Key Insights:

- The SUI chart shows a mid-term bullish pattern emerging. A falling wedge has formed between the $3.80 and $2.60 range.

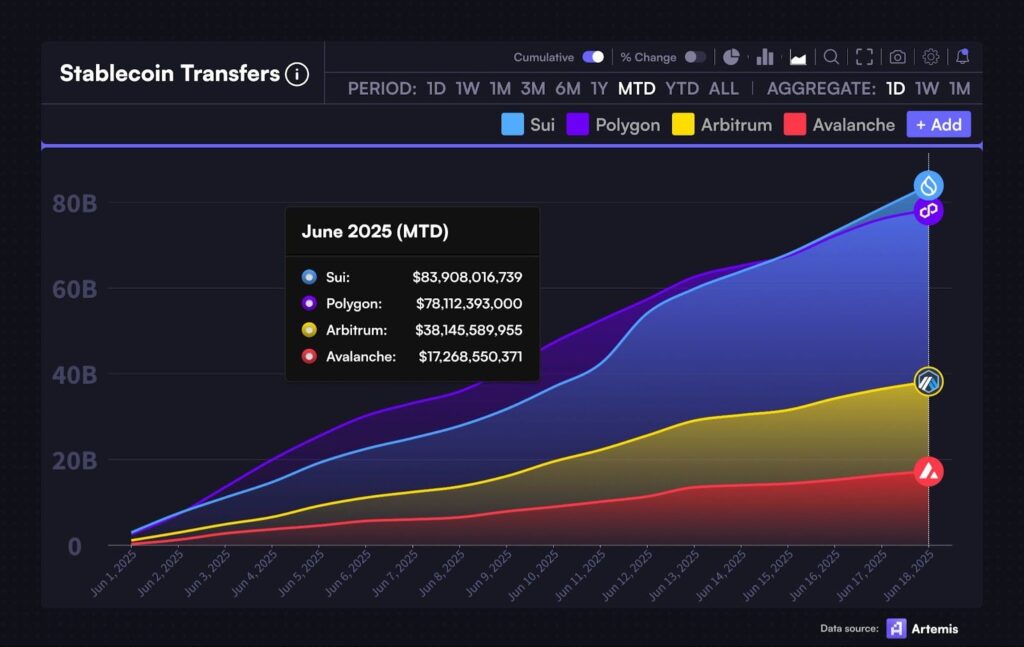

- SUI surpassed Polygon in monthly stablecoin transfers. SUI moved $83.9 billion, while Polygon handled $78.1 billion.

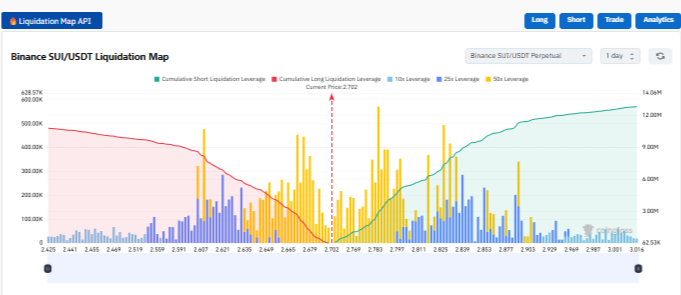

- The SUI liquidation map revealed the price trading at $2.792, which falls between the thick clusters of liquidation.

SUI crypto chart showed a mid-term bullish trend. A falling wedge pattern had formed between $3.80 and $2.60. The price recently traded at nearly $2.84. This indicates a bounce from the lower wedge support at $2.60.

SUI Crypto Price Action

The wedge pattern represented compression that in many cases caused a breakout. It was estimated that the breakout of the upper red trendline would be at $3.00-$3.20 with the target being at $5.30. This would be an indication of the 75% bull market on the present levels.

On the other hand, in case of the price to support at $2.60, it might again approach below $2.40. The price needed to break out by late July or early August to aim for $5.30. Strong momentum was also required after surpassing the $3.50 level.

The head and shoulders pattern was shown in the projection with an accumulation period immediately followed by an explosion. The key levels to watch were $2.60 for support and $3.20 as the breakout confirmation point.

The story of the wedge breakout was consistent with the bullish implications. Failure to crack over the resistance may push the bullish goal out further and see SUI move back into a consolidation phase again.

SUI Crypto Flips Polygon in Monthly Stablecoin Transfers

By mid-June 2025, Sui crypto overtook Polygon in monthly stablecoin transfers. Polygon moved $78.1 billion, while Sui handled $83.9 billion.

This marked a major shift in blockchain activity. Around June 10, Sui’s growth curve steepened sharply. This indicated a surge in user activity. Liquidity flow on the Sui network also rose significantly.

With such a moving force, there could be a possibility of the Sui hitting the $100 billion threshold even before June, having dominated the stablecoin transactions.

Polygon despite its strength may be pressured further unless it experiences reviving demand. The relaxation had been Arbitrum at $38.1 billion and Avalanche at the $17.2 billion valuation.

The evidence implies the increasing migration of users to Sui, which can restructure the liquidity hierarchy of Layer-1.

SUI Liquidation Map

The SUI liquidation map reveals the price trading at the price of $2.792. There, the price falls between the thick clusters of liquidation.

Dominant liquidations are longs above $2.750 and $2.792. This means that a move below $2.750 may automatically be followed by cascading liquidations and the price will end up at $2.720.

Conversely, there are short liquidations as high as $2.820 to $2.860. This indicates that a breakout over $2.800 has the possibility to sell the bears and cause the price to rise to the $2.880 mark.

Such spots are sensitive due to heavy leverage concentration at the level of 2.780-2.810, which enhances volatility.

It is reinforced by the high slope in the green short liquidation curve beyond the threshold reached at $2.810.

In case bulls cross the momentum mark of $2.800, then this action might continue towards $2.880 in the shortest time possible.

But the loss of more than $2.750 would send the bias to bear. The chart indicates that SUI is at the decision point and there is expected sharp movement.