The price action shows a potential double bottom, but momentum indicators remain bearish.

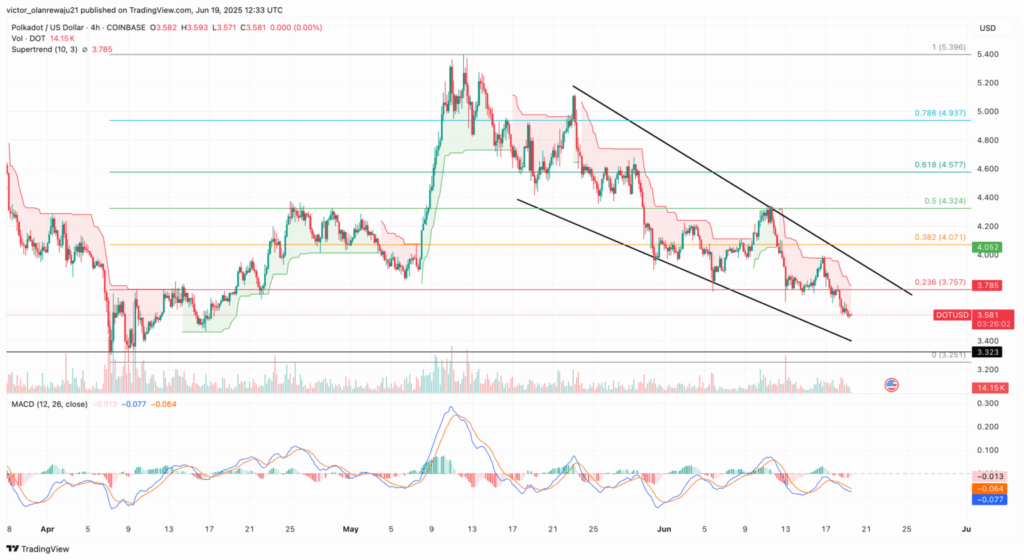

- Polkadot continues to trade within a descending channel with resistance near the upper trendline.

Polkadot’s (DOT) price has stabilized after a steep 22% drop from its May highs. Despite finding support, signs of recovery remain weak. Key indicators still point to continued bearish pressure in the near term.

Polkadot Struggles Below Falling Channel

Polkadot has settled at around $3.58 after retreating from a short-lived rally above $5. The decline undid the bulk of gains in the first half of May. Current levels are seen to be a zig-zag to the tested supports of April.

The cost has established a possible bottom two at about 3.58. But momentum indicators do not verify a reversal. The asset still trades below the decreasing trendline, and as long as that is the case, there will be pressure on upside performances.

While support has held, Polkadot has yet to break past the falling channel. The ceiling is also a weak point. Without the bulls coming back in power, a rise can remain restrictive.

Technical Signals Point to Further Downtrend

In the daily chart, the Awesome Oscillator shows that it is below the zero line. This is an indication of a further negative trend in the price movement of DOT. It indicates a small demand in the market and a small interest among buyers.

Similarly, the Relative Strength Index remains oversold. But this comes without the follow-through that is bearing control. Without a veritable reversal, price stays confined to lower levels.

Further, the Supertrend indicator has gone negative. The red line is touching a higher price bracket than the present price. The transformation is evidence of emerging opposition and dwindling consumer faith.

DOT Stuck in Channel as Sellers Dominate

The 4-hour chart favors the current bearish formation of DOT. The altcoin has been in a specified downward channel since May 23. This trend highlights a temporary selling force.

Further, the MACD indicator is even now negative. The change affirms a reversing trend and the pick-up of seller activity, contributing to the fact that recovery possibilities are slim.

Gains will be difficult to achieve as long as DOT falls below the upper trendline. The resistance is firm in this region between quotes of 4.45 and 4.45. A good breakout is needed to turn around the existing outlook.

Possible Scenarios and Support Levels Ahead

In case of further bear decline, DOT can be subjected to lower support at 3.32. Failure to maintain such a level would give way to additional losses, which could lead to a fall below 3.

Nevertheless, a breakout through the declining channel would be the indication of the change. An extension above this barrier can escalate the price to $4.58. A continuous pace would then become vital in prolonging gains.

A market’s structure will be flimsy without good volumes. In this respect, bulls have to breach the channel to shift sentiment. Resistance levels can ensure that recovery attempts are held down until then.